Ethereum (ETH) goes by a length of increased volatility as its offer is dwindling at excessive rates, however artificial intelligence (AI) tools claim it would possibly possibly well also presumably be up for a rebound quickly.

As of press time, ETH became once buying and selling at roughly $4,106, having gained some 3% in the previous 24 hours. Nevertheless, on the weekly chart, the token remains to be down 8.50%.

AI predicts ETH price

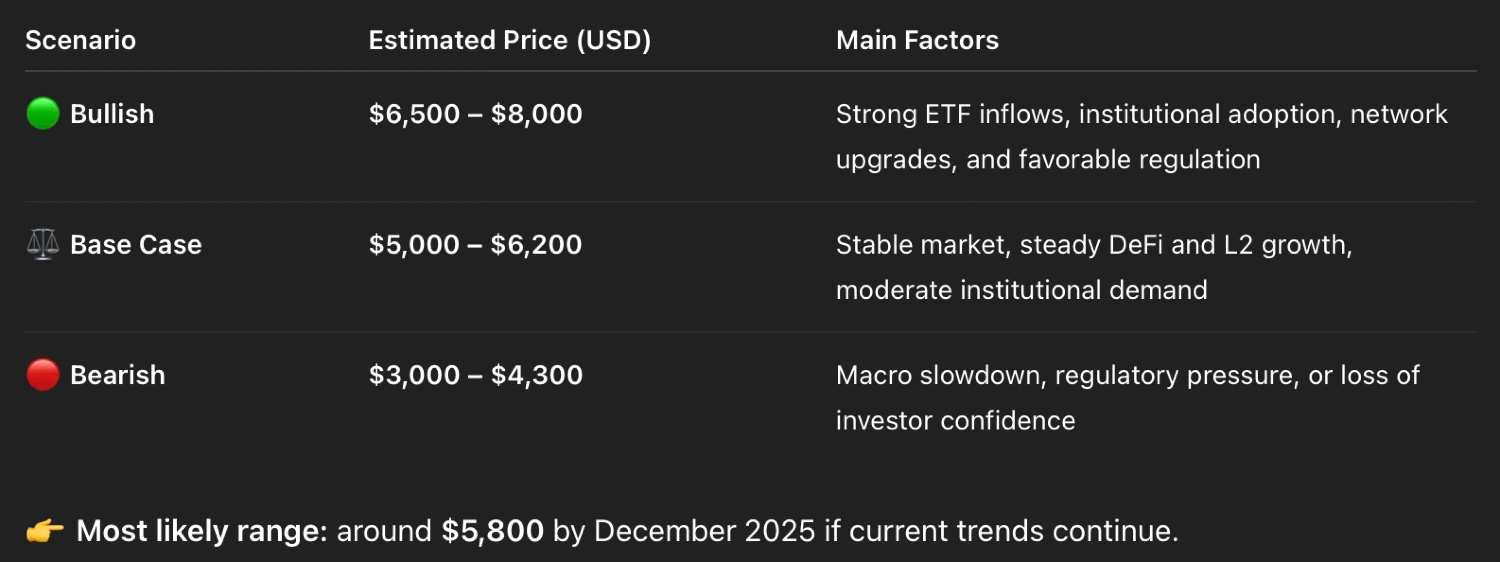

Given the ETH’s original volatility, Finbold consulted ChatGPT-5, which identified several factors that also can affect the asset’s momentum in the next months in its Ethereum price prediction for the discontinuance of 2025.

OpenAI’s model illustrious that sturdy alternate-traded fund (ETF) inflows and increased institutional adoption also can propel the pricetag as excessive as $8,000. Conversely, a aggregate of macro slowdowns, cooling investor curiosity, and regulatory tension also can sink it to $3,000.

On the identical time, the AI instructed that trusty market instances and regular institutional sail for meals also can ogle the pricetag hit the $5,000–$6,200 differ, with $5,800 being the in all probability target if the original trends continue.

