Network revenues across the blockchain ecosystem declined by 16% month-over-month in September, primarily because of reduced volatility within the crypto markets, per asset manager VanEck.

Ethereum network income fell by 6%, Solana’s fell by 11%, and the Tron network recorded a 37% good buy in fees, because of a governance proposal that reduced gas fees by over 50% in August, per VanEck’s file.

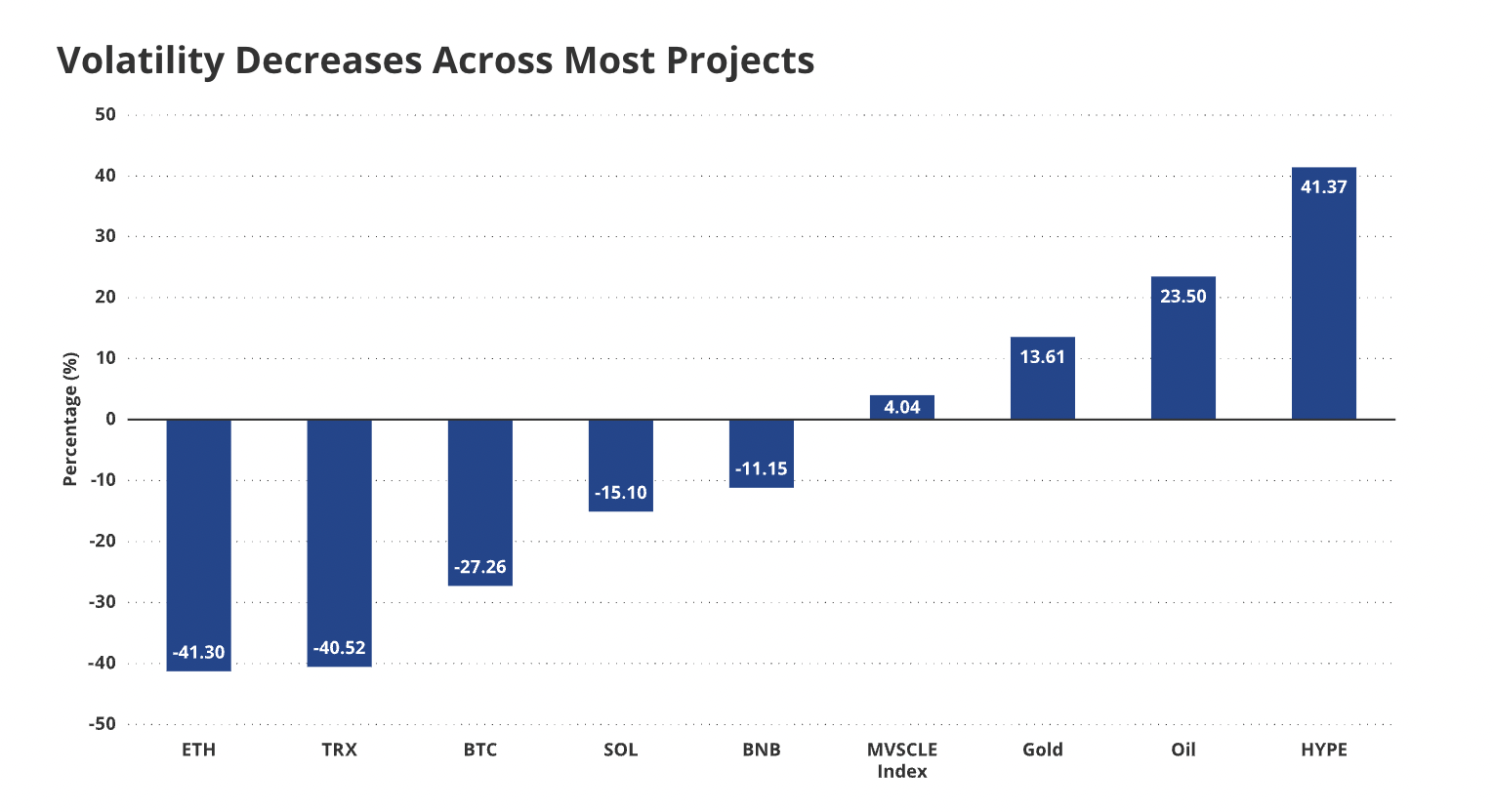

The income fall within the replacement networks used to be attributed to reduced volatility within the crypto markets and the underlying tokens powering those networks. Ether (ETH) volatility dropped by 40%, SOL (SOL) volatility fell by 16%, and Bitcoin (BTC) fell by 26% in September.

“With reduced volatility for digital assets, there are fewer arbitrage opportunities to compel traders to pay excessive precedence fees,” the writers of the file outlined.

