Two days after the Shadowy Friday crypto smash, market sentiment is initiating to stabilize, and crypto whales are already making their switch. On-chain knowledge unearths that several altcoins are seeing renewed accumulation, as colossal holders strategically rebuild positions while costs remain at post-smash lows.

Three of these money are backed by big whale inflows, product launch excitement, and bettering technical setups. Some moreover watch parallel orderly money infusion, while others watch a breakout of key patterns (or better targets), signaling early indicators of energy.

Dogecoin (DOGE)

Dogecoin (DOGE) has turn into one amongst the most fundamental altcoins crypto whales are procuring for after the Shadowy Friday smash. Earlier, mega whales retaining over 1 billion DOGE had been amongst the most fundamental to react, along with heavily staunch thru the selloff.

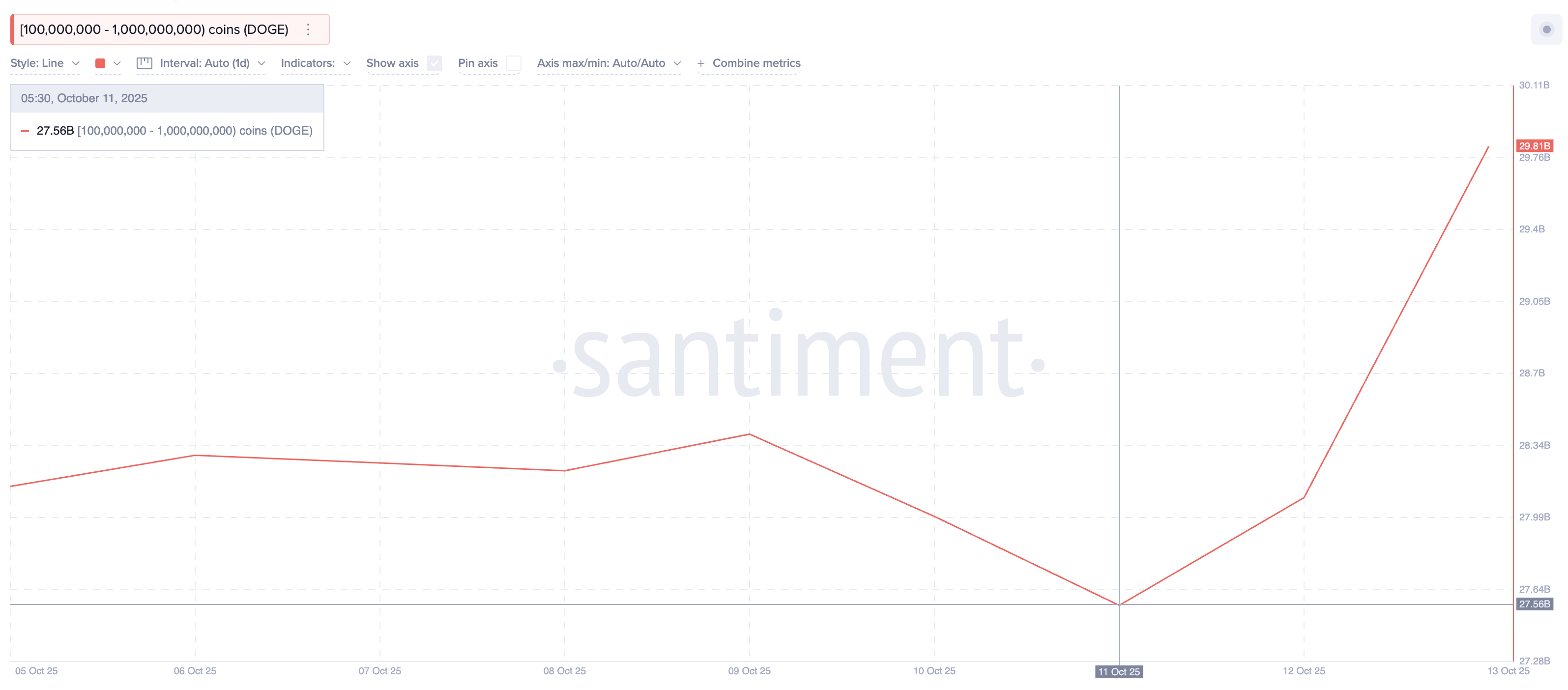

Now, the momentum has shifted to mid-tier whales retaining between 100 million and 1 billion DOGE.

These whales elevated their balances from 27.56 billion to 29.81 billion DOGE since October 11. That’s a salvage carry out of about 2.25 billion DOGE, rate roughly $475 million right this moment Dogecoin costs.

Settle on extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

This 2d wave of accumulation presentations renewed self perception in the rebound, suggesting that colossal holders are positioning for a doable continuation of the restoration.

