The crypto market is finally exhibiting signs of recovery after days of turmoil that wiped billions off its total capitalization. With Bitcoin back above $115,000 and Ethereum rallying past $4,000, optimism is slowly returning.

In the back of this rebound lies a mix of economic diplomacy, geopolitical relief, and investor psychology — as nervousness turns to hope all via world markets.

Why is Bitcoin Sign Up

1. Easing Alternate Tensions: China Signals No Desire for a Alternate War

Global sentiment improved sharply after China issued an announcement clarifying that it does no longer ogle a alternate battle with america. Following President Trump’s earlier risk of 100% tariffs, Beijing emphasized that its uncommon-earth export curbs are “decent” however no longer escalatory — signaling de-escalation as antagonistic to battle of phrases.

Trump, in flip, suggested journalists that the U.S. has “a factual opinion” with China and “no comprise to horror,” softening the rhetoric that in the begin sent markets plunging.

These diplomatic shifts helped restful world investors and restore risk appetite — a clear trigger for crypto markets, which thrive on renewed confidence.

2. Geopolitical Relief: Hostage Releases and Trump’s Talk over with to Israel

Market confidence furthermore grew following the liberate of Israeli hostages in Gaza beneath a fresh peace agreement. President Trump, who’s at the moment in Israel, addressed the state and confirmed all facets “signed off on the deal,” calling it a “leap forward for steadiness.”

This moment of geopolitical relief diminished world risk aversion and revived optimism all via monetary markets. Merchants typically elaborate such peace traits as bullish for risk resources, at the side of cryptocurrencies. The guidelines furthermore boosted trading volumes on predominant exchanges, significantly in BTC, ETH, and SOL.

3. Market Psychology: Dip Merchants Return After Fear Promote-Off

Beyond macro and political catalysts, powerful of the recovery could furthermore be attributed to the traditional crypto cycle — horror, capitulation, and rebound.

After closing week’s intelligent correction, traders and institutional investors stepped in to aquire the dip, taking encourage of discounted costs.

