After a summer season marked by cautious investor sentiment and transferring priorities across the sphere, novel figures stammer that capital flows into crypto are starting to chilly.

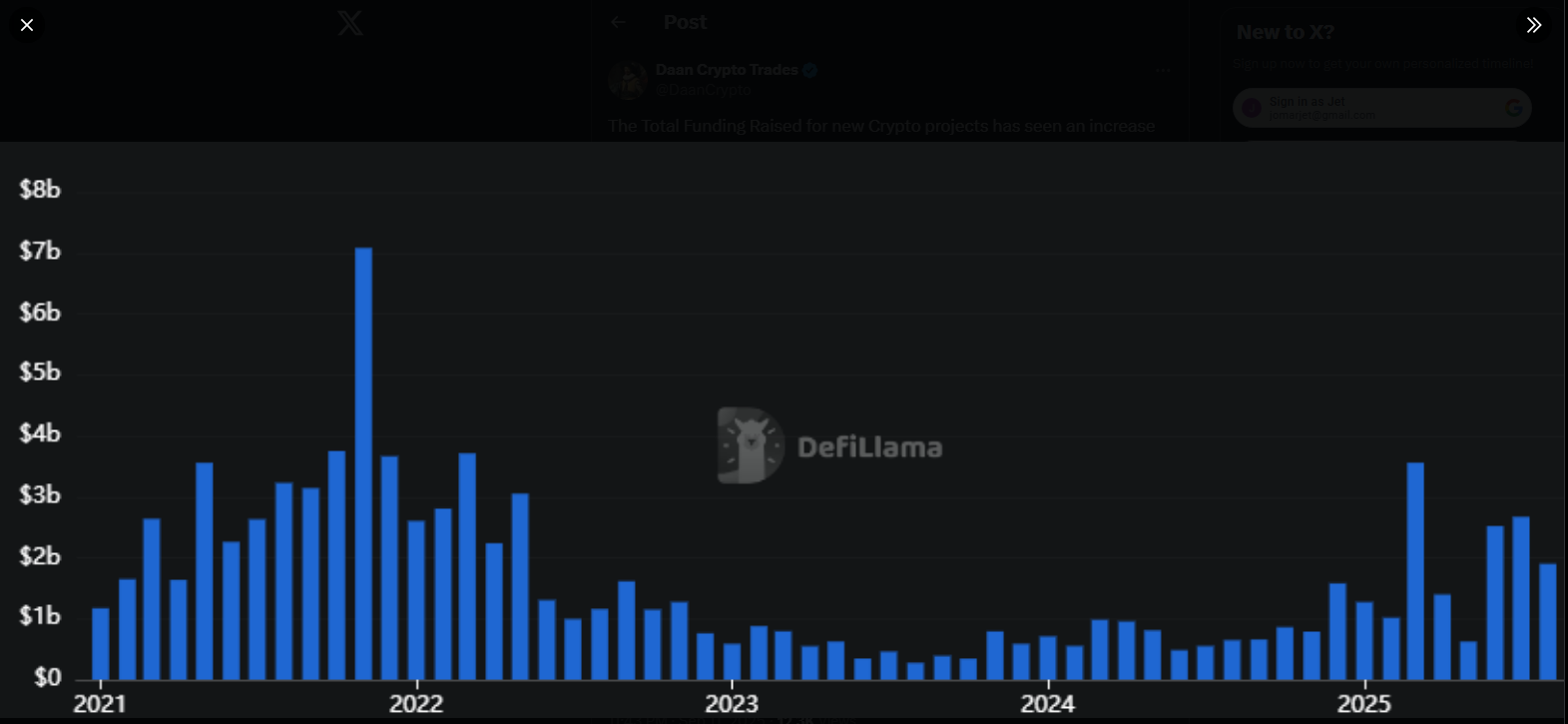

Overall funding for crypto protocols turn into down 30% in August, sliding to almost $2 billion from July’s $2.67 billion, consistent with DeFiLlama.

Funding Dips But Quarter Gains

Based totally on reports, third-quarter totals reached $4.57 billion in just two months, pushing past Q2’s $4.54 billion. That shows money is aloof transferring, even though monthly flows peruse cooler compared with past peaks.

On the starting put of 2022, monthly raises hit about $7 billion. Numbers dangle come down since then, nonetheless 2025 has confirmed several huge spikes that kept investors alert.

Investor Focal level Shifts To Existing Initiatives

In step with market analyst Daan Crypto Trades, funding has moved away from nonstop novel-chain launches in direction of treasuries and teams building on existing initiatives.

He aspects out that novel launches are hitting decrease valuations, which has helped be pleased stamp moves quieter after listings.

The Complete Funding Raised for model novel Crypto initiatives has viewed an set aside greater the past few months nonetheless is nowhere conclude to what it turn into attend in 2021 & 2022.

This cycle has been all about treasury firms that are building on high of initiatives which may possibly possibly possibly be already available.

Most capital… pic.twitter.com/nqo25QxVUo

— Daan Crypto Trades (@DaanCrypto) Sept. 11, 2025

Investments Unfold Previous DeFi

DeFi aloof drew attention in August, with money flowing into infrastructure and buying and selling platforms. But other sectors also saw distinguished rounds.

Stablecoin infrastructure turn into busy too, with Rain’s develop at $58 million. Price alternate choices also attracted funding; OrangeX took $20 million in a Assortment B.

South Korea Opens VC Doorways

Following approval by the Swear Council and cupboard, South Korea’s Ministry of SMEs and Startups stated it lifted a protracted-standing VC funding ban on September 16.

The modification to the Enforcement Decree gets rid of the label that had kept exchanges and brokerages labeled as “restricted enterprise firms” since October 2018.

Current approved pointers, collectively with the Virtual Asset User Safety Act handed in July 2025, presented deposit safeguards, record-conserving solutions, and bans on unfair buying and selling. These steps helped convince regulators to reopen the market.

Executive Improve Would possibly per chance Enhance Local Companies

The decision to steal South Korea’s long-standing restrictions on crypto funding got here with a notify message from policymakers.

Officers stated the circulate targets to invent a extra clear and to blame ecosystem, and to serve enterprise capital drift to firms centered on blockchain and cryptography.

If VCs return, native crypto firms also can merely procure novel sources of notify capital, whereas investors peruse for initiatives that can voice longer-time duration cost.

Featured picture from Unsplash, chart from TradingView