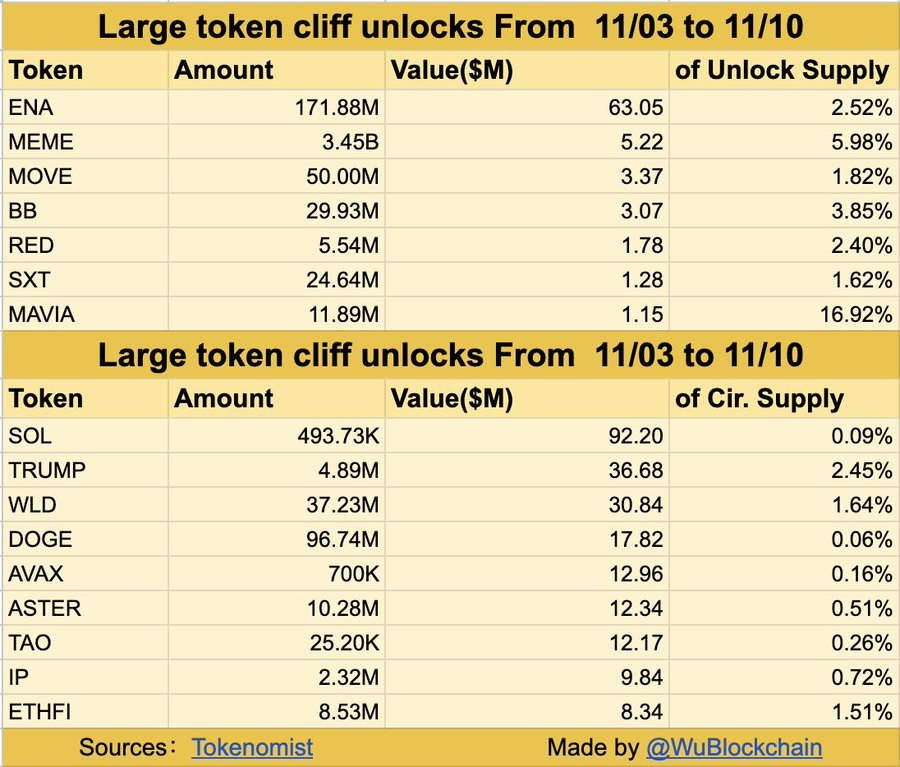

The crypto market is bracing for a wave of mighty token unlocks between November 3 and November 10, with a complete ticket exceeding $312 million, in accordance with records from Tokenomist. These scheduled releases could perhaps well introduce fast volatility for loads of altcoins as beforehand locked tokens enter circulation.

Essential One-Time Unlocks Above $5 Million

Several tokens will skills fundamental one-time unlocks this week, each and each surpassing $5 million in ticket. These embody:

- ENA (Ethena): $63.05 million charge of tokens (2.52% of provide)

- MEME: $5.22 million (5.98%)

- MOVE: $3.37 million (1.82%)

- BB: $3.07 million (3.85%)

- RED: $1.78 million (2.40%)

- SXT: $1.28 million (1.62%)

- MAVIA: $1.15 million (16.92%)

The largest among these is Ethena (ENA), with over $63 million in tokens region to release, potentially drawing trader attention attributable to its fairly diminutive circulating provide ratio.

Large Linear Unlocks to Overview

A separate region of tokens will gaze linear unlocks exceeding $1 million per day, spreading unusual provide gradually over the week. These embody major names equivalent to Solana (SOL) and Dogecoin (DOGE):

- SOL: $92.20 million (0.09% of provide)

- TRUMP: $36.68 million (2.45%)

- WLD (Worldcoin): $30.84 million (1.64%)

- DOGE: $17.82 million (0.06%)

- AVAX: $12.96 million (0.16%)

- ASTER: $12.34 million (0.51%)

- TAO: $12.17 million (0.26%)

- IP: $9.84 million (0.72%)

- ETHFI: $8.34 million (1.51%)

Solana’s $92 million release is the largest by ticket this week, though it represents appropriate 0.09% of its circulating provide, suggesting diminutive ticket impact.

Market Outlook

Token unlocks in most cases trigger fast selling rigidity, in particular when the originate dimension is mighty relative to circulating provide. On the other hand, the final impact depends on market sentiment and liquidity.

With over $312 million charge of tokens coming into the market in a single week, the market could perhaps well gaze increased volatility across affected resources, in particular ENA, MEME, and WLD, which bear smaller liquidity bases.

If institutional and retail attach a query to stays regular, worthy of this unusual provide is in all likelihood absorbed with out major disruption.