Bitcoin may per chance per chance be currently trending downwards, but a corpulent most principal breakdown presentations it is engrossing to reach help to $120,000, and it is only a topic of time.

In accordance with an intensive most principal evaluation shared by Mr. Wall Avenue on X, the original months of model stagnation and sudden drops are phase of a greater accumulation phase dominated by institutional avid gamers. The general setup, he argued, components clearly to Bitcoin’s eventual climb help above $120,000.

Institutional Accumulation And Controlled Bitcoin Label Differ

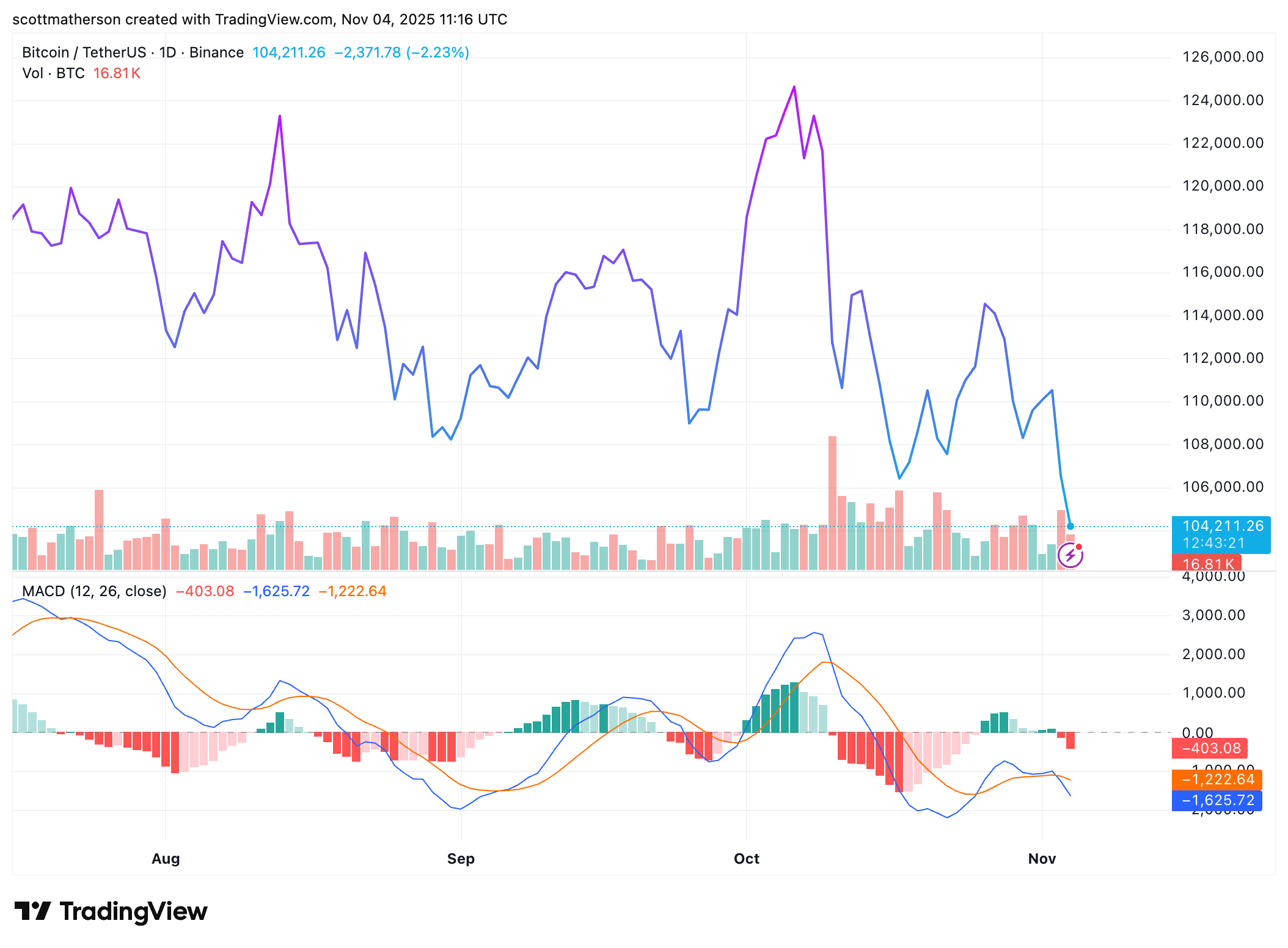

The analyst’s first point is how Bitcoin has been trading within a 120-day fluctuate, oscillating between $107,000 and $123,000 to make what is a managed consolidation fluctuate by institutions supposed to push out outdated retail investors. Mr. Wall Avenue well-known that Bitcoin’s structure stays essentially bullish despite the prolonged sideways movement.

Every strive and speed above $120,000 strongly or below the $107,000 help has failed, a signal that giant institutions are actively controlling liquidity within this slender band. Every crash within this era, in conjunction with the one precipitated by the Binance sell-off and Trump’s tariff battle with China, used to be met by robust institutional bids near the $107,000 zone, even when Bitcoin went on a flash crash to $101,000.

Therefore, there just isn’t this kind of thing as a technical or structural weak point that invalidates the bullish thesis. The imbalance to the upside, he added, is enough to push Bitcoin help to trading within the $120,000 and $123,000 fluctuate, which is the Cost Position High.

Mr. Wall Avenue furthermore tied Bitcoin’s coming surge to adjustments within the course of the Federal Reserve’s insurance policies. He identified that despite claiming to remain quantitative tightening, the Fed has quietly injected billions into the banking device thru repo operations and mortgage-backed securities purchases. He highlighted a single Friday where $50.35 billion entered the device.

In accordance with him, this liquidity will within the waste pick up its potential into possibility sources, in conjunction with Bitcoin, in a sample same to the 2019 monetary response that preceded crypto’s 2020 and 2021 bull inch. Although he warned that a fabricated crash may per chance precede the next liquidity wave, this can only make stronger Bitcoin’s long-time interval role for one other pass to $120,000 and per chance greater.

Gold And Bitcoin In The Battle For The Right Store Of Cost

Mr. Wall Avenue in most cases identified as attention to the psychological aspect of the original cycle, which has been highlighted by some investors gravitating against gold. He argued that retail investors are being pushed to gold thru manipulated narratives of stagflation and financial effort, whereas institutions quietly aquire Bitcoin. “What’s ironic is that the same logic that drives folk to aquire gold desires to be making them aquire Bitcoin as a replacement,” he acknowledged.

The ongoing gold hype is to distract the final public whereas institutions compile Bitcoin at slice charge ranges. Once retail participants exit the crypto market fully, then there may be going to be a pass upward that redefines Bitcoin’s model stage.

As he concluded, the dumb sideways phase is nearing its dwell, and the next aggressive pass, one which may maybe per chance carry Bitcoin help above $120,000, is barely a topic of time. At the time of writing, Bitcoin is trading at $104,200.