On Sunday, bitcoin ( BTC) climbed to an intraday excessive of $114,777, marking a on the subject of 2.7% rebound in 24 hours. The surge shows renewed confidence and heightened market process as crypto merchants react to provocative financial indicators and attempting to accumulate momentum.

From Caution to Renewed Conviction

The worldwide cryptocurrency market cap surged by $170 billion within the final 24 hours, signaling a solid rebound across fundamental digital assets. This upswing shows a broader recovery in investor confidence, with main cash utilizing the rally.

Bitcoin (BTC), the main crypto asset by market valuation, is altering fingers at $114,337 as of 3:30 p.m., clocking in a hefty $89.27 billion in trading quantity for the day — no longer precisely a level-headed Sunday stroll on the charts.

Ethereum ( ETH) has bounced aid above the $4,000 mark, altering fingers at $4,136 after a 9.8% take care of Sunday afternoon. BNB is flexing at $1,298 after a 12% climb, XRP popped 4.7% to $2.54, and SOL is strutting increased by 9.2%, landing at $195 per coin.

The meme coin dogecoin (DOGE) popped to $0.2093 after an 11% uptick, and tron ( TRX) is inching increased by 1.5% to $0.3225 per coin. Lots of diverse cash entirely stole the highlight, rocketing great increased than BTC and ETH. Mantle (MNT) strutted up 39% to $2.25, while bittensor (TAO) powered forward 26.7% to $376.ninety nine.

Aster (ASTER) climbed 20.1% to $1.50, and rotund penguins (PENGU) waddled 19.7% increased to $0.02631. Pump fun (PUMP) hopped 15.2% to $0.00445, WLFI lifted 14.7% to $0.143, RENDER acquired 14.6% to $2.74, and VET inched up 14% to $0.01931. As the weekend winds down, the crypto market’s $170 billion resurgence components to a decisive return of momentum and optimism across digital assets.

All over the board, investor and vendor sentiment appears to be like to be provocative from warning to renewed conviction. For merchants and prolonged-period of time holders alike, Sunday’s rebound could well well mark the first solid pulse of a revitalized digital asset cycle.

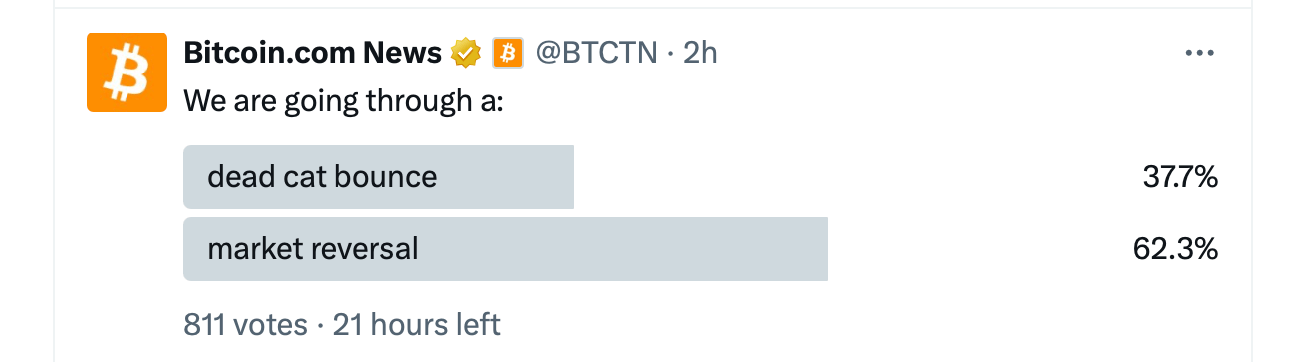

Although the jury’s quiet out on whether or no longer that is the first solid pulse of a revitalized digital asset cycle or factual one more classic unnecessary cat leap.