Ethena Lab’s stablecoin USDe has surged to a market capitalization of half a billion dollars, as almost about half of the tokens are committed to staking, enhancing the project’s resilience.

Amidst the cryptocurrency bull flee, Bitcoin, with a market cap of $62,000, has surged by nearly 40% over the closing month. In the same arrangement, Ethereum, valued at $3,402, has skilled a 47% develop in direction of the same length.

USDe Experiences Immense Improve in Market Cap

In a put up on X (formerly Twitter), on-chain data researcher Tom Wan told his 9,585 followers that USDe has reached a $500 million market cap. He also highlighted the huge yield returns accessible for investors who lock up their tokens in the project, thus increasing liquidity.

“With the loopy funding % on perps, 39% on moderate, Ethena is paying out a 24% yield on sUSDe.”

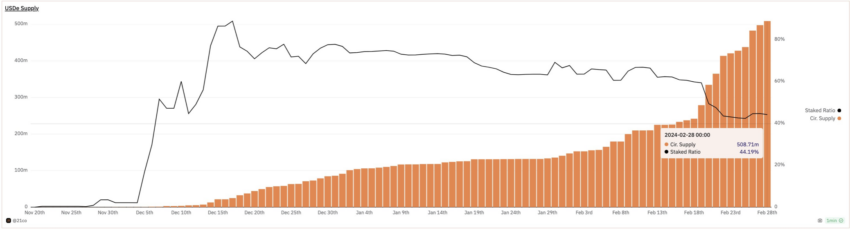

Moreover, Wan presented a graph illustrating the hasty reveal in the USDe market cap since slack November 2023, with the staked tokens gradually stabilizing across the 44% mark.

On the other hand, Wan elaborated that the reserve for the insurance protection fund would undergo a tenfold develop, causing confusion amongst numerous X customers on social media.

“Ethical news is they’re in a region to also develop the reserve for the insurance protection fund from $1M to $10M.”

In the intervening time, one X user asked if the insurance protection fund was as soon as ample “assuming a 30% every day drawdown.”

Wan clarified that the staking yield would decrease proportionately in accordance to the funding charge.

“The staking yield will drop accordingly in step with the funding charge. The insurance protection fund tries to mitigate funding threat and can be triggered when funding rates traipse unfavorable and better than stETH yield.”

After a Prolonged-Time length Decline, Stablecoins Stage a Resurgence

In the intervening time, it was as soon as handiest about a months prior to now that the stablecoin market took a gigantic plunge.

In October 2023, BeInCrypto reported that stablecoins continued an 18-month-lengthy decline. Their market cap has diminished in dimension by 35% since Would possibly perchance possibly 2022.

On the other hand, many predict that stablecoin regulations will approach into carry out this year in the United States.

On January 15, Circle chief executive Jeremy Allaire stated there was as soon as a “very proper likelihood” that stablecoin regulations might perchance well well well be passed in the US in 2024.

Disclaimer

The whole data contained on our net web page is published in proper faith and for general data applications handiest. Any depart the reader takes upon the records found on our net web page is strictly at their receive threat.