Gold is up relating to 60% year-to-date, substantially outperforming bitcoin, which, in comparability, is up a paltry 13% – despite the total discuss of a bull market.

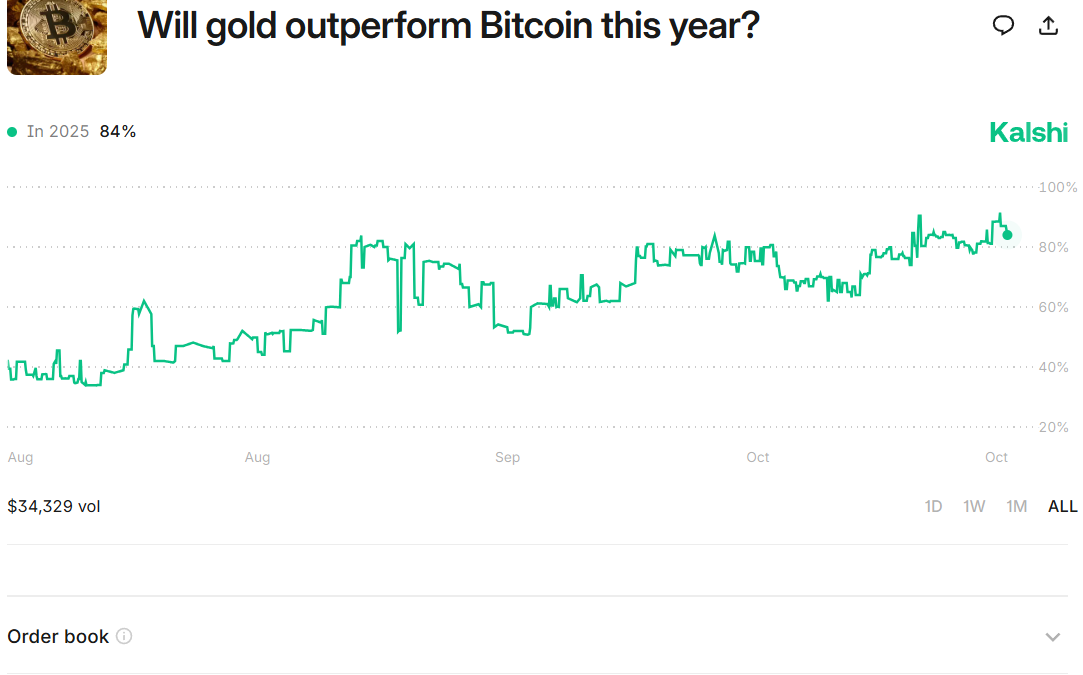

Analysts impart that gold is rarely always overpriced, despite the fable rally, and traders on Kalshi are confident that 2025 often is the year that the yellow metal outperforms BTC.

But recordsdata from Hyperliquid suggests crypto traders dwell offside. Easiest 34% of positions are long, with appropriate kind 35% of traders profitable, and a majority caught in losing brief positions as volatility whipsaws markets as hyper-leveraged accounts prolong the G-forces on the roller coaster.

The moderate user’s each day PnL has sunk to appropriate kind below $50K, indicating that nearly all had been consistently on the misguided aspect of the market.

It’s a telling snapshot of a trading team caught flat-footed. Essentially the newest wipeout of megastar trader Machi Wide Brother, whose legend plunged from $43 million in earnings to over $13 million in losses, underscores how overleveraged bets on bitcoin’s rebound proceed to backfire.

Machi Wide Brother(@machibigbrother) appropriate kind got liquidated again — his legend balance is down to easiest $32.8K.

He is long gone from +$43.64M in earnings to now over -$13M in losses! https://t.co/fk2wRZjrzZ pic.twitter.com/EJPKga65Th

— Lookonchain (@lookonchain) October 16, 2025

The combination of misplaced conviction and excessive leverage has grew to turn out to be crypto markets proper into a graveyard of mistimed trades in its establish of a reflection of genuine macro predict.

Glassnode’s newest market reveal reinforces this image of fragility.

The learn agency describes the contemporary $19 billion deleveraging as one in every of the greatest in bitcoin’s history, wiping out leverage and leaving the market in what it calls a “reset portion.”

Funding charges possess plunged to 2022 FTX-cave in phases, ETF inflows possess grew to turn out to be detrimental, and long-term holders are distributing into strength. Glassnode warns that except unique predict emerges, bitcoin dangers deeper contraction below the $108,000 level.

In distinction, gold’s ascent has been pushed by conviction in its establish of leverage. Geopolitical tension, cooling inflation, and fee-carve bets possess all bolstered its enchantment as a haven asset in a world of macro uncertainty. Crypto’s speculative construction, dependent on ETF flows and derivatives leverage, hasn’t been capable of take hang of the an analogous legend tailwind.

For now, the strategies tells a clear story: traders have to composed settle on a bitcoin bull market, however the market they basically possess seems unprecedented extra love gold’s.

Market Motion:

BTC: Bitcoin is trading spherical $108,287, sliding on renewed threat aversion, profit‑taking after contemporary rallies, and macro uncertainty.

ETH: Ether is changing hands at $3891, experiencing a sell-off in tandem with BTC as speculative predict weakens amid broader crypto stress.

Gold: Gold is rallying as traders seek a stable-haven given ongoing geopolitical tension and expectations of U.S. fee cuts.

Nikkei 225: The Nikkei 225 is down 0.3% as most indispensable markets all the draw thru Asia dash on rising concerns of geopolitical tensions.

In other areas in Crypto

- Trump Family Has Already Made Over $1 Billion in Profit on Crypto, Says Eric Trump (Decrypt)

- SEC Commissioner Peirce makes case for monetary privateness, says tokenization is a ‘wide focal point now’ (The Block)

- BNY Mellon Stays ‘Agile’ on Stablecoin Plans, Specializes in Infrastructure (CoinDesk)