Crypto Black Friday’s file liquidations erased $19 billion in positions, exposing transparency gaps between centralized and decentralized venues. As Binance stumbled, Hyperliquid held company, making the 10.10 shatter crypto’s greatest stress test since FTX.

The shatter and Binance’s recent list controversy underscored one growing theme: the heed of centralization and the allure of originate programs.

The Wreck That Shook Belief

Most traditional Change

Bloomberg reported that Hyperliquid processed over $10 billion of the $19 billion in liquidations while Binance suffered outages and refunded customers. The DEX maintained 100% uptime, proving its resilience during low volatility.

Background Context

Bitwise CIO Matt Hougan eminent that blockchains “handed the stress test,” highlighting that DeFi venues be pleased Hyperliquid, Uniswap, and Aave stayed operational while Binance needed to compensate the merchants. His conclusion: decentralization preserved market integrity as leveraged merchants collapsed.

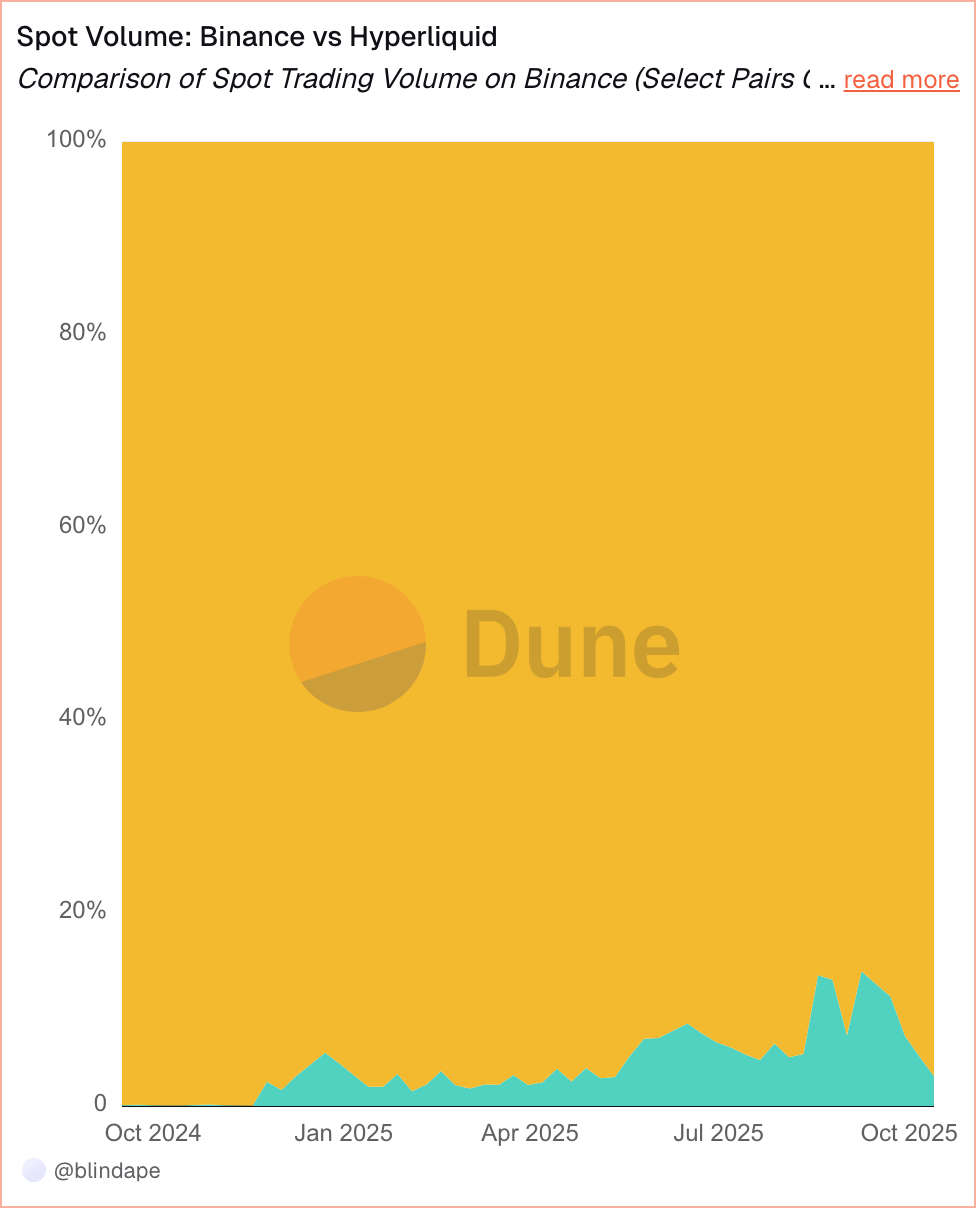

Dune records presentations Binance dominates location quantity, while Hyperliquid’s half remains below 10% despite sincere train via mid-2025. The same trust hole that surfaced during the shatter soon reappeared in a undeniable hold — the list rate debate.

Binance Faces the Checklist Backlash

Deeper Prognosis

Limitless Labs’ CEO alleged that Binance demanded 9% of the token supply and multimillion-greenback deposits for listings. Binance denied it, citing refundable deposits, and defended its Alpha program. The equity debate erupted as CEX trust hit unique lows.

Within the assist of the Scenes

CZ argued exchanges apply assorted objects and said, “Within the occasion you abhor charges, make your possess zero-rate platform.” Hyperliquid replied that on its community, “there could be now not any list rate, department, or gatekeepers.” Situation deployment is permissionless: any mission can inaugurate a token by paying gas in HYPE and catch up to half of trading charges on their pairs.

DEX and AMM hold already ensured free list, exchange, and liquidity for any asset

If a mission is appealing to pay excessive list charges it’s for advertising and marketing and marketing, now not market structure

Good sufficient with the role we played in making this a actuality

— Hayden Adams 🦄 (@haydenzadams) October 15, 2025

Uniswap founder Hayden Adams argued that DEXs and AMMs already supply free list and liquidity—if projects silent pay CEX charges, it’s purely for advertising and marketing and marketing.

