The crypto market is beginning to display early indications that a brand original altcoin season can be drawing attain, as analysts reference historical patterns and technical indicators hinting at a rebound after a lengthy move. Even supposing altcoins comprise fair as of late lagged within the support of Bitcoin, bullish components from data and macroeconomic parallels are constructing optimism that a change in liquidity conditions might perhaps perhaps well residence off a solid market-wide rally for altcoins.

Altcoin Dominance Hits Document Oversold Stages

In retaining with crypto analyst Javon Marks, altcoin dominance has entered oversold conditions for the principle time in historical past. Marks highlighted in his post that the indicator, which measures the market fragment of all altcoins, is now basically the most oversold it’s ever been.

The OTHERS.D chart reveals the market dominance percentage of all cryptocurrencies moreover the high 10 by market capitalization. It’s miles a measure of the combined market fragment of smaller altcoins and can be used to title broader altcoin rallies. His lengthy-duration of time chart of the OTEHRS.D motion spans over a decade, with every fundamental low adopted by a long duration of restoration and massive market good points.

The chart reveals that dominance has declined sharply since its 2021 height of around 20%. On the time of writing, the OTHERS.D dominance is around 7%. A wave development indicator on the bottom of the chart is in deep detrimental territory around detrimental 50%, which is its lowest in historical past.

Marks favorite that such oversold conditions continuously precede solid reversals. It blueprint that selling stress has been exhausted and that a fundamental rebound might perhaps perhaps well soon initiate up. If this sample repeats, altcoins can be entering no doubt one of their most attractive accumulation phases in years.

Fed’s Monetary Shifts And Their Influence On Crypto Liquidity

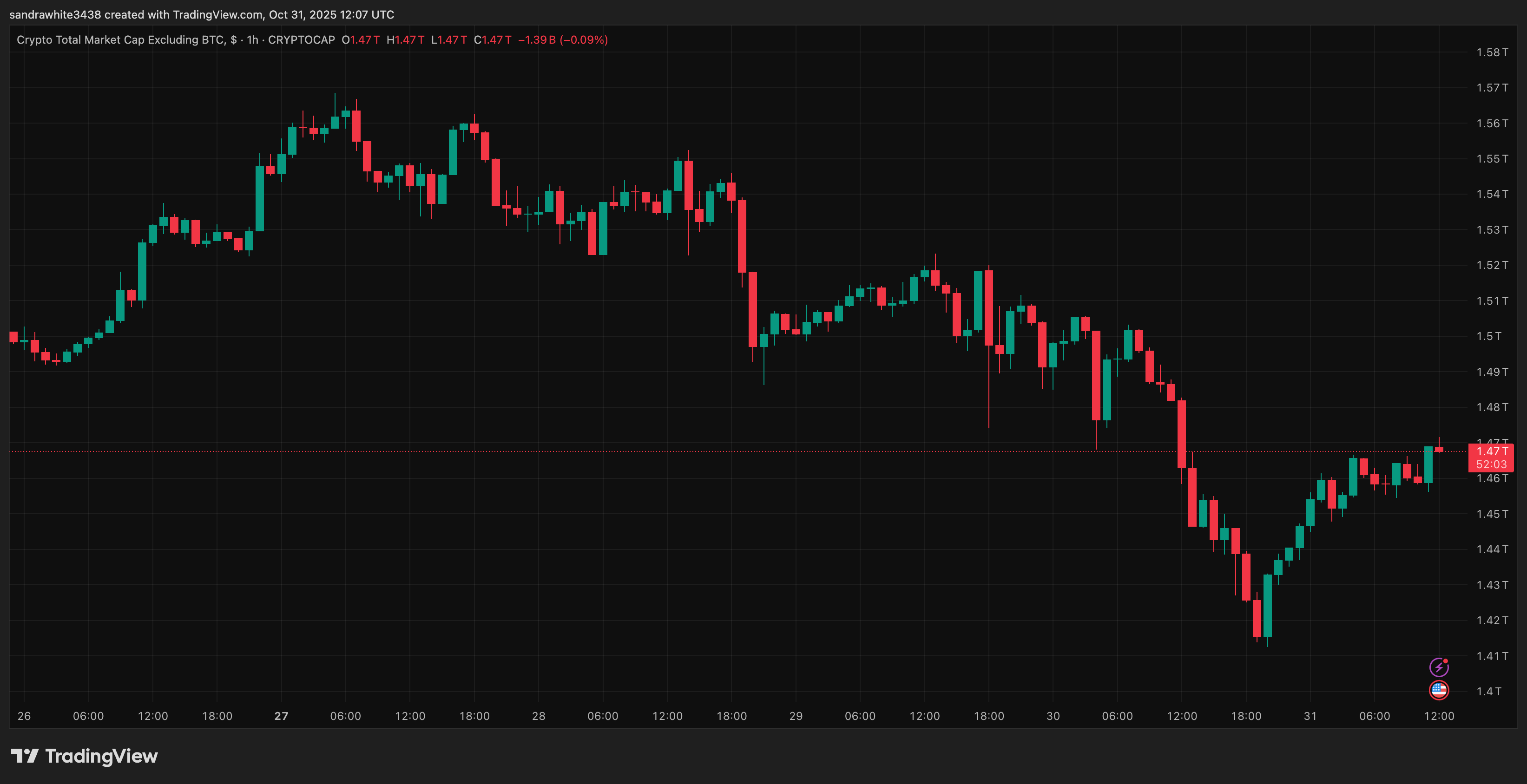

Yet any other technical standpoint came from analyst Ted Pillows, who in contrast present market conditions to the 2019-2020 cycle when the Federal Reserve ended quantitative tightening (QT) and later resumed quantitative easing (QE). His chart of the crypto total market cap moreover Bitcoin reveals a 42% decline following the tip of QT in unhurried 2019, adopted by an explosive restoration after the Fed initiated QE in March 2020.

Pillows defined that while ending QT might perhaps perhaps well ease financial stress, it would indirectly inject liquidity into the economic system, one thing altcoins must rally. In inequity, QE or Treasury Typical Narrative (TGA) releases flood the market with liquidity and enable inflows into cryptocurrencies.

He favorite that ending QT isn’t enough for alts to rally. It’s miles either the Fed begins but any other QE or the Treasury releases TGA liquidity into the economic system. The most seemingly option correct now is the 2d one.

Crypto Total Market Cap With the exception of BTC. Offer: Ted Pillows On X

With the US authorities for the time being in a shutdown, he instantaneous that a TGA-driven liquidity initiate might perhaps perhaps well happen as soon as the fiscal impasse is resolved, and this might perhaps occasionally relief because the next fundamental driver for the altcoin market.