Crypto markets might perchance also simply gaze but every other wave of alternate-traded fund debuts this week, with Solana, Litecoin and HBAR funds appearing in US alternate listings sooner than a seemingly begin on Tuesday.

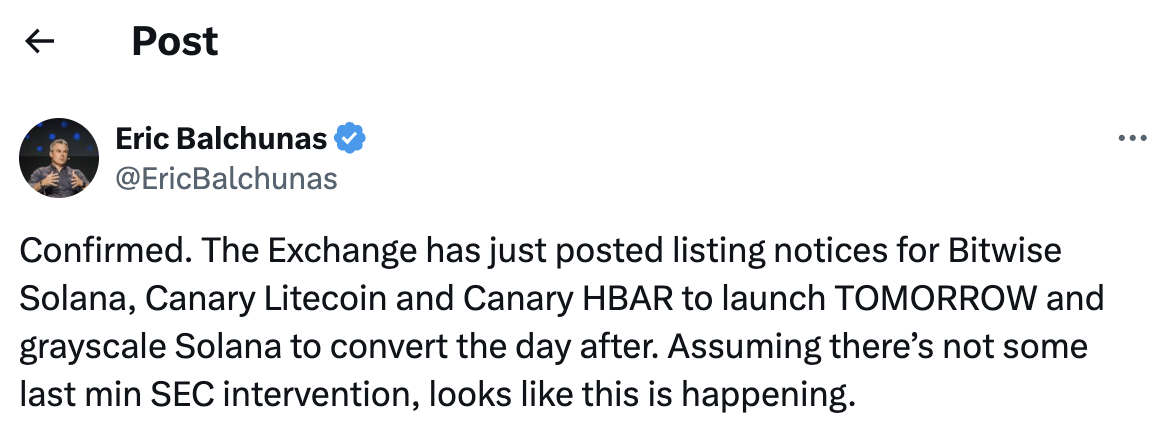

In step with Bloomberg analyst Eric Balchunas, US alternate checklist notices maintain appeared for Bitwise’s Solana (SOL) ETF and Canary’s Litecoin (LTC) and Hedera (HBAR) ETFs, with the funds slated to head stay on Tuesday.

In an X post on Monday, Balchunas acknowledged Grayscale’s Solana Belief is anticipated to convert to an ETF the following day.

A crypto ETF is a fund traded on a stock alternate that enables traders to present publicity to digital assets similar to Bitcoin (BTC) or SOL with out owning or managing the cash.

The approval job for crypto ETFs in US markets has stalled ensuing from the federal government shut down on Oct. 1. Nonetheless, the Securities and Replace Commission (SEC) is peaceful working, albeit at a shrimp ability.

