Bitcoin is trading around $107,000 after its most up-to-date flash shatter, affirming stability to prevent extra decline but is but to reach to trading above $110,000. Notably, stylish crypto analyst Titan of Crypto shared an intensive Gaussian Channel analysis on X that parts to Bitcoin’s macro bull construction ultimate intact despite rapid-term volatility. His post, which turned into accompanied by a Bitcoin impress chart, shows how Bitcoin’s problem relative to the Gaussian Channel affords a transparent glimpse of the ongoing cycle.

Bull Market Intact Above Gaussian Channel

Titan of Crypto infamous that Bitcoin’s placement above the Gaussian Channel represents strength in the lengthy-term vogue. As confirmed in the weekly candlestick impress chart below, the inexperienced channel corresponds to bullish phases, while crimson regions symbolize bearish downturns, a first-rate instance being the 2022 endure market.

At the time of writing, the upper band is positioned around $101,300 and trending upward. Attributable to this truth, Bitcoin’s impress action around $107,000 skill that it’s miles but to interrupt into the Gaussian channel and its overall market construction is easy solid. From this, it will even be inferred that Bitcoin’s present pullback from the October 6 all-time excessive above $126,000 is fully a transient live inner a elevated bull market.

Bitcoin Gaussian Channel. Provide: Titan of Crypto on X

On the opposite hand, although the Gaussian Channel reading appears favorable, Titan of Crypto infamous that the indicator must easy not be treated as a trading station off. “It’s not a aquire signal, it’s a macro context indicator,” he stated. Being above the Gaussian Channel doesn’t necessarily equate to buying more. It merely skill the bull market construction is easy intact.

The Gaussian Channel works most bright when combined with thoroughly different indicators comparable to trading quantity, transferring averages, and on-chain accumulation trends to substantiate directional momentum.

Coinbase Top rate Gap Turns Red

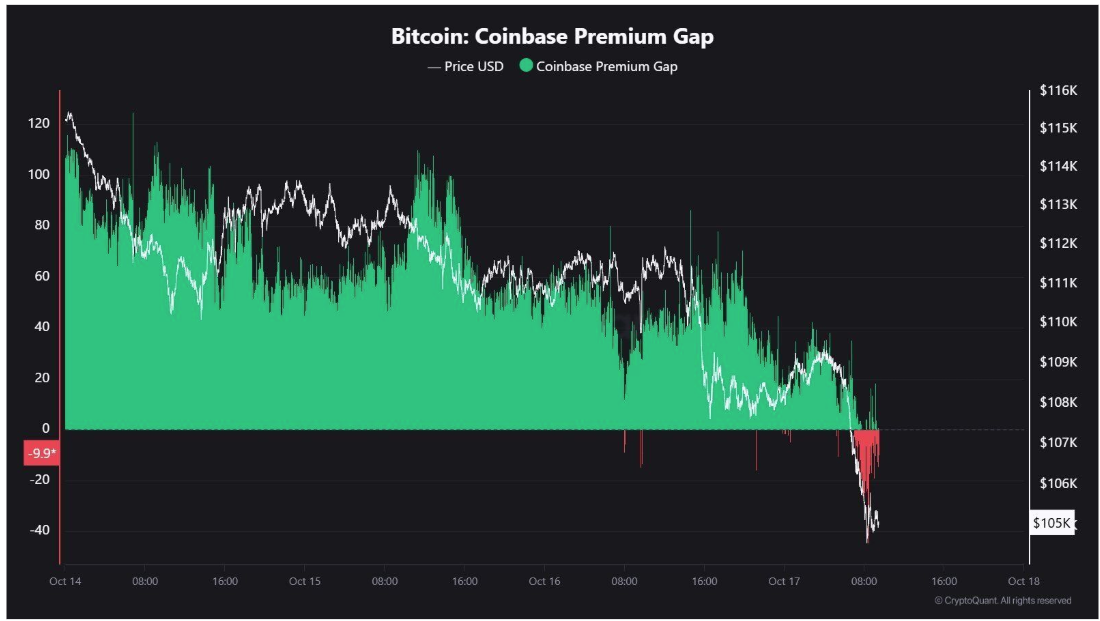

Speaking of thoroughly different indicators, on-chain info from CryptoQuant shows that the Coinbase Top rate Gap, a metric evaluating Bitcoin’s impress on Coinbase versus thoroughly different exchanges, has turned into crimson. As confirmed in the chart below, Coinbase’s Top rate Gap went on a intriguing decline from obvious top rate ranges above +60 earlier in the week to as miniature as -40 when the Bitcoin impress fell to $101,000.

Bitcoin: Coinbase Top rate Gap

Curiously, the Coinbase Top rate Gap has elevated to around -10 at the time of writing, meaning US investors are starting up to turn bullish again. This might per chance per chance be viewed as a bullish signal, as similar dips in US request had been recorded between March and April earlier than the Bitcoin impress at final rallied more than 60% to keep unique all-time highs.

On the opposite hand, a crimson Coinbase Top rate Gap on my own isn’t decisive. It desires to be interpreted alongside thoroughly different info parts, including ETF inflows, trading quantity, liquidity, and derivatives funding rates. At the time of writing, Bitcoin turned into trading at $107,120.

Featured image from Vecteezy, chart from TradingView