Shiba Inu stamp has once extra captured the highlight as its stamp reveals signs of renewed momentum, coinciding with the Federal Reserve’s most up-to-date solution to prick hobby rates. Charge cuts customarily act as gas for threat sources, pushing liquidity into equities and cryptocurrencies, and meme tokens delight in SHIB customarily earnings the most all over such speculative surges. The mammoth inquire of on every holder’s mind is whether or not or not these macroeconomic tailwinds and SHIB’s technical breakout can realistically propel the token toward the elusive $1 stamp.

Shiba Inu Model Prediction: A Macro Tailwind for Threat Property

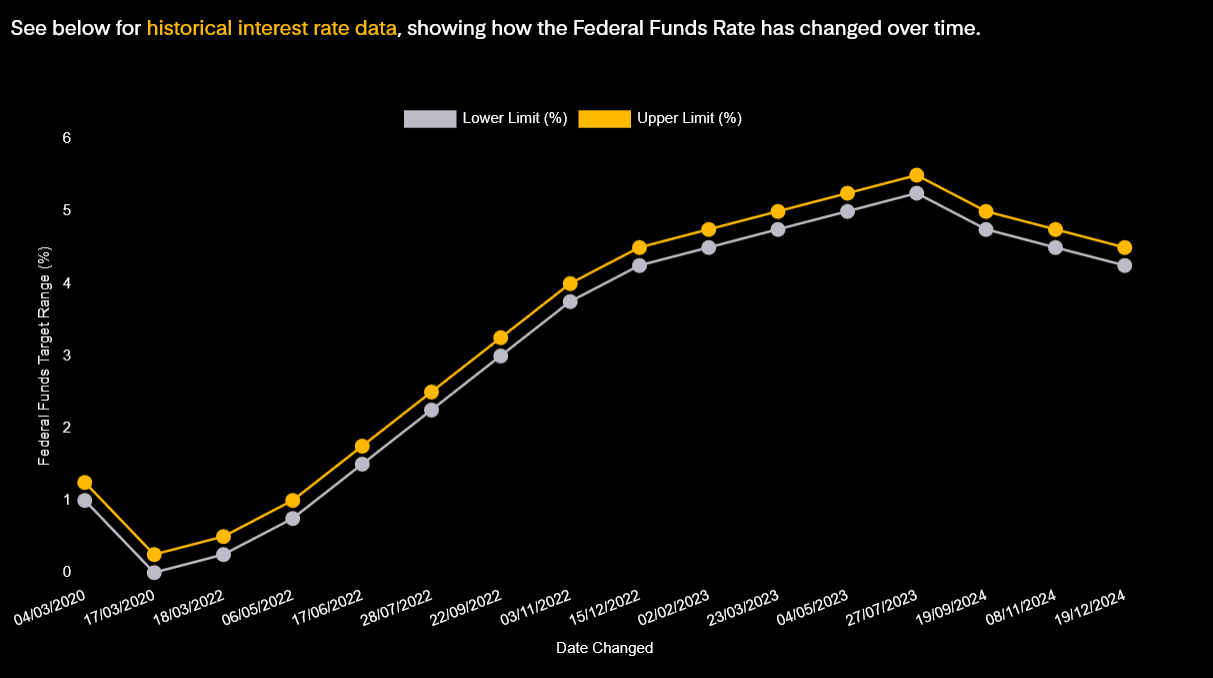

The Federal Reserve meets eight events a year to blueprint the federal funds price, which is for the time being locked at 4.25%–4.50%. Each and every option has ripple outcomes across worldwide markets. A price prick customarily drives investors far off from low-yield bonds and into increased-threat sources delight in equities and cryptocurrencies.

For SHIB stamp, a token that thrives on speculative vitality, dovish Fed coverage may per chance perchance free up waves of most up-to-date liquidity, igniting transient rallies. Conversely, price hikes tighten monetary situations, draining capital from speculative markets and weighing heavily on meme cash.

