Recordsdata reveals cryptocurrency brief investors have suffered colossal liquidations in the course of the past day as Bitcoin and altcoins have made a recovery.

Bitcoin, Ethereum Have Surged In The Ultimate 24 Hours

Bitcoin and diversified cryptocurrencies have witnessed a rally in the course of the past day, breaking far from the jog the market had earlier fallen into. At the tip of this surge, Bitcoin broke past $116,000, whereas Ethereum touched $4,250.

The assets have since seen a puny retracement. The chart below reveals how BTC’s most up-to-date trajectory has regarded.

At its fresh price of $115,400, Bitcoin is up about 4% on the weekly timeframe. Equally, Ethereum at $4,160 is in a profit of three.4%. Most diversified digital assets have seen equally budge returns, despite the incontrovertible reality that there are some outliers love Tron, which is down extra than 7%. The market-huge recovery in the course of the past day has meant that a colossal quantity of brief liquidations have piled up on the derivatives exchanges.

Crypto Market Liquidations Have Totaled At $467 Million

In accordance with data from CoinGlass, about $467 million in cryptocurrency-associated derivatives contracts were liquidated over the final 24 hours. A contract is presupposed to be “liquidated” when its platform forcibly shuts it down after it accumulates losses of a favorable stage (as outlined by the alternate).

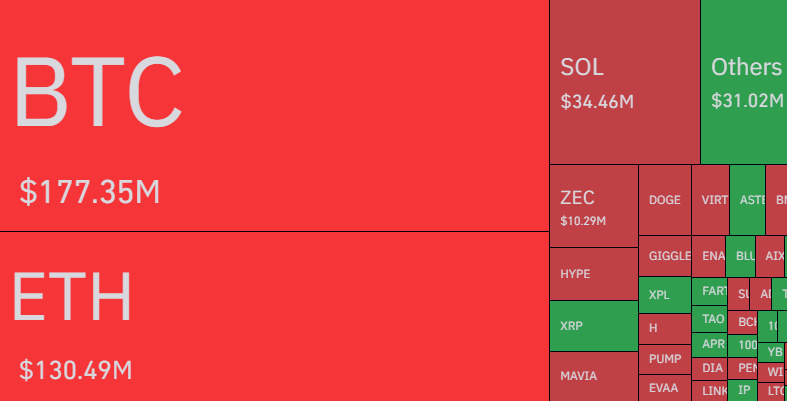

Given that coins across the board have rebounded, the contracts crossing this threshold would mostly be the brief ones. And indeed, the data would verify so.

As is seen above, liquidations associated to bearish cryptocurrency bets have reached $358 million in this window, representing 76.6% of the entire flush in the field. Bitcoin led the liquidations with $177 million in contracts alive to, whereas Ethereum contributed the 2d most with $130 million in contracts. Out of the remainder, Solana witnessed the ideal flush at $34 million.

