The Institute for Present Management’s (ISM) Manufacturing Procuring Managers’ Index (PMI) has historically aligned with main peaks in Bitcoin’s market cycles — a sample that, if repeated, might perchance per chance per chance indicate a protracted-than-stylish cycle this time around.

The correlation between the ISM PMI and Bitcoin’s (BTC) label used to be first popularized by Right Vision’s Raoul Friend and has since received traction among macro-focused crypto analysts.

“All 3 past Bitcoin cycle tops contain broadly aligned with this month-to-month, oscillating index,” analyst Colin Talks Crypto renowned, referencing the habitual overlap between Bitcoin’s market highs and the PMI’s cyclical peaks.

If that relationship holds, Colin added, “it would indicate a severely longer cycle than bitcoin cycles on the complete flee for.”

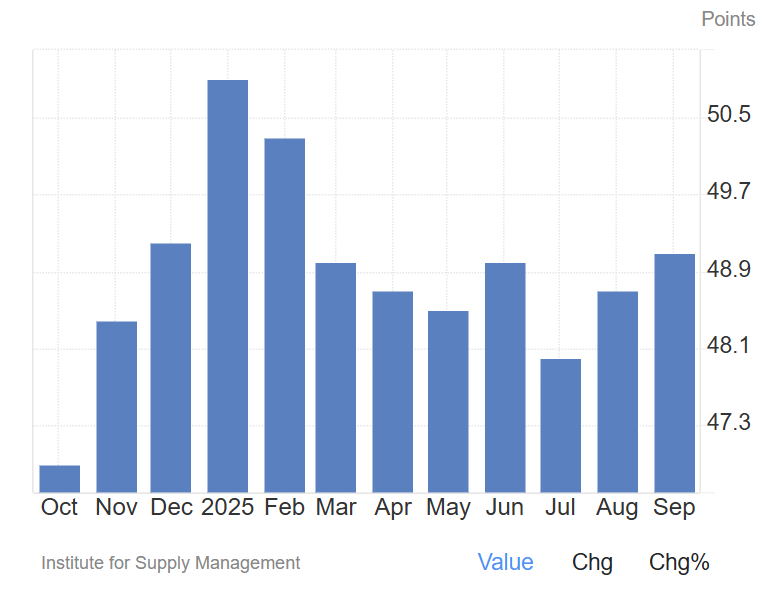

The ISM Manufacturing PMI, which measures US industrial exercise, has remained under the neutral 50 label for seven consecutive months, signaling contraction. A sustained chase above 50 would suggest renewed financial expansion, historically linked to stronger Bitcoin label performance.

Earlier this twelve months, the PMI rapidly climbed above 50 forward of slipping attend into contraction territory, underscoring continued weakness within the manufacturing economy.

Connected: Bitcoin treasuries can have more Bitcoin, says Willem Schroé

US manufacturing struggles to retain momentum amid tariffs, outmoded quiz

The manufacturing PMI signaled a convincing rebound in industry sentiment before every thing of the twelve months, partly attributed to optimism surrounding the incoming Trump administration and expectations of industry-pleasant coverage.

Alternatively, the continuing whisk from excessive tariffs, unsure commerce coverage and delicate world quiz has weighed on the sector, potentially extending the industry cycle somewhat than accelerating it.

ISM’s most traditional file showed a modest uptick in September, with costs rising while exports and imports lowered in dimension, suggesting uneven prerequisites all over manufacturing subsectors.

Despite the weakness, ISM renowned that manufacturing’s disturbed fragment of US financial output contrivance a contraction within the PMI would not primarily signal a recession. ISM has previously seen that a sustained finding out above 42.3 on the complete corresponds with disclose within the broader economy.

One procuring supervisor from the transportation instruments commerce suggested ISM in September that “industry continues to be severely sorrowful,” citing disturbed profits and “coarse taxes” within the produce of tariffs which contain raised charges all over the provision chain.

“Now we contain got increased label pressures each to our inputs and buyer outputs as companies are starting up to chase on tariffs thru surcharges, raising costs as a lot as twenty p.c,” they added.

Connected: Crypto Biz: Bitcoin whales commerce keys for comfort