A fresh 10X Evaluate file has estimated that retail merchants lost about $17 billion because of their publicity to Bitcoin treasury firms.

The losses replicate a broader decline in investor enthusiasm for Digital Asset Treasury Companies (DATCOs). Companies a lot like MicroStrategy and Metaplanet beget seen their stocks tumble in tandem with Bitcoin’s fresh sign scamper.

Bitcoin Treasury Companies Wiped Out $17 Billion in Retail Wealth

Basically primarily based totally on the file, many merchants grew to became to those DATCOs to produce indirect publicity to Bitcoin. These firms on the overall field shares at a premium to their underlying Bitcoin holdings, the usage of the raised capital to aquire more BTC.

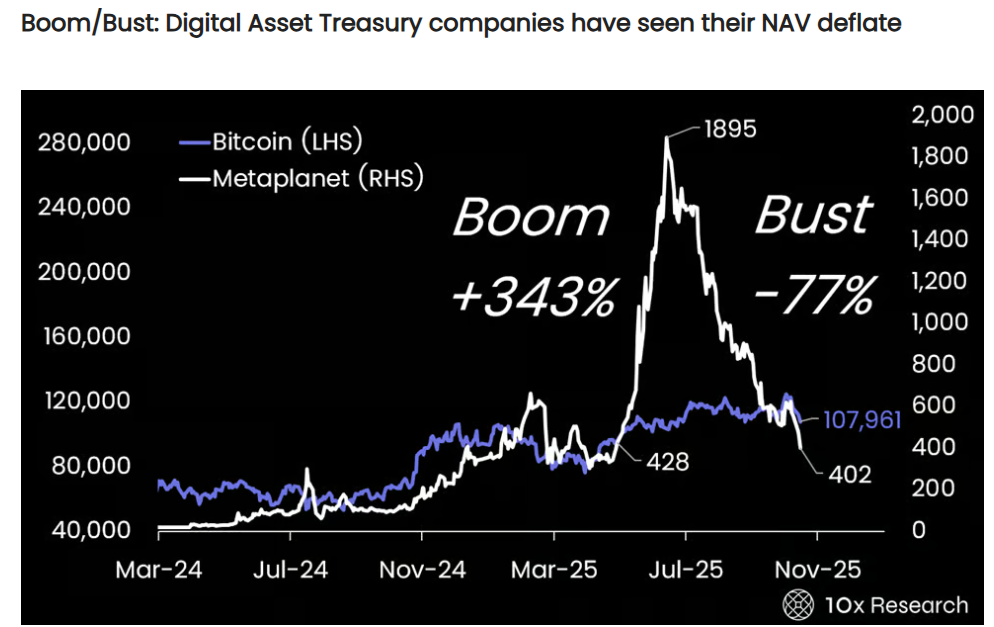

10x Evaluate illustrious that the strategy worked well when Bitcoin’s sign rose, as stock valuations basically outpaced the asset’s situation features. Nonetheless, as market sentiment cooled and Bitcoin’s momentum outmoded, those premiums collapsed.

As a result, merchants who supplied one day of the frenzy of inflated valuations beget collectively lost about $17 billion. The firm additionally estimated that unique shareholders overpaid for Bitcoin publicity by roughly $20 billion thru these equity premiums.

These numbers are unsurprising focused on BeInCrypto beforehand reported that world firms beget raised over $86 billion in 2025 to aquire cryptocurrencies.

Notably, this opt surpasses the overall US preliminary public choices this yr.

But, no topic this huge inflow, the efficiency of Bitcoin-linked equities has now not too long in the past lagged in the aid of the broader market.

