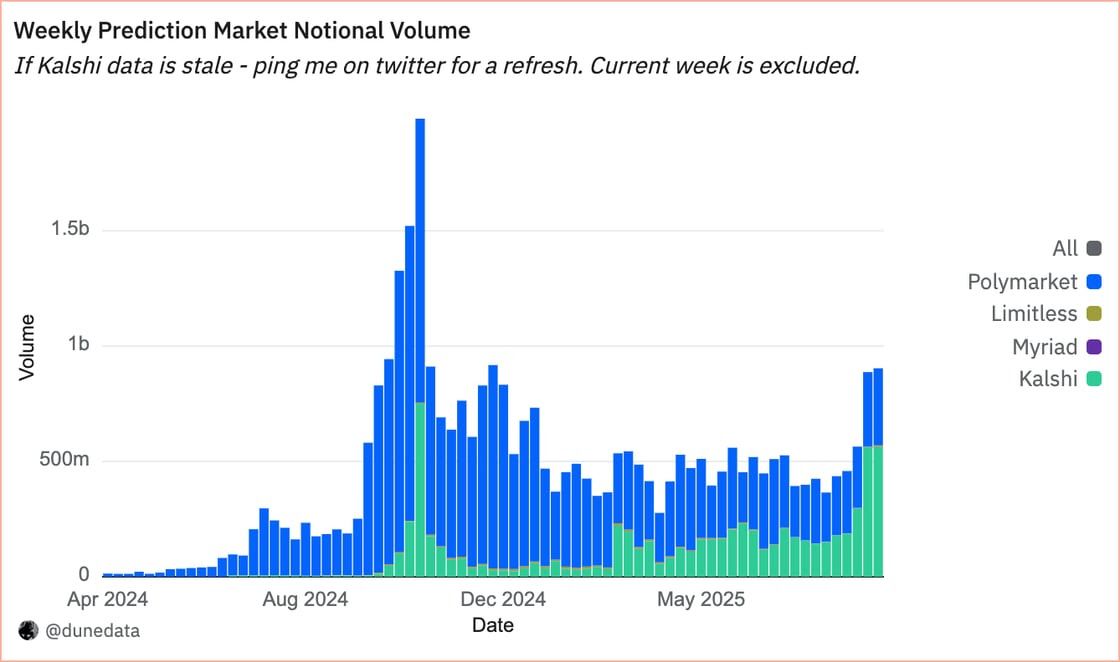

Kalshi is pulling ahead in the prediction market run, taking pictures a dominant a part of trading volume even as opponents admire Polymarket push into regulated U.S. territory.

From 11th of September to 17, Kalshi accounted for 62% of total volume in the on-chain prediction market sector, per recordsdata from Dune Analytics, while Polymarket’s stood at 37%. The light’s weekly trading roam topped $500 million, with an moderate starting up hobby of around $189 million.

Its volume is past that of Polymarket, which stood at $430 million, and its moderate starting up hobby of $164 million, which implies “sticker positions on Polymarket and sooner turnover on Kalshi.”

Polymarket’s longer-time duration markets, which ceaselessly stretch over weeks or months, defend person funds locked in for longer periods, actually.

This reveals up in the starting up hobby-to-volume ratio: Polymarket averaged 0.38, while Kalshi sat decrease at 0.29. That ability Kalshi’s customers are trading extra continuously, while Polymarket’s positions are inclined to sit.

Restful, Polymarket is constructing out an even bigger place in the U.S. The platform has cleared its acquisition of QCX, a regulated derivatives trade, to enter the nation again.

It has moreover launched earnings-based markets with social investing platform Stocktwits, designed to let stockholders hedge earnings likelihood and analysts gauge market sentiment in trusty time.