Bitcoin has not too long ago fallen beneath the the largest $100K enhance stage, indicating a notable bearish transfer. If patrons couldn’t contain this serious stage, one other cascade toward the $95K vary will happen.

Technical Analysis

By Shayan

The Day to day Chart

On the every single day timeframe, BTC stays locked between the $100K–$102K demand block and the $114K resistance cluster, with each and each the 100-day and 200-day bright averages now performing as overhead resistance.

Basically the latest rejection from the 100-day MA round $110K led to a retest of the $101K enhance, finishing up a plump liquidity sweep of the old vary low.

What stands out now would possibly maybe well well be the place stabilization inside a historical high-quantity node, precisely the attach old macro corrections have chanced on their contaminated. The extended series of equal lows (marked “$$”) means that liquidity beneath $100K has likely been harvested, a condition that, if adopted by consolidation and a better low formation, would possibly maybe well well ascertain the presence of solid fingers spicy provide.

For bulls, the first confirmation of regained strength will most certainly be a reclaim of $106K–$108K, while for bears, a natty every single day discontinuance beneath $99K opens the door to the $93K–$95K macro accumulation zone.

The 4-Hour Chart

Zooming in, the 4-hour enhance shows a compressed descending vary, the attach every decrease high is forming closer to enhance, a classic sample of momentum exhaustion.

The asset has over and over tested the $101K–$102K zone, increasing transient imbalance pockets above $106K and $110K, that will moreover later act as magnet ranges for any corrective rallies. This coiling behavior in most cases appears to be like discontinuance to the halt of a corrective phase, as leveraged positions are flushed out and volatility contracts.

If the place manages to reclaim the $106K pivot, a transient reversal toward $110K would possibly maybe well well prepare, finishing up the mean-reversion transfer. Nonetheless, sustained rejection from $104K would take care of the accumulation grief originate for an extended interval, extending the sideways vary through mid-November.

On-Chain Analysis

By Shayan

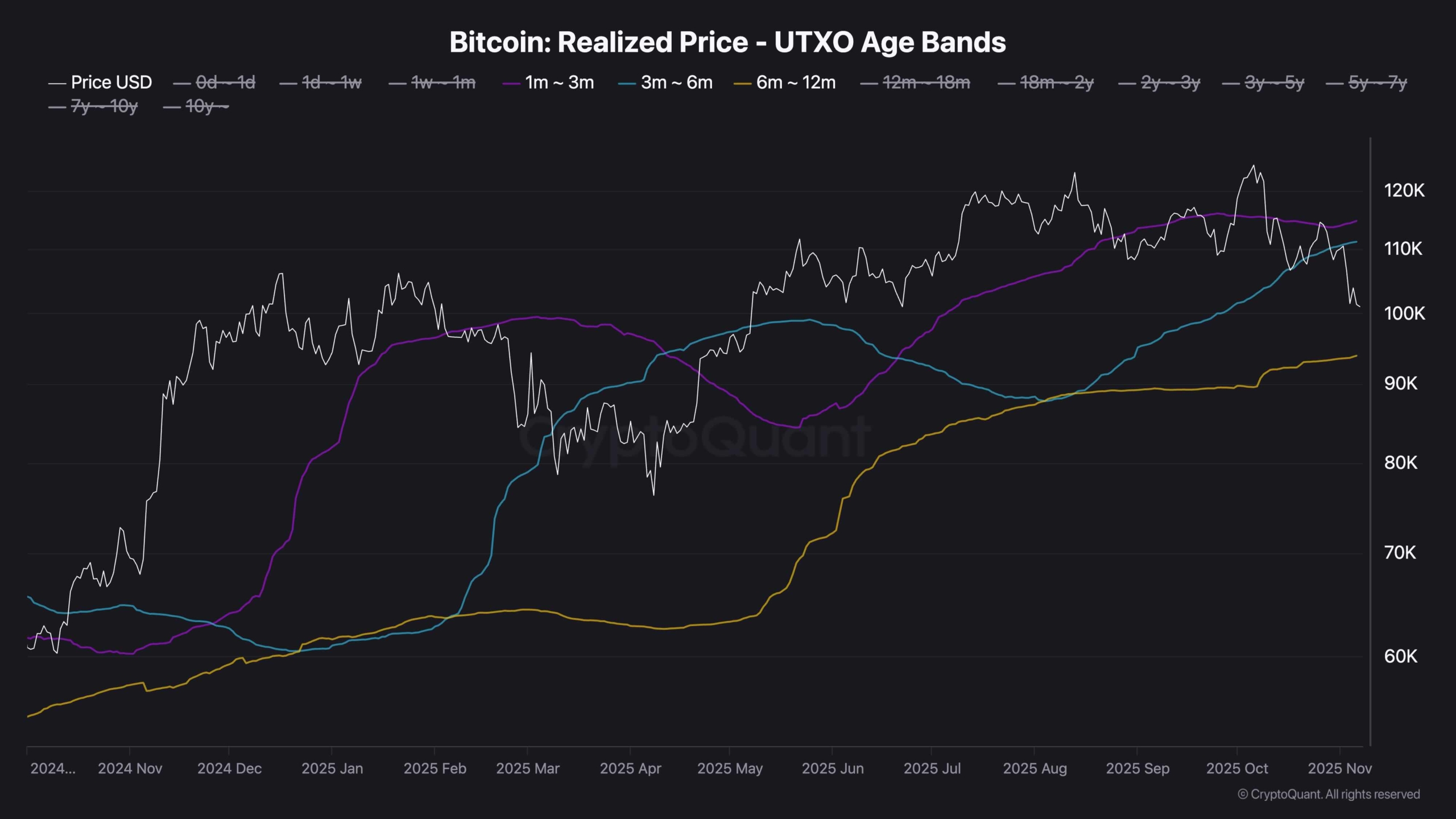

The Realized Mark by UTXO Age Bands affords serious perception into the original provide–demand balance between market cohorts.

Bitcoin’s place has declined beneath the 1–3 month and 3–6 month holders (crimson and blue lines), that ability these cohorts are collectively underwater. This shift transforms their realized place ranges (roughly $107K–$110K) into overhead provide zones, areas the attach many of those transient holders would possibly maybe moreover exit at breakeven once the asset rebounds, increasing preliminary resistance sooner or later of restoration phases.

Conversely, the 6–12-month cohort’s realized place (yellow line, discontinuance to $95K–$96K) is rising as a seemingly demand boundary. This team, in most cases extra affected person mid-timeframe holders, historically affords market enhance sooner or later of leisurely-stage corrections, spicy provide from capitulating transient patrons.

This distribution of realized costs paints a clear structural image; Bitcoin is trapped between realized provide (transient loss holders) and realized demand (mid-timeframe solid fingers). A sustained defense above the 6–12 month realized place band would signal that longer-timeframe capital continues to raise in terror-pushed selling, hanging forward the better bullish cycle intact.

Nonetheless, a decisive breakdown beneath that stage would notify a deeper capitulation occasion, likely resetting sentiment sooner than any macro reversal.