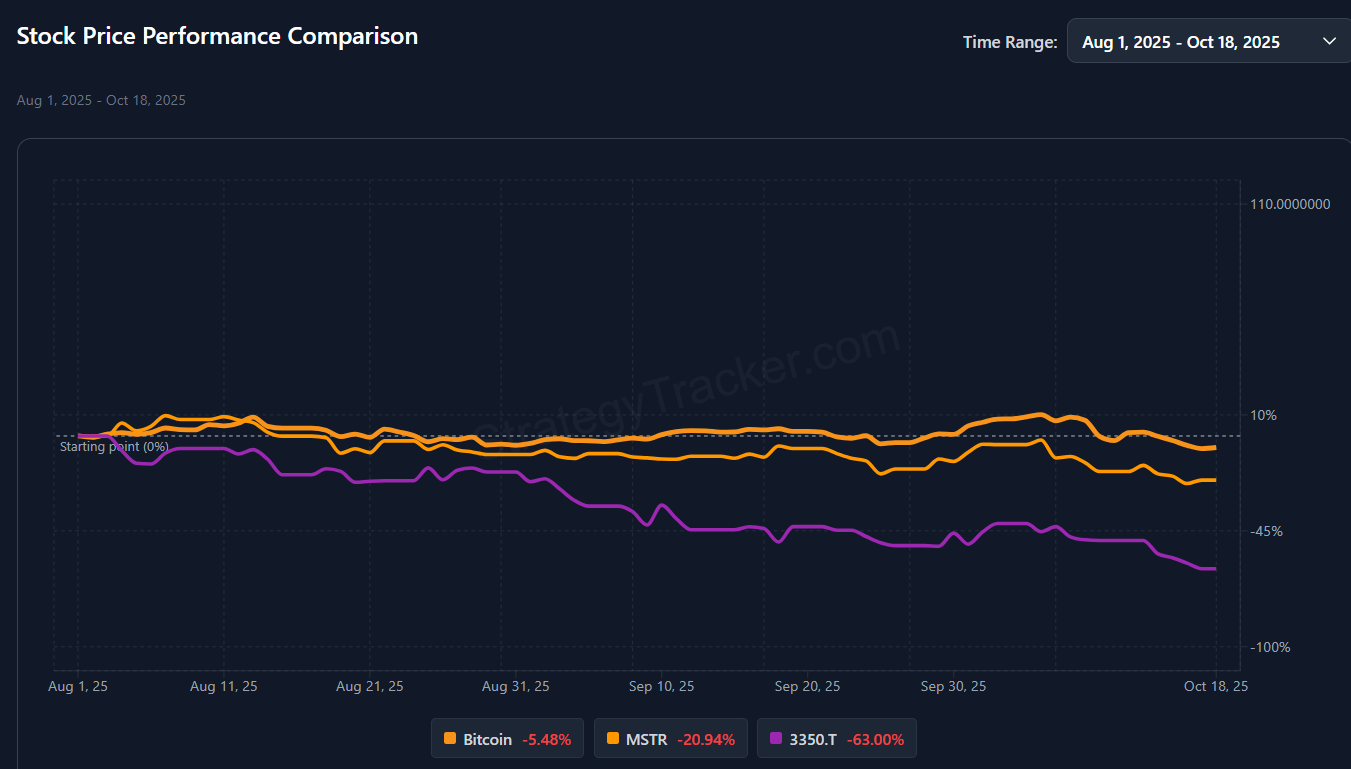

For context, Technique’s (formerly MicroStrategy) MSTR stock has fallen more than 20% since August. Tokyo-primarily primarily based Metaplanet, per Technique Tracker info, additionally lost over 60% of its price one day of the an identical duration.

Bitcoin DATCOs mNAVs Decline

At the an identical time, their market-to-earn-asset-price (mNAV) ratios, as soon as a measure of investor confidence, beget additionally deteriorated.

MicroStrategy now trades spherical 1.4x its Bitcoin holdings, whereas Metaplanet has slipped below 1.0x for the first time since adopting its Bitcoin treasury mannequin in 2024.

“These as soon as-famend NAV premiums beget collapsed, leaving merchants retaining the empty cup whereas executives walked away with the gold,” 10x Evaluate acknowledged.

All over the market, when it comes to 1-fifth of all listed Bitcoin treasury firms reportedly commerce below their earn asset price.

The contrast is inserting given that Bitcoin now not too long in the past hit a file excessive above $126,000 this month earlier than pulling reduction after President Donald Trump’s tariff threats in opposition to China.

Unexcited, Brian Brookshire, head of Bitcoin strategy at H100 Community AB, argued that mNAV ratios are cyclical and accomplish now not replicate long-timeframe price. H100 Community AB is the supreme Bitcoin-retaining firm in the Nordic converse.

“Most BTCTCs trading advance 1x mNAV beget supreme arrived there within the previous couple weeks. By definition, now not a norm…even for MSTR, there’ll not be such a thing as a such ingredient as a frequent mNAV. It’s a volatile, cyclical phenomenon,” he talked about.

Alternatively, analysts at 10X Evaluate talked about the most up-to-date episode marks “the stay of financial alchemy” for Bitcoin treasuries, the establish inflated fraction issuance as soon as created the phantasm of limitless upside.

Brooding about this, the firm acknowledged that these DATCOs will now be judged by earnings self-discipline rather than market euphoria.

“With volatility falling and the easy features gone, these firms face a exhausting pivot from marketing-pushed momentum to valid market self-discipline. The next act obtained’t be about magic—it will possible be about who can mute generate alpha when the target market stops believing,” 10X Evaluate concluded.

The put up How Bitcoin Hype Left Retail Patrons $17 Billion Poorer regarded first on BeInCrypto.