September 17th: A Excessive Date

The next FOMC option lands on September 17, 2025. Market odds for a prick are below 50%, reflecting mixed signals from inflation and labor records. If the Fed surprises with a prick, SHIB may per chance perchance occupy the earnings of a broader crypto market surge. Retail merchants, already drawn to meme cash all over sessions of cheap money, may per chance perchance pile in aggressively. A preserve or hawkish tilt, alternatively, would chilly sentiment and again SHIB capped shut to most up-to-date ranges.

Security Shocks: The Shibarium Bridge Hack

While macroeconomic tailwinds delight in Fed price cuts can give a enhance to SHIB’s transient rallies, ecosystem dangers remain a heavy jog on lengthy-term credibility. The most up-to-date $2.4 million flash loan exploit on the Shibarium bridge exposed weaknesses in validator governance and compelled developers to cease staking and unstaking activities. The attacker briefly received validator again watch over by leveraging 4.6 million BONE tokens, draining 224.57 ETH and 92.6 billion SHIB sooner than being locked out.

Despite the indisputable truth that the Shiba Inu team responded fleet—freezing the attacker’s stake, participating security companies, and even exploring a bounty recovery—the injury to sentiment is already seen. SHIB holders are now weighing not unswerving macro coverage shifts however additionally the resilience of the community’s infrastructure. For a token already battling skepticism about ever reaching $1, security breaches delight in this undermine investor confidence and stall momentum. The hack doesn’t erase SHIB’s speculative appeal, however it completely makes the facet motorway to sustained development and fearless stamp stages even steeper.

