The crypto market is surging this week, with Bitcoin and Ethereum nearing their all-time highs and the total market capitalization mountain climbing above $4.2 trillion. This text breaks down the tip four drivers at the befriend of the rally, including rising expectations that the Federal Reserve will lower interest charges sooner than the tip of the year.

- The crypto market rally is going down as odds of Fed interest price cuts upward thrust.

- Bitcoin has emerged as a safe-haven asset because the U.S. executive shuts down.

- The crypto market on the total does neatly in October and the fourth quarter.

Fed interest price cuts odds upward thrust

One key the explanation why the crypto market goes up is the rising possibility that the Federal Reserve will lower interest charges within the final two meetings of the year.

The potentialities of price cuts jumped after ADP printed a weaker-than-anticipated jobs report on Wednesday. The U.S. economic system misplaced 36,000 jobs in September. Economists were looking at for it to be able to add over 50,000 jobs.

These numbers mean that the Fed may per chance seemingly per chance deem to lower charges over again to enhance the economic system. Cryptocurrencies and other unstable sources attain neatly when the Fed is reducing charges.

Crypto as a safe haven

The crypto market jumped as traders embraced the role of Bitcoin (BTC) as a safe-haven asset because the U.S. executive shutdown continues. This also explains why gold mark jumped to a file high this year.

In a recent white paper,BlackRock eminent that traders factor in that Bitcoin has solid fundamentals to thrive as a safe-haven asset when risks rose. The white paper pointed to its fundamentals, including the 21 million present cap and the rising quiz.

One evidence of cryptocurrencies as safe-haven sources is the continuing ETF inflows. Ethereum (ETH) funds added over $1.3 billion in inflows, whereas Bitcoin ETFs added $3.2 billion in sources.

Bitcoin, altcoins jump attributable to the season

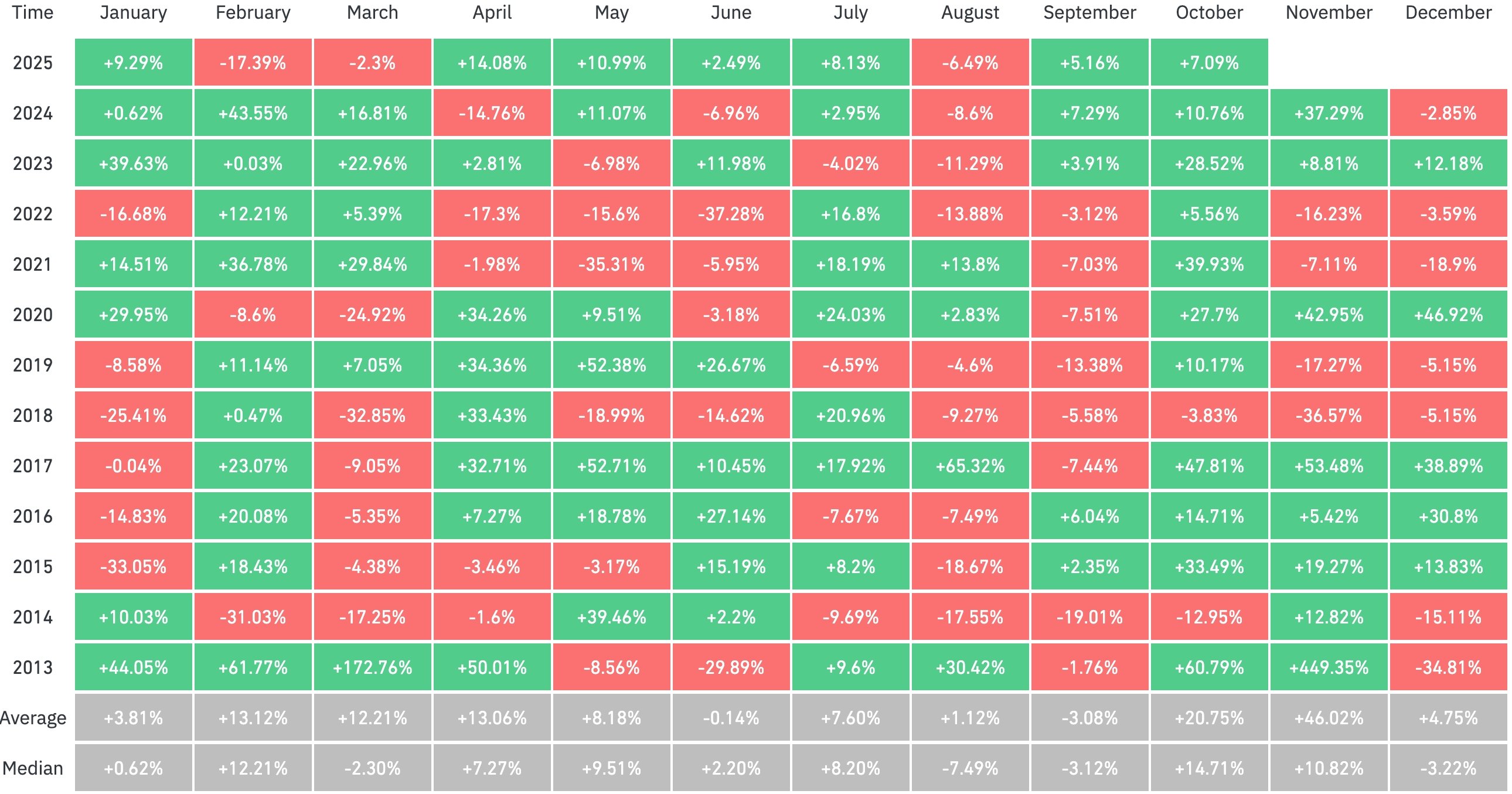

Seasonality also contributed to the crypto market rally this week. Crypto traders are speaking about Uptober, which is the anxiousness the save the industry rallies in October.

Data compiled by CoinGlass reveals that the Bitcoin mark on the total jumps in October. It has had certain returns in October of all years since 2020. The moderate return in October since 2013 is 20%, making it the most attention-grabbing month after November.

Additionally, the fourth quarter is on the total the most attention-grabbing length for the crypto industry in a year. Bitcoin’s moderate return is 80%, 2d handiest to Q1’s 51%.

Altcoin ETF approvals forward

The other most most important the explanation why the crypto market goes up is the hope that the Securities and Alternate Commission will open approving crypto ETFs soon.

The agency has situation October because the time limit for heaps of altcoin ETFs, including popular names esteem Solana and XRP. These approvals will seemingly enhance prices as Wall Avenue traders open making an try for as they’ve accomplished with Ethereum and Bitcoin.