The crypto market is calling green for the coming few days because the US Authorities Shutdown is anticipated to continue. This might possibly per chance continue driving Bitcoin and altcoins’ prices up, which in flip might diagram modern capital from modern traders.

BeInCrypto has analysed three such altcoins that trace doable to build gains within the coming few days.

SPX6900 (SPX)

SPX is trading at $1.62, declaring its articulate above the wanted $1.58 toughen stage. The altcoin has surged virtually 62% throughout the last week, hitting a two-month high. This moving rally shows renewed investor passion.

At masks, SPX is about 41% a long way off from retesting its all-time high of $2.29, finished in slack July. Technical indicators, particularly the exponential inviting averages (EMAs), highlight sustained bullish momentum. If this strength continues, SPX might spoil via the $1.74 resistance stage and likely climb toward $2.00 within the coming sessions.

Need extra token insights treasure this? Signal in for Editor Harsh Notariya’s Daily Crypto Newsletter right here.

On the different hand, market sentiment stays wanted to sustaining this rally. Must traders open taking earnings, SPX might drop below the $1.58 toughen. A deeper correction might push the worth the overall formulation down to $1.39 or lower, undermining bullish momentum and signaling a brief reversal within the altcoin’s upward trend.

Optimism (OP)

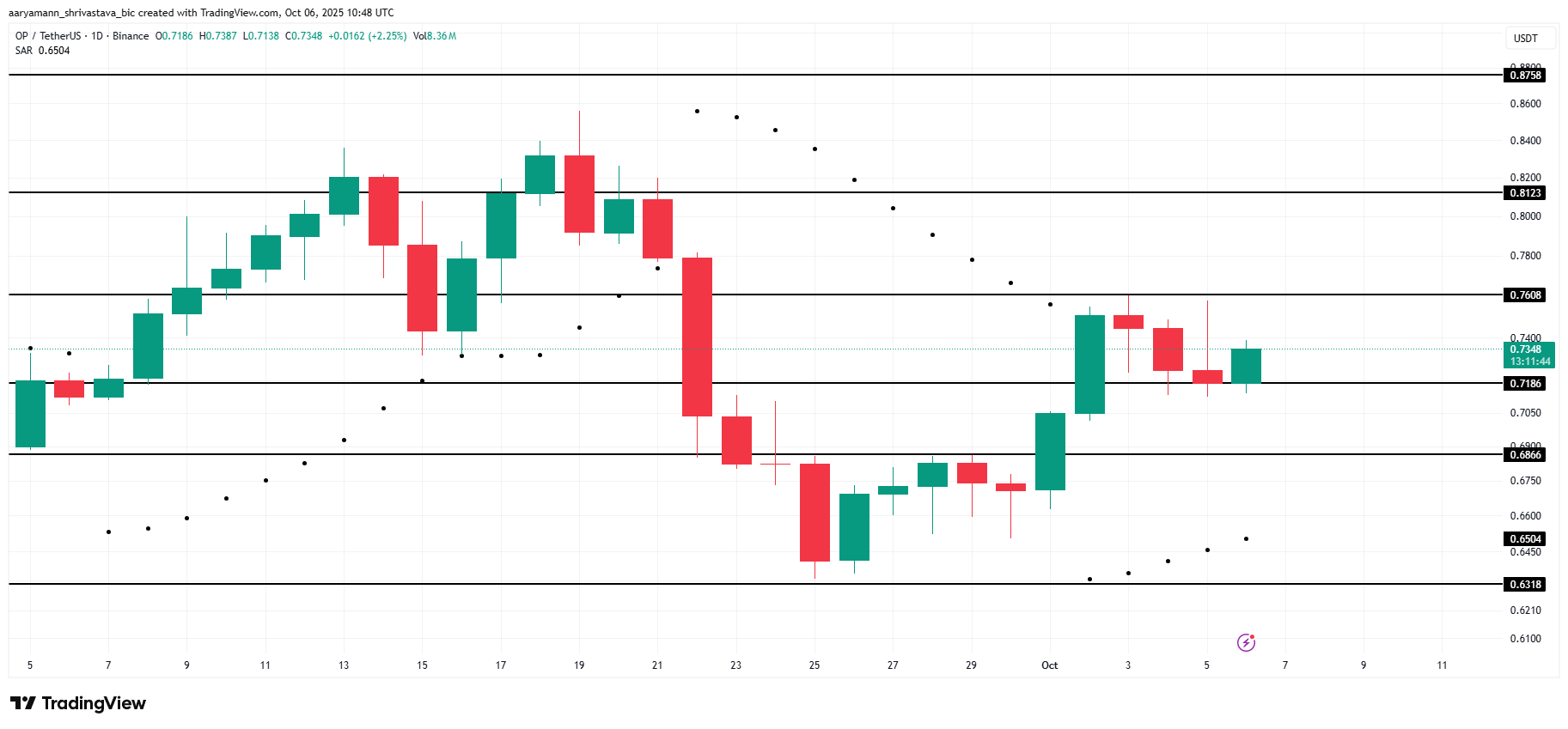

Optimism is making ready for a predominant token free up this week, with 4.47 million OP tokens worth extra than $3.28 million coming into circulation. Historically, such events in most cases trigger promoting force, main to doable short-term downside. Merchants are staring at carefully because the enlarge in supply might in short weigh on OP’s save.

No matter the aptitude sell-off, technical indicators offer blended indicators. The Parabolic SAR positioned below the candlesticks indicates that OP might furthermore retain its consolidation between $0.76 and $0.71. This sample suggests that traders aloof retain some alter, keeping volatility restricted because the market absorbs the modern token inflow.

On the different hand, if bearish sentiment strengthens after the free up, Optimism’s save might spoil below the $0.71 toughen stage. A deeper correction might drive OP the overall formulation down to $0.68 and even lower. Such motion would invalidate the short-term bullish outlook and highlight the token’s sensitivity to market supply dynamics.

Aptos (APT)

Aptos is field for a predominant token free up this week, with 11.31 million APT worth virtually $60 million coming into circulation. Such events in most cases introduce short-term volatility as supply increases, which might slack APT’s upward momentum and trigger promoting force.

No matter this, Aptos has delivered precise efficiency, rising 24% within the previous week to prevail in $5.31 — its top possible stage in two months. The Chaikin Cash Waft (CMF) indicates rising capital inflows, signaling investor self belief. If procuring for continues, APT might push previous $5.50 and $5.73 in spite of the free up match.

On the different hand, the bullish outlook depends on sustained investor participation. If inflows diminish, APT might face challenges declaring its contemporary strength. A descend below $5.06 might end result in a deeper correction toward $4.seventy 9, effectively invalidating the bullish scenario.

The put up 3 Altcoins To Glance In The 2d Week Of October 2025 regarded first on BeInCrypto.