The US Senate Finance Committee would possibly possibly well well assist a hearing Wednesday on cryptocurrency taxation, a day after the Treasury Department and Interior Earnings Carrier (IRS) issued meantime steering easing company crypto tax guidelines.

The Treasury and IRS on Tuesday issued meantime steering aimed at easing compliance under the Corporate Replacement Minimum Tax (CAMT), in conjunction with for companies running in the digital assets sector.

Signed into law under light President Joe Biden as allotment of the Inflation Reduction Act of 2022, CAMT imposes a 15% minimum tax on the monetary map revenue of spellbinding companies.

The 2 pieces of the most up-to-date meantime steering, Explore 2025-46 and Explore 2025-49, intend to “carve compliance burdens and provide readability on advanced areas of the CAMT” till final regulations are issued.

Excluding unrealized gains

A few of the steering documents, Explore 2025-49, affords steering on applying the CAMT under Sections 55, 56A and 59 of the Interior Earnings Code.

It in particular foremost points amendments to Adjusted Financial Assertion Earnings (AFSI), allowing digital asset companies to exclude unrealized gains and losses on digital assets held as spellbinding designate assets from CAMT revenue.

“Counting on the relevant monetary accounting principles, this meantime steering would possibly possibly well well prepare to holdings of digital assets,” Explore 2025-49 states.

Associated: US government poised to shut down: Will it affect crypto market structure invoice?

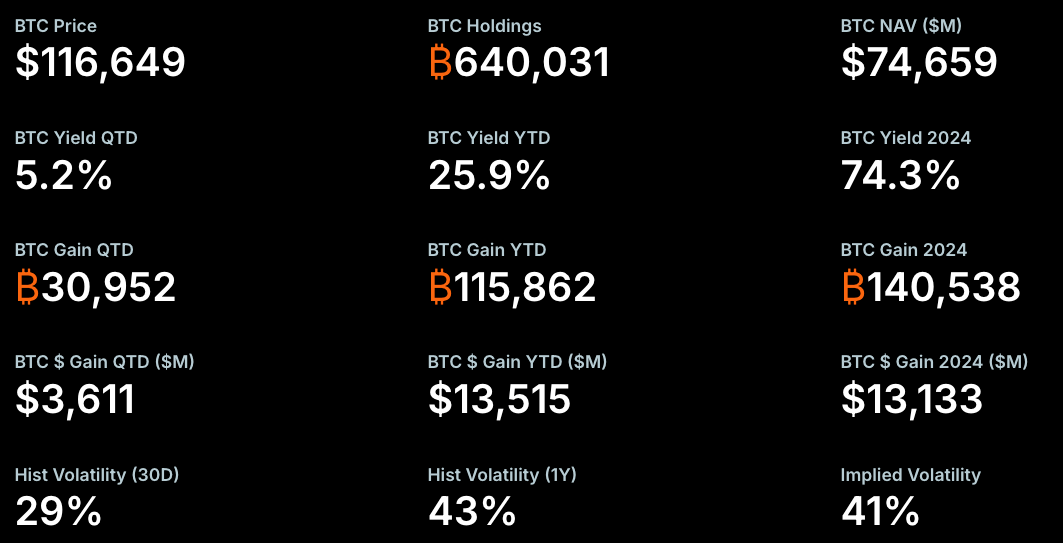

In line with journalist Eleanor Terrett, companies like Michael Saylor’s Approach — which holds bigger than 640,000 Bitcoin (BTC) with $13.5 billion in three hundred and sixty five days-to-date unrealized gains — would gain faced billions in CAMT authorized responsibility without relief.

Senate hearing on digital asset taxation

The most contemporary steering from the IRS got here a day sooner than the Senate hearing on “Inspecting the Taxation of Digital Resources” on Wednesday.

The hearing shall be led by the Finance Committee’s Chair, Mike Crapo, with the participation of Coinbase vice chairman of tax Lawrence Zlatkin and Coin Middle policy director Jason Somensatto.

The hearing follows the White House Digital Asset Working Neighborhood’s crypto suggestions in July, which entreated lawmakers to acknowledge crypto as a brand contemporary asset class and adjust tax guidelines for securities and commodities to digital assets.

Journal: Quitting Trump’s top crypto job wasn’t easy: Bo Hines