As Bitcoin (BTC) continues to remain range-certain between $110,000 – $115,000, information from crypto exchanges looks divided in the direction of the leading cryptocurrency. While Binance merchants are exhibiting a bullish stance, merchants from diverse exchanges are tranquil exhibiting a level of hesitation.

Binance Traders Waiting for Bitcoin Price Surge

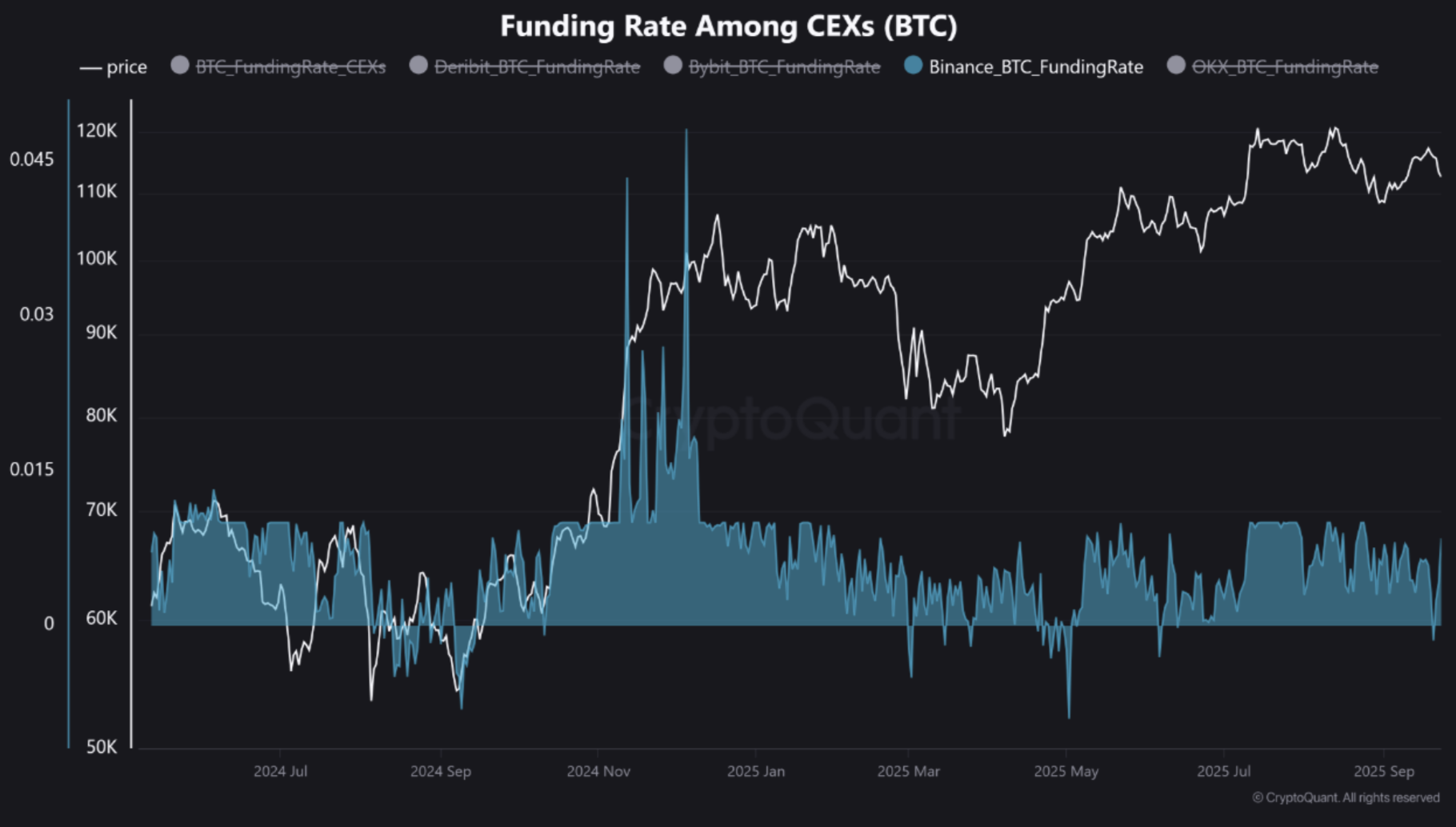

Per a CryptoQuant Quicktake post by contributor Crazzyblockk, recent derivatives information from Binance is signaling shifting market dynamics – namely, potentially the most modern BTC funding payment on Binance aspects in the direction of merchants taking a bullish stance.

On the contrary, the BTC funding payment from diverse exchanges, corresponding to OKX, Bybit, and Deribit, suggests that merchants on these platforms are tranquil unsure about taking any directional wager.

As of September 23, the BTC perpetual funding payment on Binance climbed to +0.0084%, suggesting that the lengthy positions are dominant and merchants are inspiring to pay a premium to retain their bullish bets.

It’s miles worth highlighting that the win bigger in funding payment is rarely any longer an isolated tournament, because it suggests a obvious seven-day switch, indicating strengthening conviction among Binance merchants.

For comparability, the BTC funding payment on OKX is currently hovering at -0.0001%, while on Bybit it sits at 0.0015%. Finally, Deribit exhibits a funding payment of 0.0019%. The analyst added:

This isn’t factual a distinction in numbers; it’s a distinction in account. While funding charges on OKX and Bybit enjoy really decreased over the past seven days, Binance’s payment has climbed.

