Despite the expectations for an altcoin season in 2025, the rallies for most sources maintain been short-lived. On-chain metrics also counsel that even the leading altcoins are back to crypto iciness conditions, as activity is winding down.

On-chain metrics indicate an ‘altcoin iciness’, the assign most sources will exclusively lag to a decrease differ. In 2025, prices shifted to altcoin season on a lot of occasions, however the rallies exclusively lasted for a pair of days.

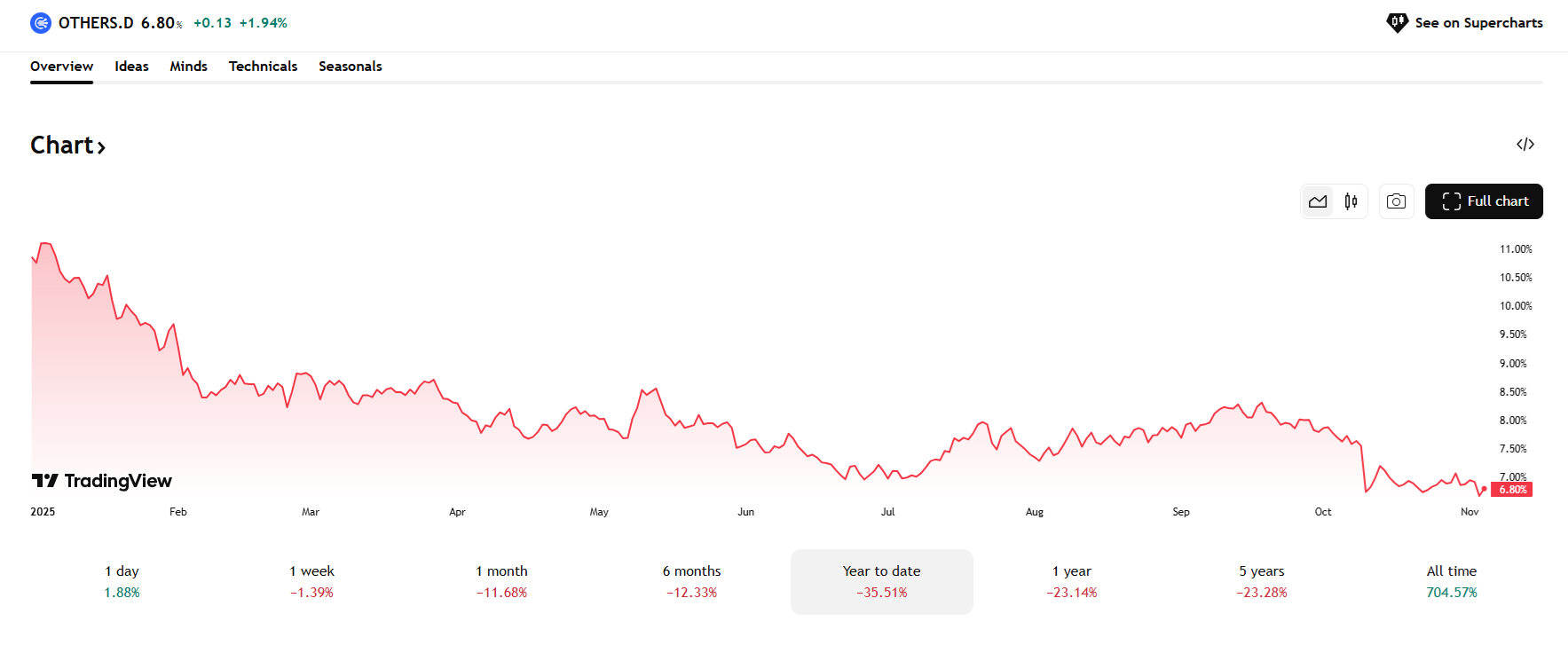

For the twelve months to this level, altcoins rather then the conclude 10 sources are down by 35.5%, extending their long-time period lag. Even blue-chip sources saw a downturn in the previous month, no topic expectations for a market-huge recovery in October.

For most of 2025, on-chain activity remained high, boosted by DeFi, meme tokens, and DEX procuring and selling, as well to lending. Stablecoin transfers also kept one of the well-known crucial main chains packed with life.

Some altcoins might moreover outperform BTC in the short time period, but overall, the markets infrequently look a fat rotation of liquidity into the riskier sources. The rise in perpetual DEX procuring and selling also ability fewer patrons for altcoins, and fewer holders, but extra directional bets thru leveraged procuring and selling.

Altcoin prices lost 50% on reasonable

Within the previous three months, these metrics took a downturn, with a decrease quite a lot of of packed with life wallets, new customers, and transaction counts. Most altcoins are down 50% on reasonable over the final three months, while they also by no means revisited all–time highs from outdated cycles.

In accordance to the altcoin season index of 41 points, it is neither a BTC season nor an altcoin season. As BTC crashed closer to $100,000, altcoins took even deeper cuts. ETH led the fall, dipping to $3299.88. BNB returned to $955, while SOL dipped additional to $155.

Smaller altcoins remained lazy and differ-inch, with tiny exceptions from pumping tokens and legacy personal coins. Despite the occasional recoveries, overall slowdowns in altcoin metrics maintain persevered for six months and are starting up to resemble outdated crypto iciness classes.

Merchants also benefit the in vogue perception that there’s potentially no longer a market the assign all sources are rising, no topic fundamentals or procuring and selling profiles. Thousands and thousands of most up-to-date tokens maintain been created, and exclusively a tiny handful maintain fetch entry to to liquidity. The slowdown in South Korean markets is also cutting into the expansion seemingly of altcoins.

Despite the favorable altcoin purchase signal, there is diminishing demand for doubtlessly illiquid coins and tokens. Even high meme sources like PEPE maintain lost their on-chain activity, while Solana’s community is now focusing on the ZCash (ZEC) integration.

Altcoins lose attraction as crypto matures

Altcoins extended their series of losses as there are doubts in regards to the return of a each day four-twelve months cycle. In 2025, some altcoins bought a boost from treasury firms, but most sources maintain been too dreadful to be added to reserves.

Altcoin treasuries also frail present reserves from ICOs, team allocations, and whale wallets, and occasionally led to originate market searching out out.

The total expectation is that altcoins will defend shedding in BTC terms, and additional will seemingly be forgotten with no probability of returning.