In the 2nd week of September, the altcoin season index reached 80 aspects, officially entering the acceleration segment. Right here is the stage when capital assuredly flows into low-cap altcoins, even in the occasion that they lack main recordsdata events.

On-chain data displays that some altcoins with a market capitalization below $200 million are experiencing intriguing declines in alternate reserves. This on the total indicators rising accumulation.

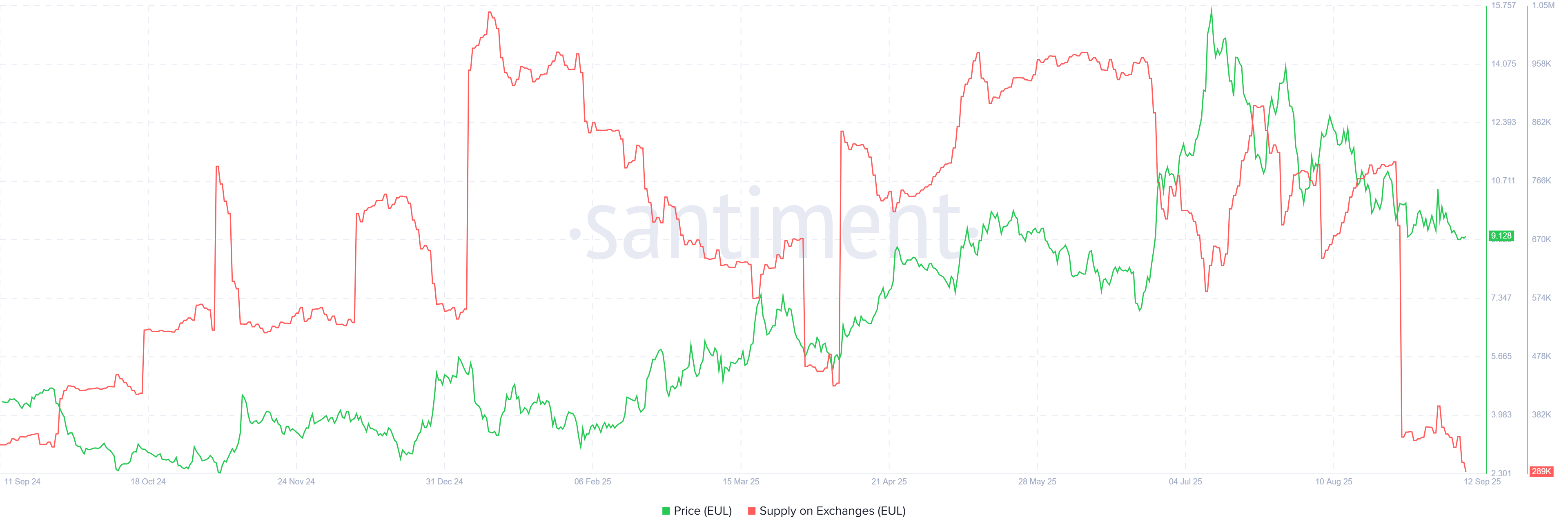

1. Euler (EUL)

Euler (EUL) is a non-custodial, permissionless lending protocol on Ethereum. The mission launched in 2020 and raised $40 million from VCs comparable to Paradigm and Coinbase Ventures. In 2023, the protocol suffered a hack that precipitated with regards to $200 million in losses.

The token’s most modern market capitalization stands at $181 million, in response to CoinMarketCap. A most modern itemizing on Bithumb drew valuable consideration from retail merchants.

Santiment data displays that the September 5 itemizing precipitated a intriguing tumble in alternate reserves, which fell to their lowest level in a one year. Solely 289,000 EUL remain on exchanges, which methodology more than 500,000 EUL are left since the August top.

In addition, the protocol’s complete tag locked (TVL) reached a brand unusual high in September, surpassing $1.5 billion. DefiLlama data displays TVL has elevated tenfold since the muse of the one year.

This methodology the protocol’s TVL is more than seven cases its market capitalization. Investors also can merely see this as a bullish indicator contributing to the steep decline in alternate reserves.

“Now now not many protocols can creep it aid after a $200M hack. But you gotta give it to Euler Finance for the insane comeback wander,” investor Anze commented.

2. COTI

COTI is a rapidly and gentle-weight-weight confidentiality layer on Ethereum. It introduces a highly evolved and compliant solution for data protection on the public blockchain.

