Plasma’s XPL token is intently watched for a trace recovery, because it aloof hovers around $0.86. The token completed the very preferrred day-to-day turnover, with day-to-day buying and selling exceeding the token’s provide.

XPL is the most actively traded token, with day-to-day turnover exceeding the provision for a ratio of 1.1. The token is aloof buying and selling with a excessive mindshare, even supposing that is not any longer reflected out there trace.

XPL originate passion also stalled at correct below $1B, with around 67% in lengthy positions. For now, the token mostly seen lengthy liquidations, to the tune of $3.3M in the previous 24 hours. The token is aloof extremely active on Hyperliquid, with 56% of whales going lengthy. Alternatively, the biggest Hyperliquid spot is a handy guide a rough commerce with a $72.5M notional price.

XPL has been sliding since September 28, after peaking at $1.67. The token’s trace remained rather downhearted, despite the scorching files of selecting up ChainLink as a unswerving oracle.

Stablecoin rails for world money motion require correct, excessive efficiency files feeds.

We are partnering with @Chainlink to give oracle companies on Plasma so builders can exhaust digital bucks to produce existence-altering monetary applications for those that need it most. https://t.co/FSt7zHSTwZ

— Plasma (@Plasma) October 3, 2025

Even with the guarantees of turning correct into a stablecoin and monetary hub, the early efficiency of XPL upset among the customers, while the chain aloof has to expose its right utility.

XPL trades with extra than one sources of liquidity

No matter the eye, XPL traded below $0.90, getting nearer to its all-time low of $0.74. The initiating of XPL coincided with assorted excessive-profile airdrops, in particular Aster (ASTER). Alternatively, XPL didn’t construct the ‘up preferrred’ outcome following its airdrop, despite the general market recovery.

Plasma is aloof the most active token in conserving with the ratio of its buying and selling volumes to market cap. Volumes ranged between $2.4B and $1.7B, turning over all of the circulating provide of 1.8B tokens. The volumes are also continuously above the token’s market cap of $1.6B, suggesting basic liquidity and packed with life buying and selling.

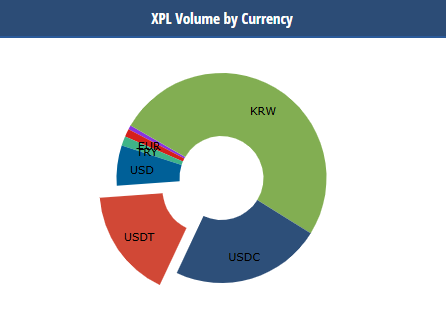

XPL instruct shifted to Bybit, which carries over 24% of the commerce quantity, with 18% on Binance. The recent XPL valuation also involves a reported 49% of volumes in opposition to the Korean obtained. The token’s pairs on Upbit and Bithumb, alternatively, luxuriate in fluctuating volumes as XPL aloof discovers its predominant sources of liquidity.

Did the Plasma group sell XPL tokens?

One of many sources of trace stress for XPL used to be rumours of insider promoting. Alternatively, many of the XPL is vested and visual on a single tackle, at least on its BSC model. There don’t appear to be any signs of promoting or sending XPL to exchanges.

Plasma’s CEO, Paul Faecks, denied the rumours of insider promoting, despite chart analysts suspecting a directed effort to tank the price of XPL. As Cryptopolitan reported earlier, on-chain files point out that the Wintermute market maker transferred basic portions of XPL to exchanges.

The token won quick listings and ought to aloof even luxuriate in some of its volumes boosted by market makers. Plasma’s excessive-profile birth and its positioning because the sixth-biggest chain by price locked and stablecoin provide also meant XPL used to be considered as a skill breakout token, comparable to ASTER.