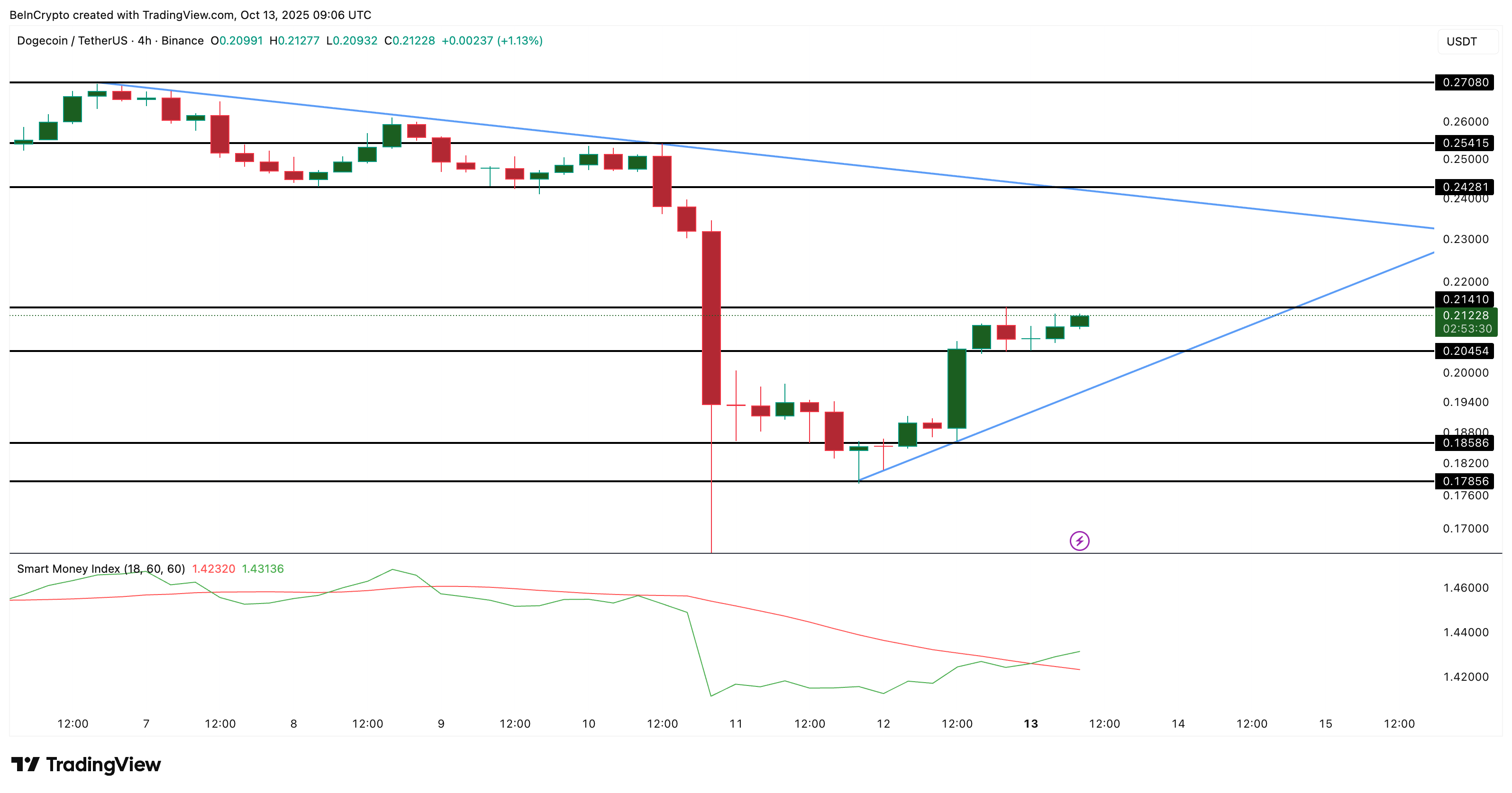

On the 4-hour chart, extinct to residing early vogue shifts, the DOGE mark trades honest correct below a key resistance at $0.214, forming a symmetrical triangle sample. A 4-hour candle breakout above $0.214 may perhaps perhaps verify a temporary uptrend towards $0.242, $0.254, and $0.270.

Nonetheless, dropping below $0.205 may perhaps perhaps simply extend this switch and repeat DOGE to $0.185 and $0.178.

Adding conviction to this setup, the Heavenly Cash Index (SMI), which tracks exercise from skilled merchants versus retail, has began turning better. This uptick suggests that seasoned merchants are aligning with whales.

Synthetix (SNX)

Synthetix (SNX) has been one amongst the strongest rebounders after the Shadowy Friday smash, surging over 80% in 24 hours and hitting a 10-month high. The rally has been fueled by renewed excitement around its upcoming perpetual DEX on Ethereum.