Hyperliquid Emerges because the On-Chain Contender

Well-known Details

| Platform | Sept 2025 Quantity | Market Cap |

|---|---|---|

| Hyperliquid | ≈ $200 B | ≈ $13.2 B |

| Aster | ≈ $20 B | ≈ $2.5 B |

| dYdX | ≈ $7 B monthly | $1.5 T cumulative |

Searching Forward

VanEck confirmed Hyperliquid captured 35% of blockchain rate income in July. Circle added native USDC to the chain, and Eyenovia launched a validator and HYPE treasury. HIP-3 enabled permissionless perps, letting builders make futures markets for any asset.

Grayscale reported that DEXs hold develop into heed-competitive with CEXs, citing Hyperliquid as 2025’s breakout. It projects that DEXs could maybe well dominate the long tail of resources the put transparency and community governance topic most.

Hyperliquid’s edge lies in efficiency. A ten-engineer team runs a venue rivaling Binance’s 7,000 team of workers and $500M advertising and marketing and marketing employ. The DEX turns savings into token cost and liquidity rewards by cutting list bureaucracy and ads. VanEck calls this “income with out advertising and marketing and marketing employ”—a moat no centralized participant can copy.

The records presentations Hyperliquid’s half of Binance’s quantity hit ~15% in August sooner than easing a chunk of—signaling rising trader hobby in on-chain derivatives.

The Avenue Ahead for Exchanges

Risks & Challenges

Bitwise analyst Max Shannon told BeInCrypto that decentralized perps could maybe well hit $20–30 trillion in annual quantity inside of five years if law aligns. He warned that DEXs processing $67B on each day basis could maybe well face oversight and wish standardized oracles, audited insurance funds, and risk controls.

Educated Opinions

“Perp DEXs can fail, but their risks are clear and on-chain,” said Max Shannon, Bitwise.

“Hyperliquid has the whole lot it takes to develop into the Home of Finance,” said OAK Be taught.

“Centralized exchanges will defend relevant by embracing hybrid objects—combining non-custodial trading, deep liquidity, and regulatory trust,” Gracy Chen, Bitget CEO told BeInCrypto

Bottom Line

Paradigm told the CFTC to hunt DeFi transparency, arguing decentralized trading already meets key regulatory desires be pleased fair catch entry to and auditability. With regulators warming to DeFi and establishments adopting on-chain objects, Hyperliquid’s permissionless ecosystem stands as crypto’s most credible different to centralized vitality—the put transparency replaces trust because the basis of finance.