Following the flash shatter of closing week, the Bitcoin price has as soon as more sunk to identical depths, albeit in a more real price correction. Notably, the leading cryptocurrency dipped below $105,000 on Friday as crypto liquidations rose to above $1.2 billion. Alternatively, underlying investor buying for enlighten paints an encouraging image of a potentially bullish rebound.

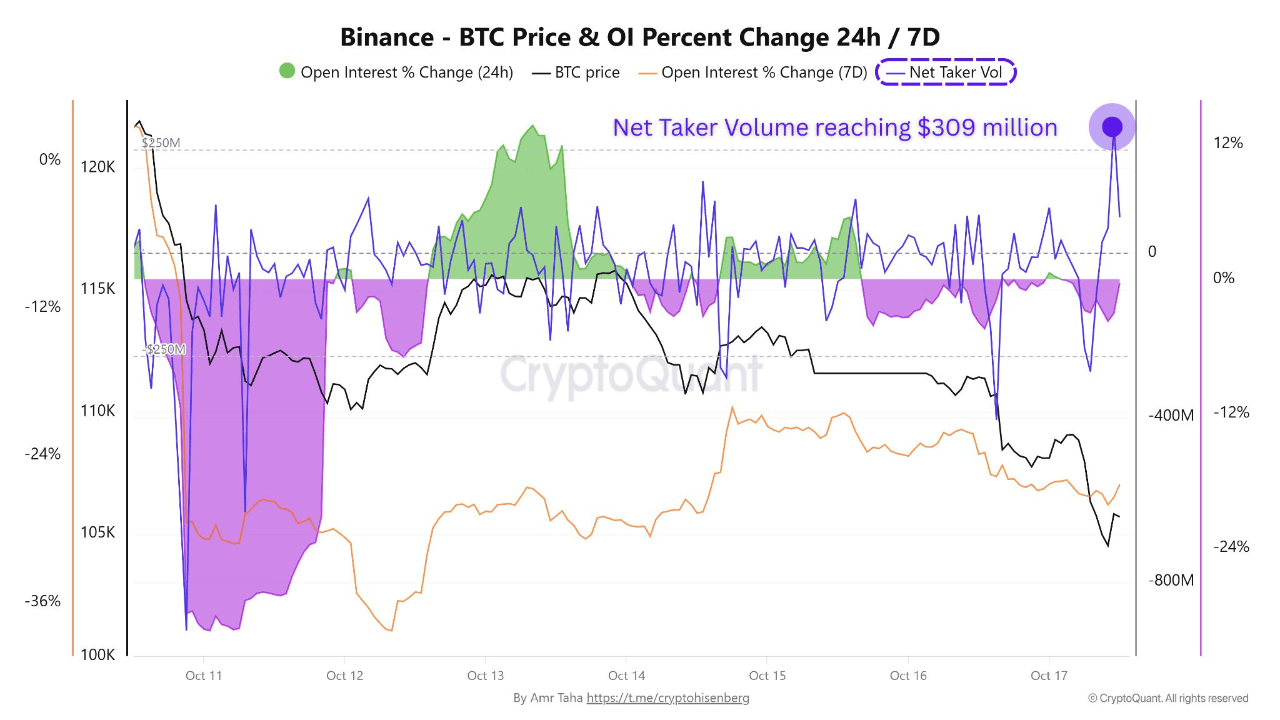

Bitcoin Pick up Taker Volume Hits $309 Million Despite Trace Drop

In a QuickTake submit on X, widespread analyst Amr Taha shares an alternate enlighten update on the Bitcoin market amidst a important price correction. The pundit reports a main uptick in buying for stress, this ability that merchants would possibly well well very neatly be quietly gathering despite the most fashionable price weakness.

Notably, on-chain knowledge reveals that the Bitcoin shatter to below $105,000 coincided with a spike within the on-line taker quantity on Binance to around $309 million, marking its first particular zone since October 10. In buying and selling terms, aquire-taker quantity represents orders that actively hit the query, i.e., merchants keen to aquire correct now at market price as a alternative of looking ahead to a wiser entry.

The switch means that, despite short-term volatility, there stays a deep undercurrent of bullish conviction among Bitcoin holders and merchants. This high accumulation enlighten at some stage in a cost inquire assuredly precedes local bottom formations, as aggressive consumers relish promoting stress, atmosphere the stage for a parabolic price rebound.

Moreover, whereas the taker quantity surged, Amr Taha reports that the delivery hobby (OI), which measures the total decision of prominent futures and perpetual contracts, failed to upward thrust in tandem. This divergence suggests that buying and selling enlighten is targeted within the distance market as a alternative of in leveraged derivatives, reinforcing the indisputable fact that merchants are actively taking part within the most fashionable market direct.

In summary, the famed crypto analyst views this alternate enlighten pattern as a doable bullish undercurrent. Taha explains that space accumulation around key liquidity stages, such as the $105K zone, assuredly serves as a foundation for future price recoveries as soon as promoting stress subsides.

Bitcoin Rebound Verified By Gold Trace Surge

In diversified knowledge, a market analyst with the username Crypto Jebb echoes Bitcoin’s potentialities of a main price rebound. Alternatively, the expert anticipates the premier cryptocurrency would possibly well well quiet quiet glimpse a extra decline sooner than at closing discovering a bottom around $92,000.

In accordance with a rising idea, Jebb hinges his bullish thesis on a doable rotation of capital from the gold market to Bitcoin as soon as the weak hits a brand new market high. Notably, gold is for the time being declaring an spectacular bullish momentum, having change into the first asset to surpass a $30 trillion market capitalization price.

Jebb predicts an eventual capital rotation when the gold market starts to very most attention-grabbing, with doable inflows anticipated to push Bitcoin to around the $150,000 price label in January. At press time, Bitcoin trades at $107,053, representing a 0.74% decline within the past day following a modest restoration effort.