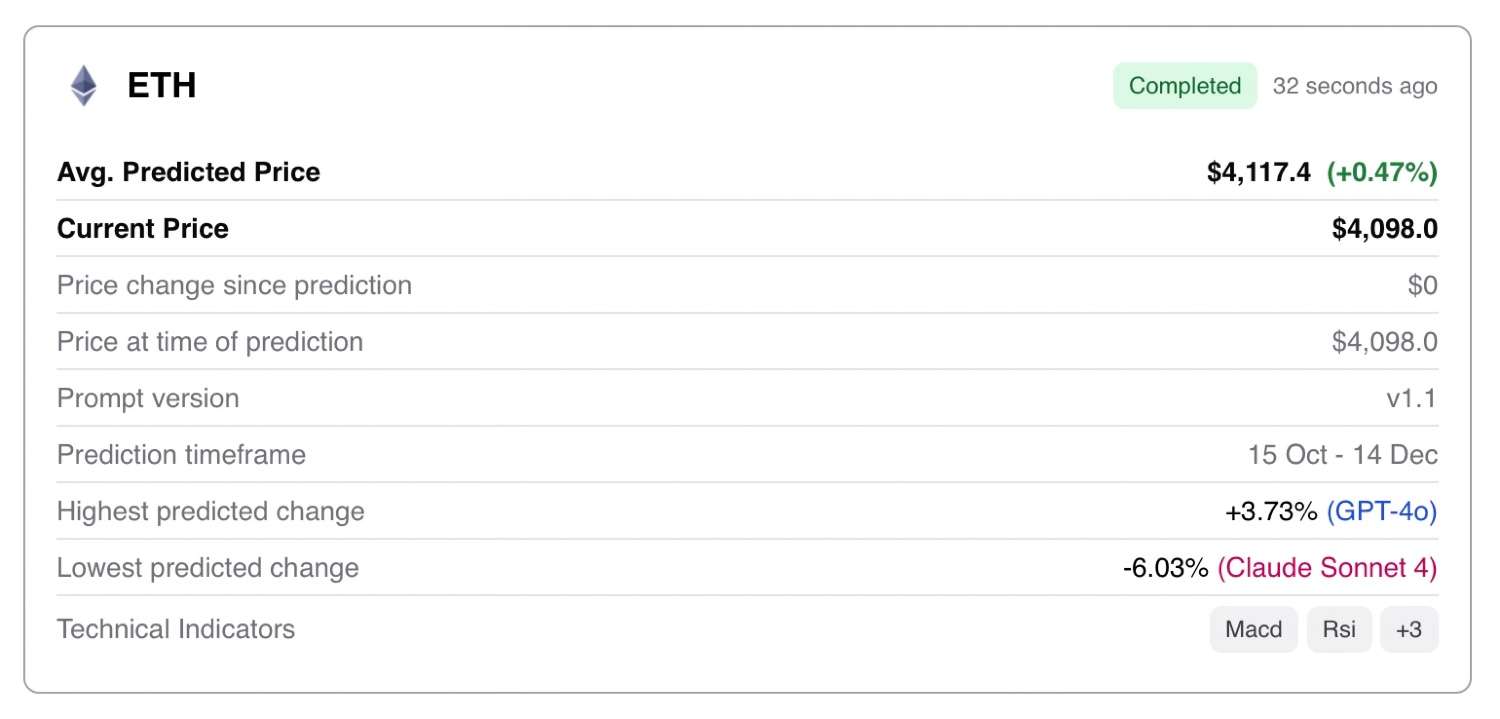

To salvage a clearer image of the save the 2nd-glorious crypto also can presumably be spherical mid-December, Finbold also consulted its occupy AI Indicators machine studying tool, which integrates several immense language objects (LLMs) with momentum-pushed market technical indicators.

Unlike ChatGPT, the algorithm became once manner less bullish. Specifically, basically based entirely on the analysis, Ethereum will alternate at most spirited $4,117 by December 14, implying a modest upside of 0.47%.

The most important distinction between the two prediction tools is that the GPT-4o LLM leveraged by Indicators estimated a price of $4,250 (+3.73%), manner below ChatGPT-5’s $5,800 year-discontinuance outlook.

Grok 3 forecasted the correct identical numbers as GPT-4o, while Claude Sonnet 4 went the unsuitable manner, assuming the pricetag goes to fall -6.03% to $3,850.

All in all, when the two analyses are in comparison, evidently ETF inflows have the prospective to play a vital role in riding the asset upward, as instructed by ChatGPT, while the technical indicators lined by Finbold’s Indicators app point out the trajectory couldn’t be as steep, at the least not till the closing couple of weeks of 2025.

Featured image via Shutterstock