Shiba Inu Model Prediction: SHIB’s Contemporary Breakout

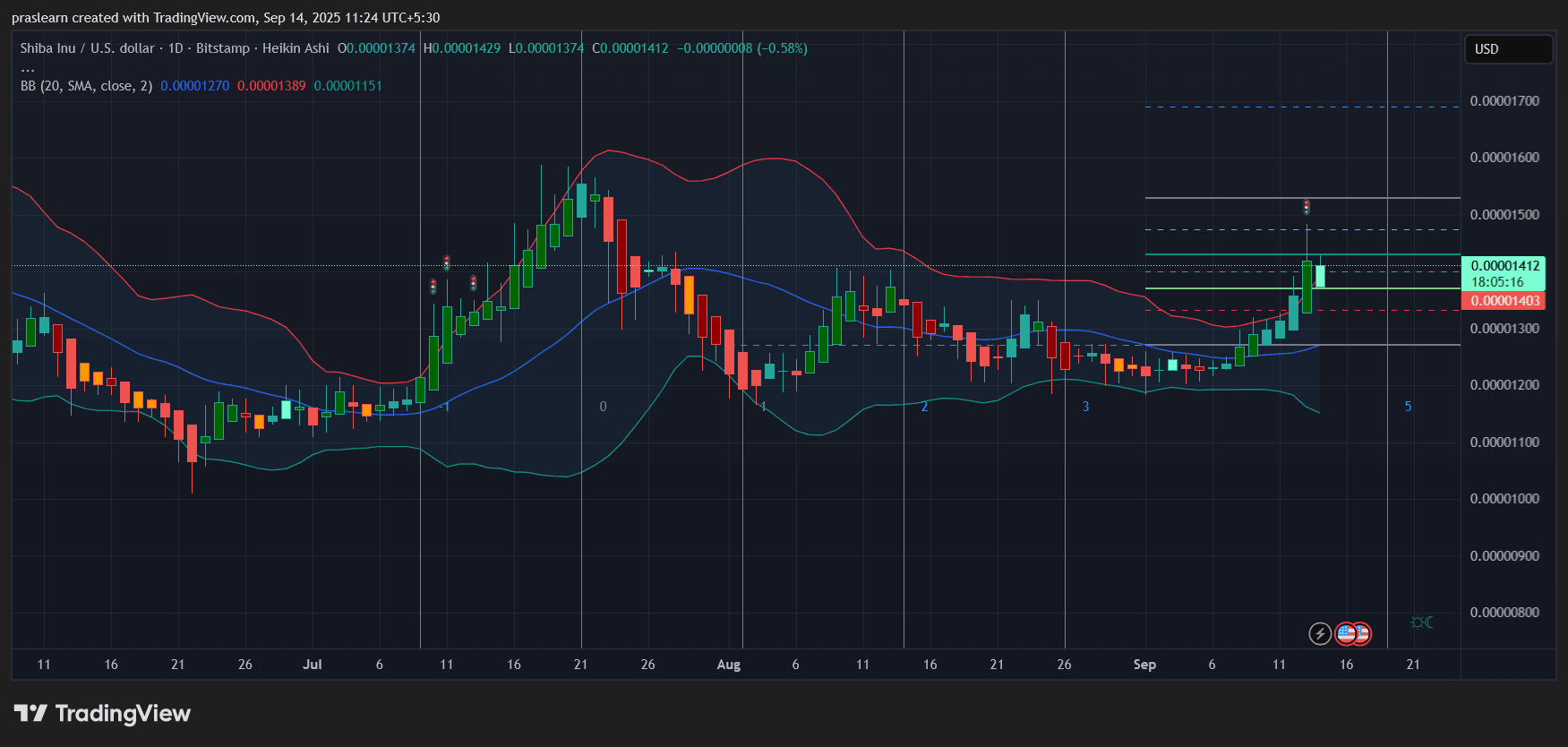

The day-to-day SHIB/USD chart reveals a provocative breakout above the mid-Bollinger band and the 20-day interesting average. Model surged from around 0.00001200 to 0.00001429 sooner than pulling relief reasonably, printing a Heikin Ashi candle with lengthy wicks—evidence of both making an strive to win tension and earnings-taking.

Key stages to seek:

- Strengthen: 0.00001350 (shut to the center of the most up-to-date breakout zone)

- Instantaneous Resistance: 0.00001500 (psychological barrier and Fibonacci level)

- Subsequent Target: 0.00001700 (higher Bollinger band extension)

The Bollinger Bands are widening, signaling rising volatility. Momentum is bullish, however the wick on the most up-to-date candle suggests the rally may per chance perchance cease sooner than one other leg up.

Can SHIB Model Truly Attain $1?

As of late’s stamp of around $0.000014, SHIB would desire to multiply extra than 70,000 events to hit $1. That implies a market cap within the tens of trillions of bucks—higher than your entire worldwide crypto market mixed, even higher than worldwide GDP. This is mathematically unrealistic below most up-to-date tokenomics, unless an outrageous token burn reduces circulating provide enormously.

SHIB’s team has been engaged on burn mechanisms and ecosystem expansion (Shibarium, DeFi projects), however the scale required to originate $1 seemingly is monumental. A extra excellent goal is a return to old highs around $0.00008, which is ready a 6x from here. With Fed price cuts fueling liquidity and speculative mania, this kind of switch is doable in a bullish cycle, though not guaranteed.

The Realistic Outlook

- Short-Length of time (Subsequent 30–60 days): If momentum holds, SHIB stamp may per chance perchance take a look at 0.00001500–0.00001700. A breakout above 0.00001700 may per chance perchance crawl up toward 0.00002000.

- Medium-Length of time (2025 cycle): With broader market tailwinds from Fed easing, Shiba Inu Model may per chance perchance revisit 0.00005–0.00008 if Bitcoin leads one other leg increased.

- Long-Length of time: $1 remains out of reach with out huge burns or tokenomics changes. The extra realistic perspective is incremental beneficial properties supported by retail hype, ecosystem development, and favorable macro liquidity.

Closing Take

The Fed’s price prick has blueprint the stage for one other threat-on wave across markets. Shiba Inu has already responded with a provocative breakout, however merchants may per chance perchance accumulated mood expectations. $1 is a legend below most up-to-date situations, while a switch toward $0.00005–0.00008 in this cycle is far extra realistic. $SHIB remains a speculative play, however in a global of cheap money, speculation thrives.