Brian Kelly is a monetary analyst and television persona identified for his abilities in cryptocurrencies and blockchain abilities. He is the founder and CEO of BKCM LLC, an funding agency interested by digital currencies. Kelly is in point of fact a frequent contributor to CNBC, the put he presents prognosis and commentary on monetary markets, with a mutter level of curiosity on cryptocurrency developments and funding systems. He has authored “The Bitcoin Immense Bang: How Different Currencies Are About to Replace the World,” which explores the aptitude of Bitcoin and other digital currencies to revolutionize the monetary industrial.

On February 28, Kelly appeared on CNBC’s “Hasty Money” to discuss the surging mark of Bitcoin, at a time when it became trading correct below the $61,000 degree. In an huge conversation with host Melissa Lee, Kelly shared his insights on the cryptocurrency market’s dynamics and what the long flee holds.

Kelly emphasized the importance of timeframe when interested by Bitcoin’s future trajectory. He acknowledged the cryptocurrency’s resistance at outdated highs and noted the a lot of enlarge in funding rates, which also can point out an impending pullback. Kelly identified that a non everlasting retracement wouldn’t be excellent-searching, given the asset’s ancient previous of volatility. Even at some stage in the bullish market of 2017, Bitcoin skilled grand monthly drops. Thus, a 25% to 30% pullback in the cease to term is all the way via the realm of risk, in step with Kelly.

He stated:

“In the pretty short term, it may maybe perhaps no longer shock me to enjoy a examine a pullback, and I command my team each day, even in 2017 as soon as we had, , Ethereum up 4,000%, it soundless had a month that became down 50%. So, that is an asset that is soundless extremely volatile. If it pulled succor 25 or 30%, it wouldn’t shock me at all.“

No matter the aptitude for non everlasting volatility, Kelly’s long-term outlook for Bitcoin stays bullish. He believes that the cryptocurrency will proceed to reach contemporary highs, pushed by its inherent value and rising adoption.

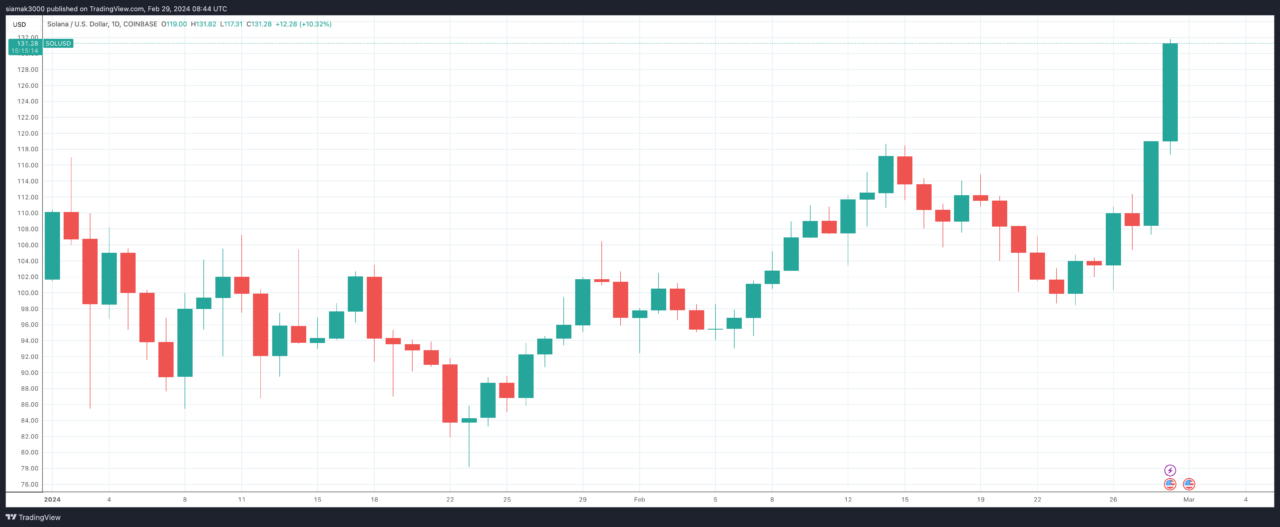

The conversation also touched upon the aptitude affect of an authorised space Ethereum (Ether) ETF and its implications for the crypto put. Kelly suggested that the anticipation of an enviornment Ether ETF may maybe perhaps power costs up, identical to what has been seen with Bitcoin. He also highlighted the broader curiosity in other cryptocurrencies, comparable to Solana (SOL), which also can profit from a rotation of investments following gains in Bitcoin and Ethereum.

Kelly also supplied insights into equities which also can profit from the present crypto wave, including miners and restore suppliers fancy Coinbase (NASDAQ: COIN). Whereas he acknowledged the cruel nature of the mining industrial attributable to its capital-intensive requirements, he also identified the a lot of gains miners can quit at some stage in bull markets. He says that Coinbase, as a vital player in the cryptocurrency alternate put, stands out as a beneficiary of the inflow of investments into cryptocurrencies.

Addressing the distribution of investments all the way via the crypto put, Kelly seen that Bitcoin and Ethereum enjoy dominated most fashionable gains, doubtlessly on the expense of different cryptocurrencies. Nonetheless, he anticipates a that it is possible you’ll perhaps perhaps maybe maybe imagine rotation of investments into other promising projects with solid fundamentals and utilize cases, comparable to Solana (SOL) and Chainlink (LINK), especially if Bitcoin experiences a non everlasting pullback.

Discussing the efficiency of public miners and the affect of the Bitcoin halving tournament (which is expected in April 2024), Kelly believes the halving is more psychological than indispensable in its affect in the marketplace. He expects miners to live profitable by controlling charges and views the halving as share of the market’s cyclical nature, which historically aligns with bull markets.

When pressed for his high cryptocurrency decide out of doorways of Bitcoin, Kelly highlighted Solana as his want for the subsequent possible surge. His preference for Solana is in step with its promise and the anticipated rotation of investments from Bitcoin and Ethereum into other cryptocurrencies with enhance possible.

Featured Image via Pixabay