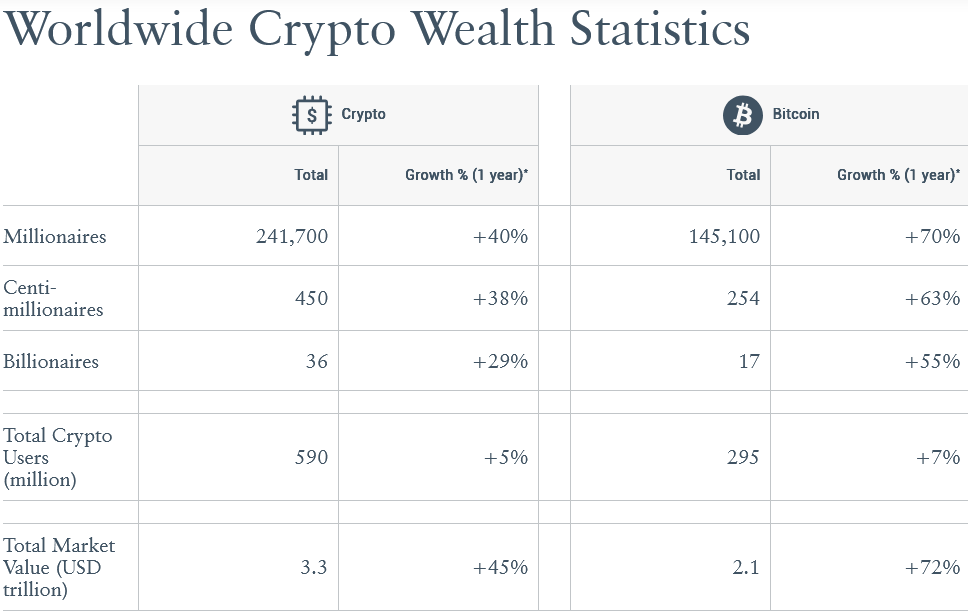

The different of crypto millionaires has risen by 40% year-on-year to 241,700, fueled by Bitcoin’s rate rally and the broader crypto market valuation pushing past $3.3 trillion by mid-2025, in accordance with a brand current yarn.

The different of crypto centimillionaires — folks with crypto holdings above $100 million — rose 38% to 450, whereas the crypto billionaire rely jumped 29% to 36 by the cease of June, wealth and citizenship advisory firm Henley & Partners said in its Crypto Wealth Story on Tuesday.

“This major allege coincides with a watershed year for institutional adoption,” Henley said.

Public companies and major monetary companies have an increasing number of bet on cryptocurrencies, especially in the US, because the Trump administration’s crypto-pleasant coverage actions have given Wall Aspect road self assurance to invest, which has helped to elevate the market’s cost.

To this level in 2025, inflows into US-essentially based space Bitcoin replace-traded funds have increased from $37.3 billion to $60.6 billion, whereas space Ether (ETH) ETF inflows have risen fourfold to $13.4 billion.

Investment advisory companies and hedge fund managers scooped up the most space ETH ETFs in the 2nd quarter, increasing their holdings to $1.35 billion and $688 million, whereas brokerage and inner most equity companies moreover increased their positions.

Bitcoin millionaires look “dramatic surge”

Henley said the increased different of crypto millionaires over the year modified into “fueled by a dramatic surge in Bitcoin millionaires.”

Bitcoin millionaires rose 70% over the year to 145,100, partly due to Bitcoin outperforming the broader market between July 2024 and June 2025.

The Bitcoin centimillionaire rely moreover jumped 63% to 254, whereas the different of billionaires rose 55% to 17.

Phillipp Baumann, founding father of monetary study and quantitative asset administration firm Z22 Technologies, knowledgeable Henley that share of the rise could perchance moreover be attributed to Bitcoin turning into the “terrible forex for gathering wealth” for more consumers.

In spite of the rise, adoption by the total crypto user rely only rose 5% to 590 million.

Related: Procuring for Bitcoin years up to now wouldn’t have made you well off at the moment time, trader says

Henley’s findings were constant with in-apartment wealth tier gadgets, which inclined separate modelling to resolve the different of crypto millionaires, centimillionaires, and billionaires, along with data from CoinMarketCap, Binance and the Ethereum block explorer Etherscan.

US amongst top migration areas for crypto

Henley, which advises well off clients — along side crypto consumers — on citizenship and residency, ranked Singapore, Hong Kong, and the US because the cease locations for crypto migration.

Switzerland and the UAE rounded out the cease 5 in the firm’s Crypto Adoption Index, which factored in public adoption, infrastructure adoption, innovation and abilities, regulatory environment, financial factors and tax-friendliness.

On the different hand, it infamous that smaller international locations hold Costa Rica, El Salvador, Greece, Latvia, Panama, Recent Zealand and Uruguay have all developed strategies to attract digital asset consumers.

Journal: 3 folks who all accurate away grew to develop into crypto millionaires… and one who didn’t