The Federal Reserve Begin Market Committee (FOMC) announced a 25 basis point hobby price lower on Wednesday, bringing the aim Federal Funds price down to some.75%-4%.

Wednesday’s price lower turned into once “fully priced in” by merchants, who broadly anticipated the decision, consistent with Matt Mena, a market analyst at investment firm 21Shares. Mena also forecast:

“November has historically been one in all Bitcoin’s most effective-performing months, with obvious returns in 8 of the past 12 years, averaging 46.02% returns. Overall, we remain moderately threat-on and ogle a credible direction for Bitcoin to smash its all-time high sooner than three hundred and sixty five days-discontinue.”

Asset costs remained flat or fell by modest amounts on Wednesday following the FOMC decision, with the price of Bitcoin (BTC) falling by about 2.4% at the time of writing, following Federal Reserve Chair Jerome Powell’s comments signaling that FOMC participants are divided on a December price lower.

“The surprising hawkish dissent from a regional Fed president highlights that future moves are turning into extra contentious,” Michael Pearce, deputy chief US economist at advisory firm Oxford Economics, talked about in comments shared with Cointelegraph.

The rising dissent among the many FOMC alerts a deeply divided Fed, which might put a damper on crypto costs by starving the market of liquidity that can per chance per chance float into digital and other threat-on assets.

Connected: US Bitcoin and Ether ETFs rebound as Powell alerts price cuts

Market participants gauge the likelihood of further price cuts in 2025

The Federal Reserve started the 2025 price-cutting cycle in September with an initial 25 basis-point lower, which helped spur BTC costs to all-time highs of over $125,000.

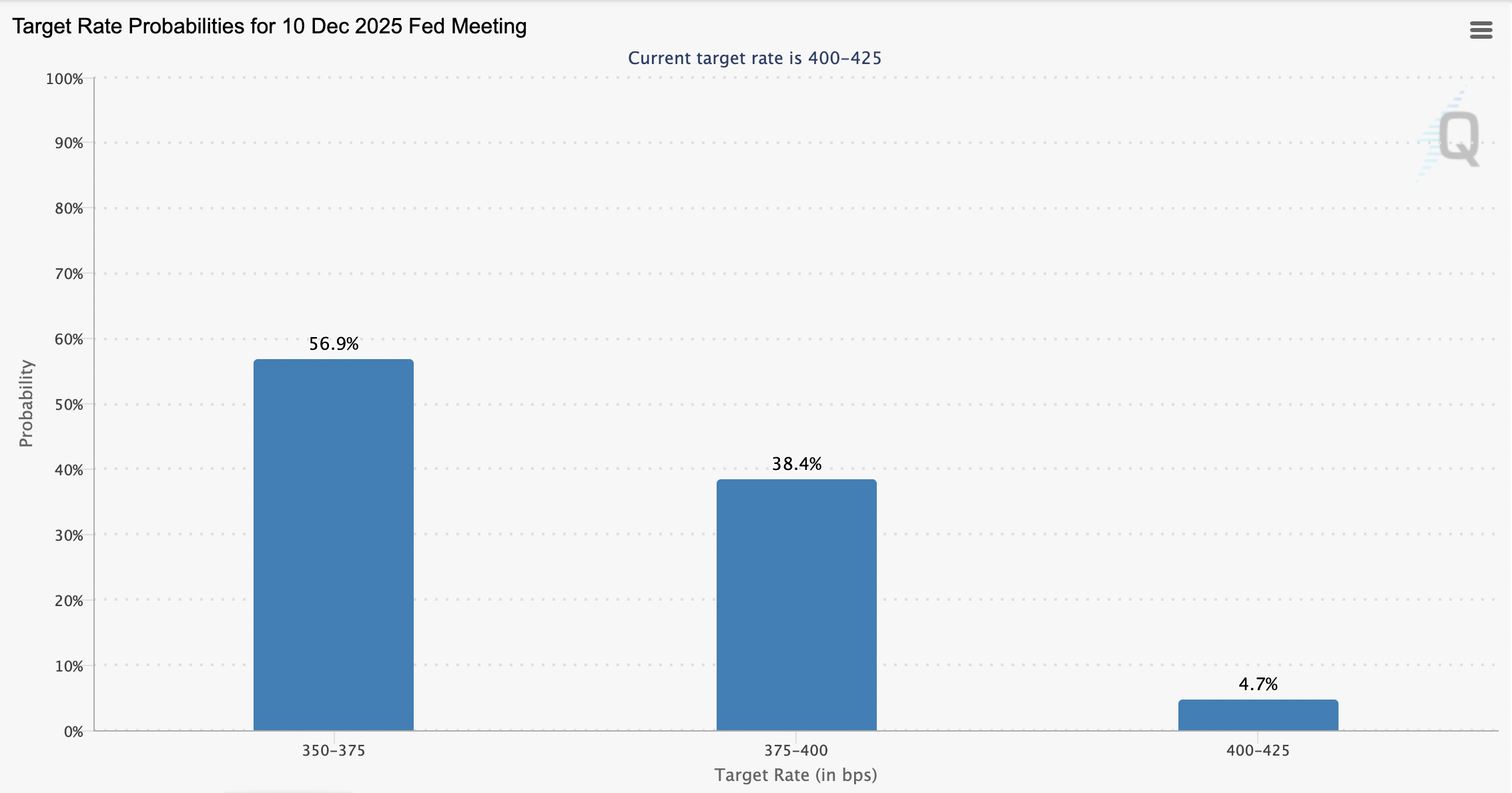

Over 56% of market participants inquire the Fed to lower hobby charges to a aim window of 3.5%-3.75% in December, consistent with files from the Chicago Mercantile Change (CME).

In September, several commercial banking giants, including Financial institution of The United States, Citigroup and investment bank Goldman Sachs forecast at the least two price cuts in 2025.

The cuts would usually boost asset costs. On the opposite hand, the broadly anticipated cuts is liable to be overshadowed by the looming uncertainty sparked by alternate tensions between China and the US, constructing investor hesitation.

Magazine: Crypto merchants ‘fool themselves’ with label predictions: Peter Brandt