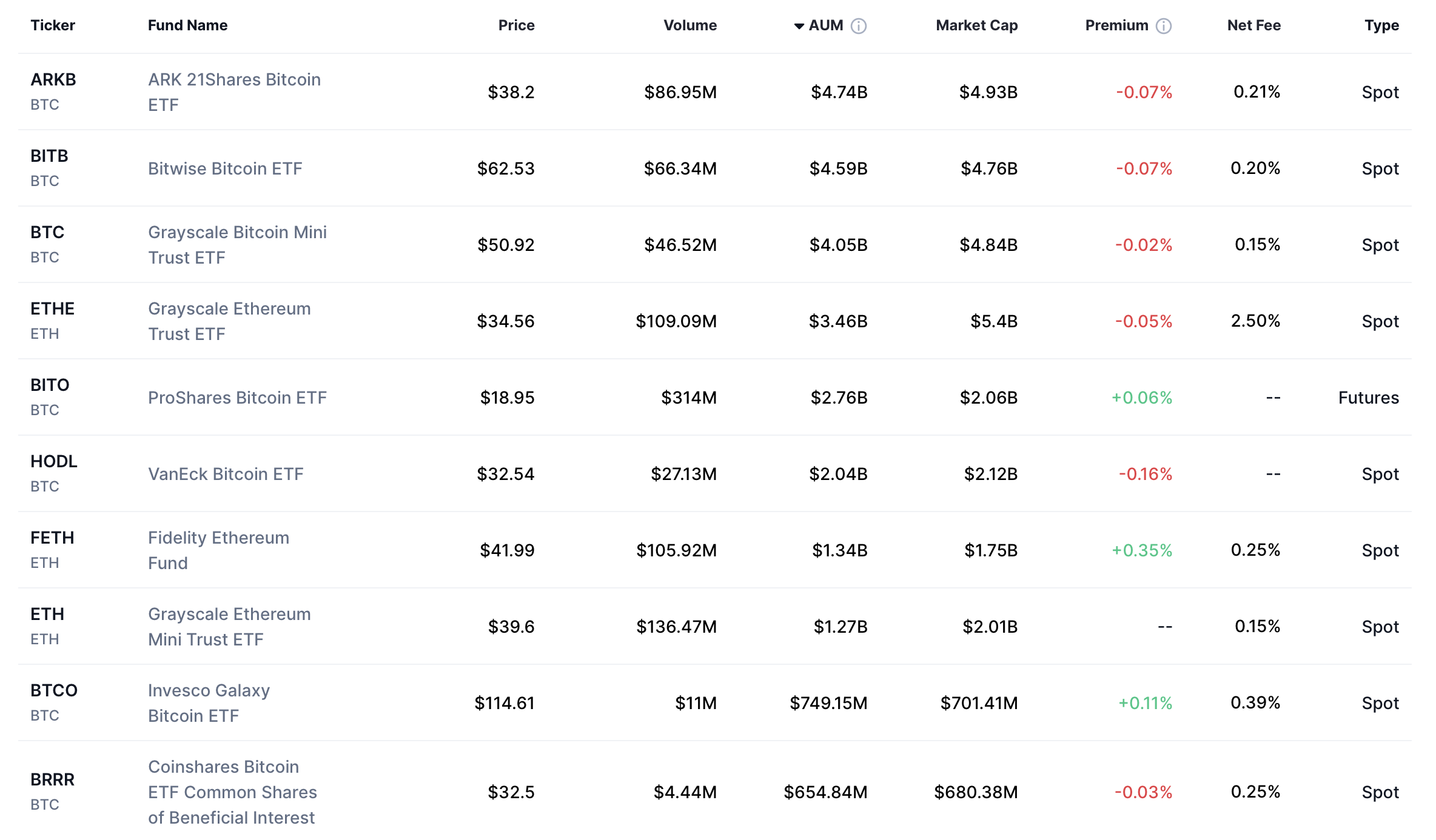

The SEC licensed basically the major US field Bitcoin ETFs on Jan. 10, 2024, opening the door for ETFs to be listed and traded by BlackRock, Grayscale, Bitwise, ARK 21Shares, WisdomTree, Fidelity, Valkyrie, VanEck, Hashdex, Franklin Templeton and Invesco Galaxy.

As Cointelegraph reported in September, as many as 16 ETFs maintain been queued up for SEC approval in October, linked to varied altcoins, including SOL, LTC, and Dogecoin (DOGE).

Solana Staking ETFS

Staking, which involves locking up cryptocurrency to encourage stable a proof-of-stake blockchain luxuriate in Solana and incomes rewards paid out within the same token, has change into one amongst basically the major narratives in crypto this yr.

In July, the REX-Osprey Solana Staking ETF debuted on the Cboe BZX Replace, turning into basically the major crypto staking ETF licensed within the USA.

Grayscale currently added staking to its Solana Belief, following the SEC’s September commentary clarifying that definite staking activities produce no longer checklist securities choices.

Bitwise’s proposed Solana ETF, which might perchance be licensed on Tuesday, moreover entails staking parts.

Thomas Uhm, chief working officer of Solana-basically basically based liquid staking and MEV protocol Jito, instructed Cointelegraph that the Solana ETF approvals are appropriate the inspiration.

“We’re already working with tier 1 funding banks on merchandise linked to those ETFs and on accumulation systems the use of staked Solana ETF alternate choices,” he acknowledged.