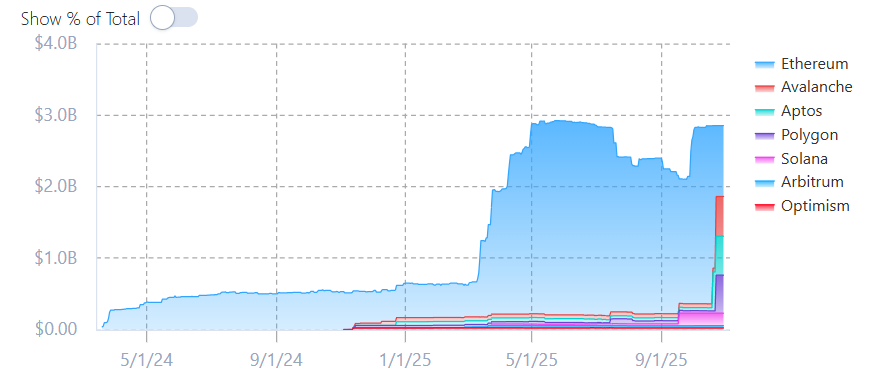

BlackRock and its tokenization partner Securitize have redistributed a immense chunk of the asset supervisor’s tokenized fund BUIDL across several blockchains, quietly decreasing its market cap on Ethereum by about 60%.

Recordsdata from RWAxyz shows that the $2.8 billion fund’s holdings on Avalanche, Aptos, and Polygon jumped to spherical $554.7 million, $544.1 million, and $530.9 million as of Oct. 30, up from staunch $54.3 million, $43.4 million, and $30.7 million respectively as of Oct. 19. Over the same duration of time, the $2.4 billion of the fund held on the Ethereum community dropped to about $990 million.

BUIDL used to be within the origin launched handiest on Ethereum in March 2024, before origin its expansion to quite loads of blockchains staunch below a year ago, with the overwhelming majority of the fund remaining on Ethereum except this month. Both BlackRock and Securitize failed to straight away reply to The Defiant’s quiz for comment on the mosey by press time.

BlackRock is the world’s largest asset supervisor with over $13.4 trillion in sources below administration as of Q3. BUIDL stays the largest tokenized staunch-world asset (RWA) product, holding over $2.85 billion in sources.

BUIDL’s community diversification comes because the total trace of tokenized RWAs continues to surge this year, at the second at bigger than $35.6 billion, up about 8.8% over the past 30 days, essentially essentially based completely on RWAxyz.

Ethereum stays the most up-tp-date blockchain for RWAs, with practically $12 billion in tokenized RWA trace, or about fifty three% of the field.

Launched by BlackRock in partnership with Securitize, BUIDL lets certified merchants support and get dividends on blockchain‑essentially essentially based completely tokens backed by U.S. Treasuries, money, and repurchase agreements.

Earlier this week, Securitize announced plans to change right into a publicly listed firm by a commerce aggregate with Cantor Equity Partners II, Inc., a SPAC backed by Cantor Fitzgerald, an organization previously led by Howard Lutnick before he became U.S. Secretary of Commerce.

The deal values the firm at about $1.25 billion, and the blended entity is expected to commerce on Nasdaq below the ticker SECZ.