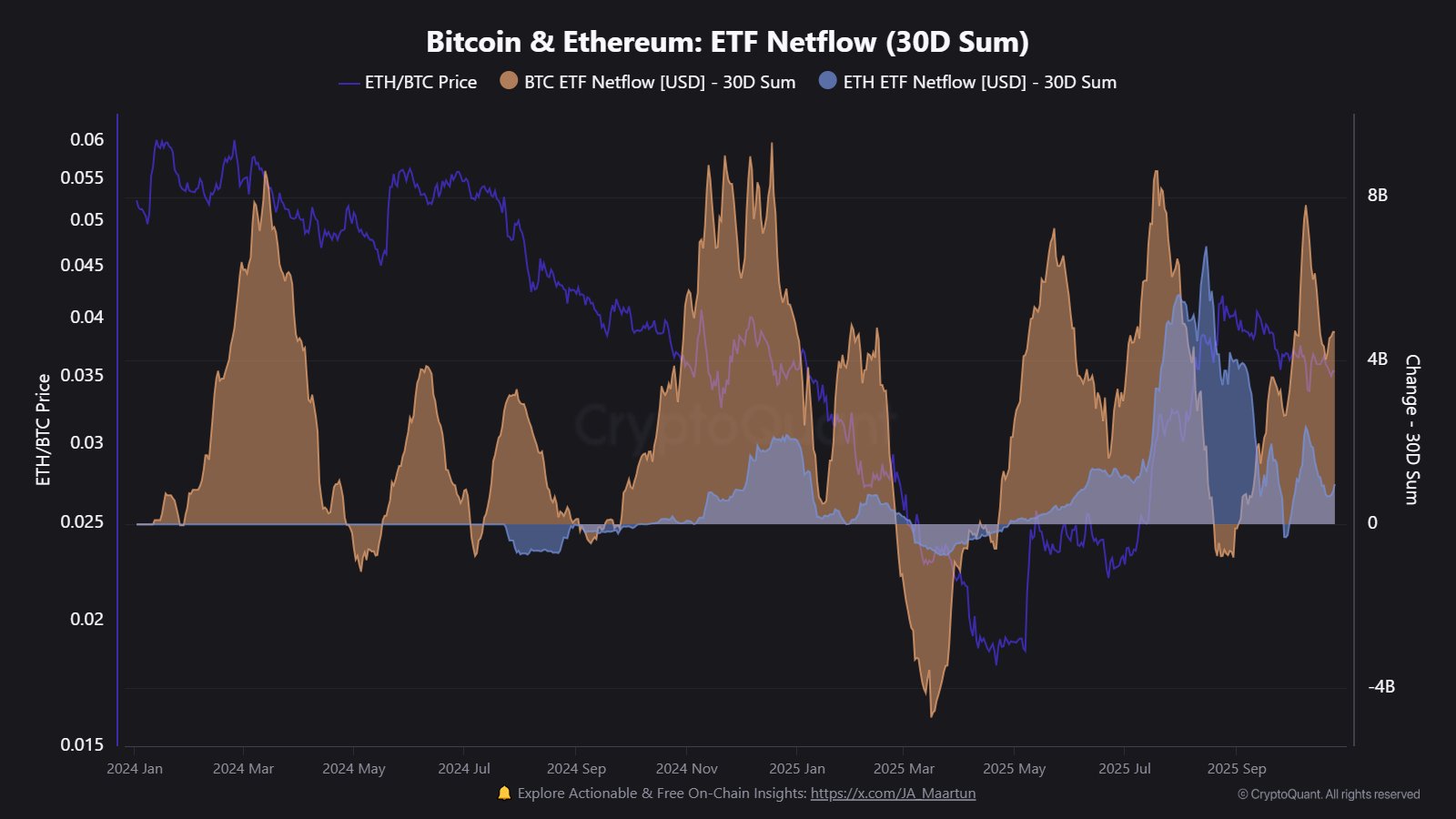

In some diversified data, Bitcoin keep alternate-traded funds (ETFs) have noticed a notable quantity of inflows over the final month, as CryptoQuant neighborhood analyst Maartunn has identified in an X put up.

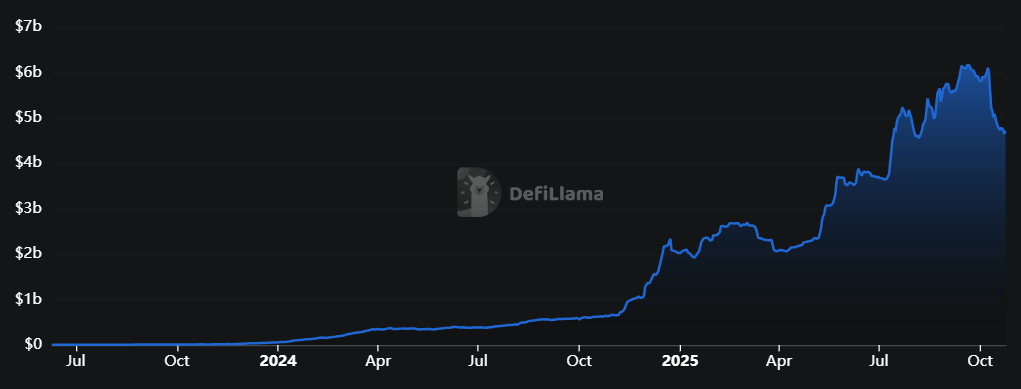

Residing ETFs take a look at with investment automobiles that allow investors to manufacture publicity to an asset without having to at as soon as have it. The US SEC permitted BTC keep ETFs in January of 2024. Here is the chart shared by the analyst that reveals how the 30-day netflow for these automobiles has fluctuated since:

As displayed in the above graph, Bitcoin keep ETFs have seen inflows of $4.7 billion in the course of the past month. Ethereum keep ETFs, which won approval in mid-2024, have also enjoyed inflows in this era, despite the incontrovertible reality that their worth of $983 million is vastly much less than BTC’s.