Network revenues and charges are a extreme metric for economic activity in crypto ecosystems. Market analysts, traders, and traders video display network fundamentals to gauge the total properly being of a particular ecosystem, particular person initiatives, and the broader crypto sector.

Related: Ethereum income dropped 44% in August amid ETH all-time excessive

Tron network continues to dominate income metrics

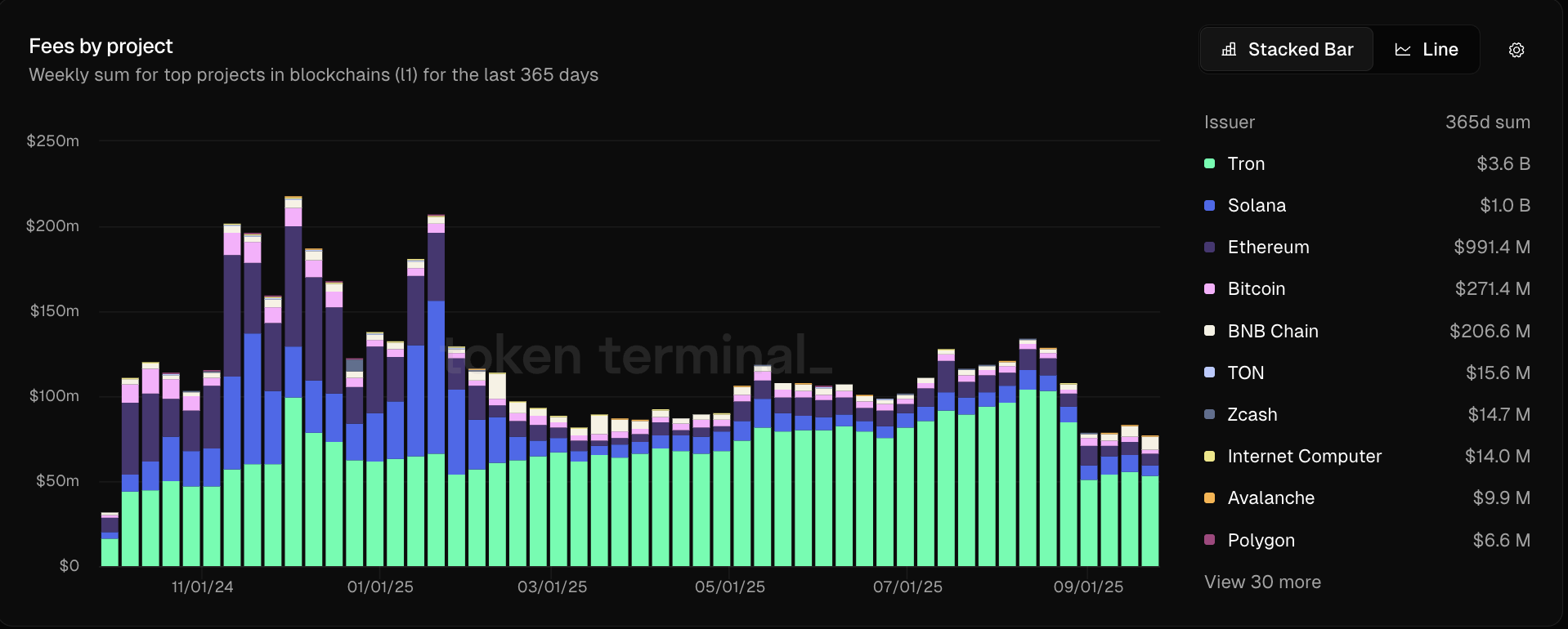

The Tron network is ranked because the amount 1 crypto ecosystem for income, generating $3.6 billion within the good yr, per data from Token Terminal.

Ethereum, by comparability, highest generated $1 billion in income over the good yr, despite ETH hitting all-time highs in August, and a market capitalization of about $539 billion — over 16x the TRX (TRX) market capitalization, which is acceptable north of $32 billion.

Tron’s income is attributed to its position in stablecoin settlements. 51% of all circulating Tether USDt (USDT) supply has been issued on the Tron network.

The stablecoin market cap crossed $292 billion in October 2025 and has been gradually rising since 2023, per data from RWA.XYZ.

Stablecoins are a main use case for blockchain know-how, as governments strive to lengthen the salability of their fiat currencies by placing them on crypto rails.

Blockchain rails allow currencies to float between borders, with near-instantaneous settlement times, minimal fees, 24/7 buying and selling, and manufacture now not require a bank memoir or frail infrastructure to access.

Journal: Ether could well ‘rip take care of 2021’ as SOL traders brace for 10% fall: Alternate Secrets and suggestions