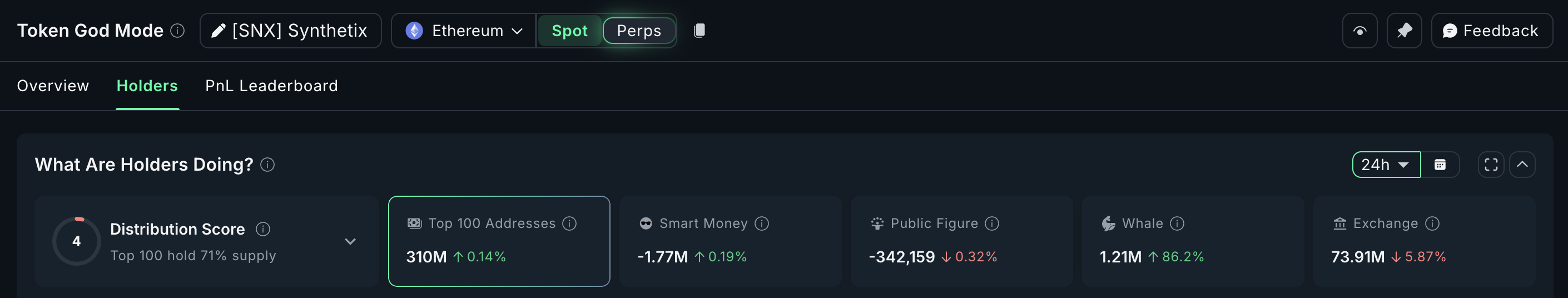

Nonetheless, on the abet of that mark budge, on-chain knowledge presentations that whales are playing an ultimate bigger position in driving the switch.

Whale wallets retaining colossal quantities of SNX devour elevated their positions by 86.2% in honest one day. This cohort now controls about 1.21 million SNX. Which design they’ve added roughly 560,000 SNX, rate nearly $1.23 million at an moderate mark of $2.20.