COTI’s market capitalization stays below $120 million. The token’s tag performance has been lackluster, fluctuating around $0.05 for the past three months.

Contemporary data, alternatively, displays that alternate reserves dropped sharply prior to now two days to 812 million tokens, near the yearly low.

Charts existing a prolonged downtrend in alternate reserves, mirroring the cost decline. The sideways circulation in most modern months extra supports the foundation of ongoing accumulation.

If capital rotation on this altcoin season performs out as analysts interrogate, low-performing tokens admire COTI also can attract unusual consideration.

In the period in-between, COTI’s TVL spiked in July, with more than 8 million tokens locked — identical to only about half a thousand million dollars.

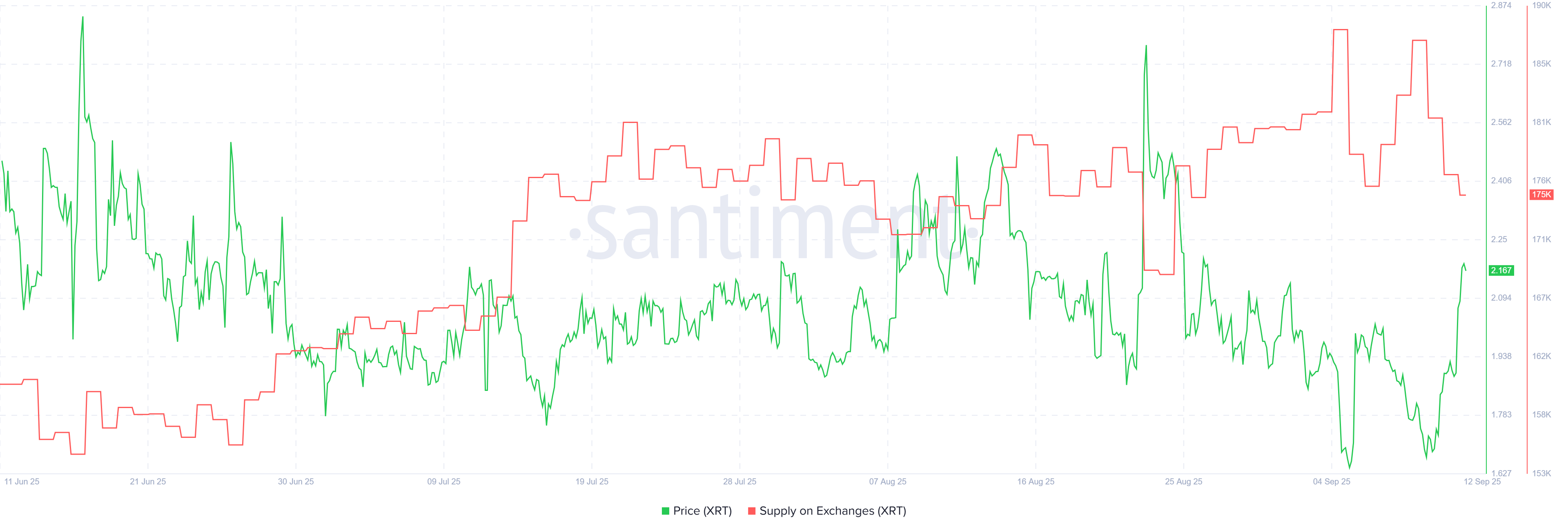

3. Robonomics Community (XRT)

Robonomics Community earns a spot apart on this listing due to the the rising interest in combining robotics with tokens. Experts interrogate this sector to change into a tough candidate for the 2025 altcoin season.

“Crypto x robotics will be retail’s wager on what also can perchance be the glorious and most disruptive secular growth fashion we’ve ever seen,” predicted Simon Dedic.

Robonomics Community is a suite of commence-source programs for Robotics, Neat Cities, and Industry 4.0 builders. XRT has a in actuality tiny market capitalization, below $10 million, and low trading quantity, making it highly unhealthy.

On the other hand, Santiment data suggests a definite outlook. The token’s tag has held around $2 since the muse of the one year, even as alternate reserves rose. By September, reserves began to decline from their top, suggesting renewed accumulation.

Some merchants think XRT also can doubtlessly amplify 100 cases if the robotics sector gains more consideration soon.

The put up 3 Low-Cap Altcoins Seeing Main Accumulation as Altcoin Season Heats Up seemed first on BeInCrypto.