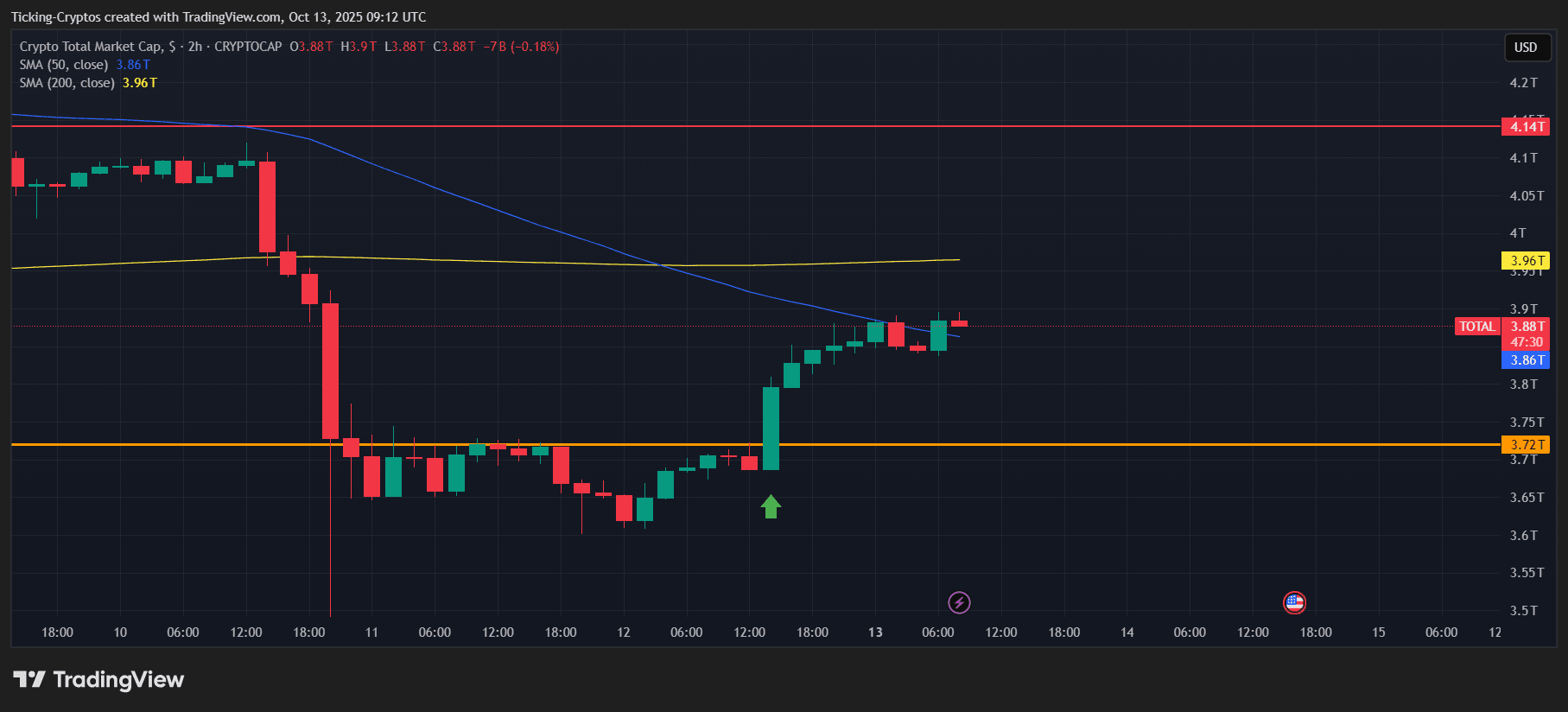

Whole market cap in USD – TradingView

This wave of renewed shopping momentum helped Bitcoin stabilize above $115K and lifted predominant altcoins double digits in 24 hours. As nervousness subsided, greed slowly returned to the market — a pattern crypto veterans know well.

Crypto Sign This day: Top 10 Crypto Performances

The recovery wasn’t miniature to $Bitcoin. Most of the tip 10 cryptocurrencies posted sturdy each day beneficial properties:

| Crypto | 24h % Alternate | Contemporary |

|---|---|---|

| 1. Bitcoin ($BTC) | +3.53% | BTC rebounds above $115K as investors re-enter after the break. |

| 2. Ethereum ($ETH) | +9.12% | Outperformed BTC — a bullish signal for altcoin sentiment. |

| 3. $BNB | +16.08% | One of the most day’s strongest performers; BNB’s community activity spiked. |

| 4. Tether ($USDT) | -0.01% | Stable as expected. |

| 5. $XRP | +10.31% | Ripple’s token regains strength after steep weekly losses. |

| 6. Solana ($SOL) | +9.04% | Encourage shut to $200 as traders wager on Solana’s sturdy ecosystem. |

| 7. $USDC | -0.01% | Fair, serving as a shelter. |

| 8. Dogecoin ($DOGE) | +12.02% | Meme coin enthusiasm returns with market optimism. |

| 9. TRON ($TRX) | +2.60% | More conservative beneficial properties; miniature volatility. |

| 10. Cardano ($ADA) | +12.57% | Solid recovery; ADA typically tracks market rebounds. |

This standard strength confirms a massive-primarily primarily based recovery, no longer excellent a Bitcoin-led rebound. Altcoins, especially Ethereum, BNB, and Cardano, indicate renewed speculative passion.

Hope Returns — But Dangers Stay

While sentiment has improved, markets dwell fragile:

- Alternate members of the family between the U.S. and China could smooth flare up.

- The Heart East peace deal stays in early phases.

- Macro uncertainty — at the side of inflation and doubtless fee strikes — could trigger volatility all but again.

Aloof, for now, hope is changing nervousness, and the crypto market has regained its footing.