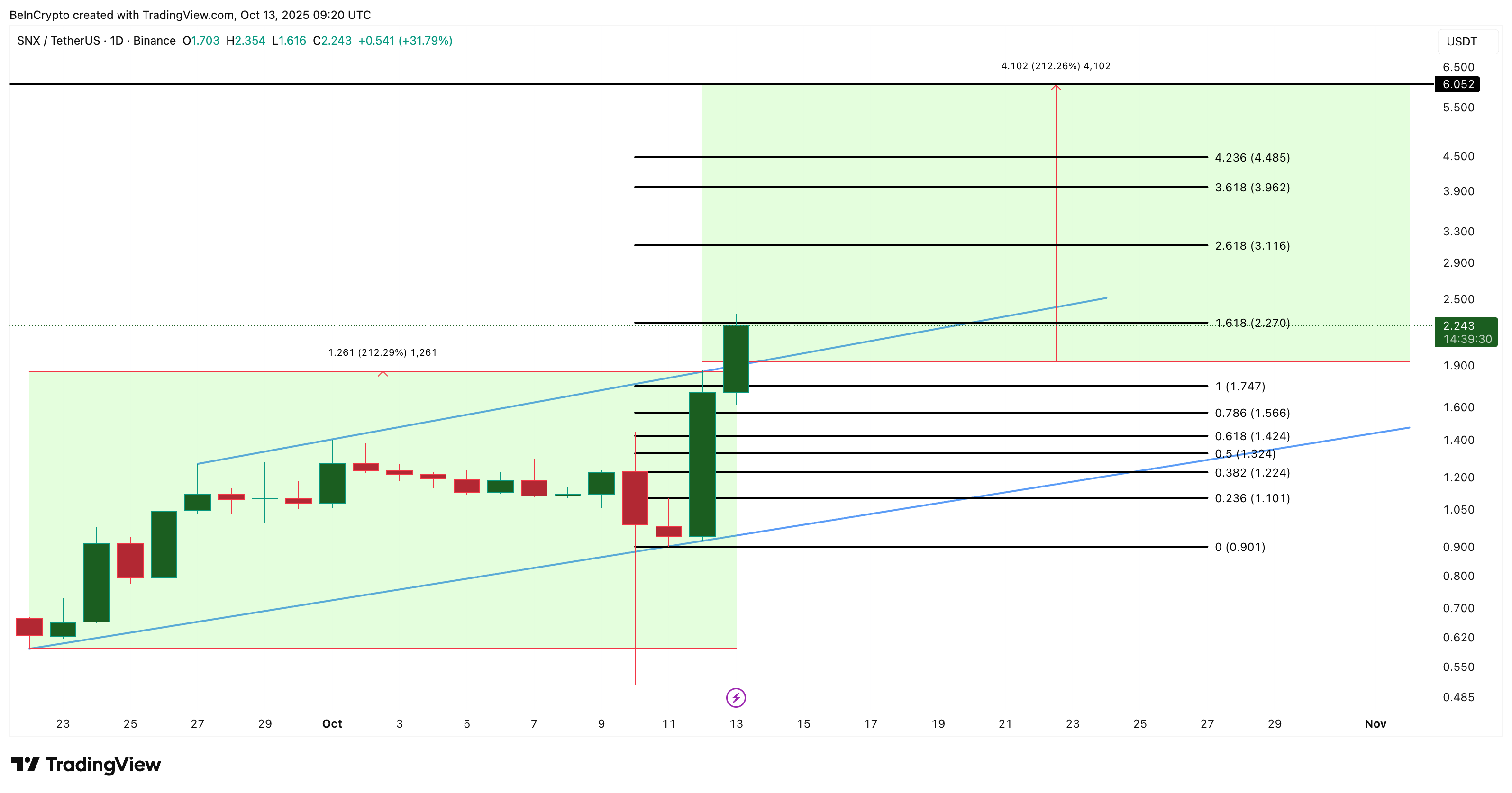

From a technical attitude, SNX has broken out of an ascending channel on the day to day chart, a bullish sample that alerts continuation when confirmed.

The breakout projects a doable 212% upside from the breakout point, which translates to an extended purpose conclude to $6.0. For now, the most fundamental resistance is conclude to $2.27, followed by $3.11 and $3.96. A breakout above $4.Forty eight would validate the bigger switch.

On the downside, key helps lie at $1.74, $1.56, and $1.10. A dip below the final level ($1.10) would flip the SNX mark structure bearish.

If whale accumulation continues at this tempo, it’ll enhance SNX in retaining above its instantaneous enhance zone and lengthening towards better targets, in particular as the DEX launch nears and broader market sentiment stabilizes.

Aster (ASTER)

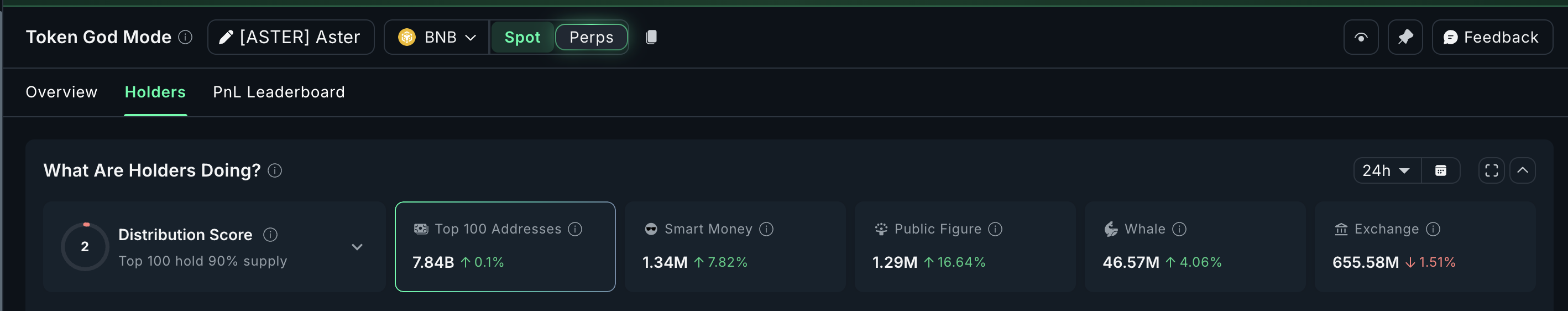

Aster (ASTER), a snappy-growing perpetual DEX project built on BNB Chain, has immediate won consideration after its explosive debut and inferior-chain trading mannequin. The project permits customers to alternate with yield-bearing collateral, a characteristic that has drawn whales and orderly money in after the Shadowy Friday market smash.

Whales devour elevated their holdings by 4.06% over the previous 24 hours, now sitting on 46.57 million ASTER. Which design they’ve added roughly 1.82 million ASTER, rate about $2.7 million at an moderate mark of $1.50.

This stylish manufacture-up aligns with a identical sample viewed amongst orderly money and public figure wallets, which devour grown their holdings by 7.82% and 16.64%, respectively.

Such synchronized accumulation across key investor segments suggests growing self perception that ASTER’s rebound is extra than a temporary soar.

On the technical aspect, Aster’s 4-hour chart presentations the token trading internal a bullish pennant, a sample that continually precedes continuation. For the bullish setup to verify, the 4-hour mark must fracture above $1.75 (better trendline breakout). That will be followed by a switch previous $1.88, which would commence the door to $2.10 and $2.20.

On the downside, shedding $1.43, a key enhance level, may perhaps perhaps push the token decrease to $1.27 or $1.15.

The post 3 Altcoins Crypto Whales Are Procuring for as Market Recovers From Shadowy Friday Atomize looked first on BeInCrypto.