For the uninitiated, funding charges may possibly per chance furthermore be viewed as an exact-time gauge of seller sentiment in the perpetual swaps market. A stable obvious payment worship that of Binance, which diverges from the rest of the market, aspects in the direction of aggressive bullish speculation.

Is BTC About To Get A Switch?

In a separate CryptoQuant post, contributor XWIN Compare Japan renowned that Bitcoin’s implied volatility has dropped to its lowest stage since 2023. Attend then, the lull out there used to be followed by an explosive rally of 325%, which propelled BTC from $29,000 to $124,000.

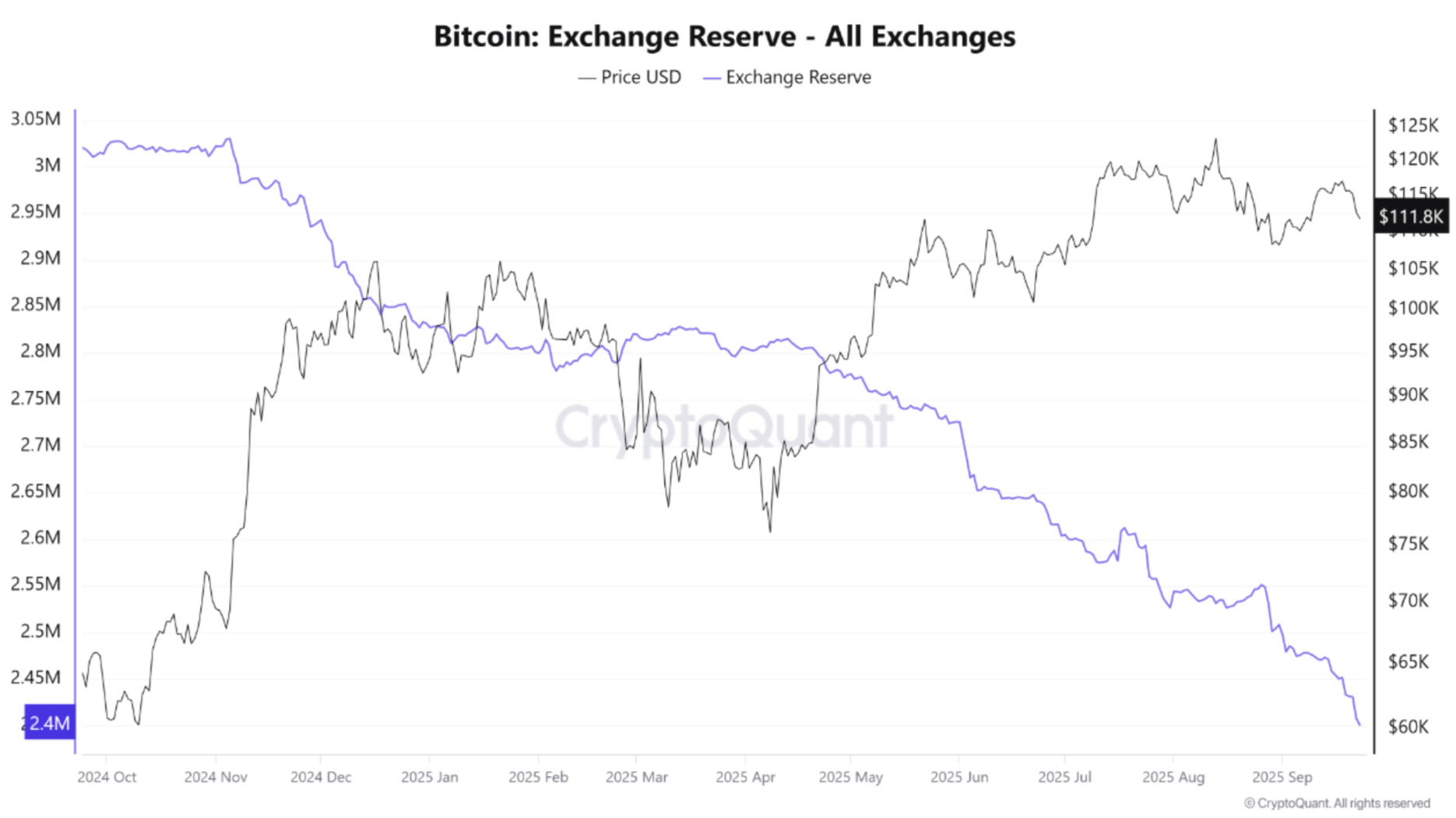

The analyst added that the entire Bitcoin switch reserves continue to fritter away at a fast roam, hitting recent multi-three hundred and sixty five days lows. Traditionally, the kind of tumble in BTC switch reserves has preceded present squeezes, leading to a dramatic upward thrust in demand.

That acknowledged, the total sentiment in the direction of BTC appears to be frigid currently. The Bitcoin Peril & Greed Index suggests that investors are fearful of entering the market, that may possibly per chance well supply a factual opportunity to amass BTC at most modern market prices.

On the other hand, recent information from BTC wallets confirms that recent wallets – those that’re lower than a month feeble – are starting to purchase the highest digital asset. At press time, BTC trades at $113,796, up 1% previously 24 hours.