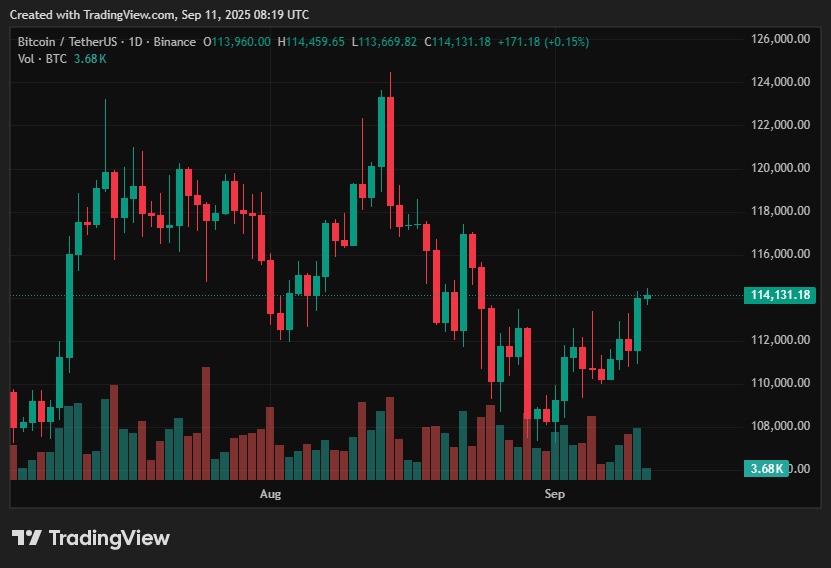

- Between the $110K toughen and the $115K resistance, Bitcoin is shopping and selling at about $114K.

- If Bitcoin breaks above $115K, Bitcoin designate prediction analysts mediate it would possibly per chance maybe per chance transfer toward $118K–$130K; if it doesn’t, it would possibly per chance maybe per chance fall beneath $100K–$108K.

- Bullish capability is supported by stablecoin liquidity and ETF inflows, while downside tension is increased by whale selling.

- It is a ways uncomplicated to plan every bullish and pessimistic estimates for the explanation that market is coiled for a $20K whipsaw.

As it sits above $114,000, stuck between the weight of overhead resistance and growing bullish momentum, Bitcoin designate prediction analysts now peek BTC as being yet again at the guts of market consideration.

With volatility indicators flashing warnings of an impending breakout, traders are on edge as the cryptocurrency trades in a narrowing differ following weeks of stabilization.

Whale job, seasonal patterns, and institutional inflows are coming collectively to be pleased a high-stakes disaster where the subsequent large resolution would possibly per chance well per chance price a tiny tens of hundreds of greenbacks. This tightening setup has left analysts divided of their Bitcoin designate prediction, with some calling for a surge and others bracing for a correction.

Table of Contents

Bitcoin designate prediction: What to take dangle of for this present day

In the intervening time, Bitcoin is shopping and selling at about $114,000, consolidating internal a runt band and affirming above the mandatory $110,000 toughen. The 50-day transferring realistic is pressuring the immediate resistance, which has moved better toward $114,500. As a result of the slim differ between the $110,000 toughen and the $114,500 resistance, traders are shopping for a transparent leap forward.

Launch passion in futures has increased even extra, indicating that the intention’s leverage is nonetheless develop, increasing the likelihood of a severe liquidation squeeze after a obvious course is made up our minds. Measures of volatility additionally suggest that the market is tightly wound and that avid gamers are wanting forward to a large transfer.

Upside Outlook for Bitcoin designate

Bitcoin (BTC) would possibly per chance well per chance stare a rapid rapid-length of time surge toward $118,000–$122,000 whether it is miles going to decisively atomize above the $114,500–$115,000 resistance zone. A strong bullish signal would be despatched if that differ were cleared, which would possibly per chance well per chance pave the methodology for a protracted rally toward $125,000–$130,000.

Given that be troubled Bitcoin ETFs get viewed necessary inflows all over the last week, the bullish argument is bolstered by tough institutional ask. As an illustration, BlackRock these days increased its publicity to Bitcoin by $169 million via its fund, and in early September, complete ETF inflows exceeded $246 million.

Additionally, stablecoin liquidity is nonetheless tough, giving it the skill to face up to selling tension and toughen extra features would possibly per chance well get to nonetheless momentum derive run. This expectation of continued inflows and supportive liquidity strengthens the case for a bullish breakout.

Downside Risks

Bitcoin would possibly per chance well per chance retreat to retest the $110,000 level if it is unable to conquer resistance at $114,500–$115,000. The $108,000 zone becomes mandatory if that level fails; a breakdown beneath it would possibly per chance maybe enlarge the likelihood of a extra severe decline toward $100,000–$104,000. Cascade liquidations as over-leveraged longs are pushed out of the market would possibly per chance well per chance plan greater the form of shift.

The proven reality that whale selling has increased these days—large holdings get unloaded over 115,000 BTC in the closing month—increases the hazards of the downside. The market is additionally plagued by September’s seasonal weakness, which heightens considerations that if mood shifts speedy, one other flash break would possibly per chance well per chance happen.

BTC Rate Prediction Fixed with Present Stages

Bitcoin is currently shopping and selling between $110,000 and $114,500, which is a serious direct. The obvious viewpoint, which tasks a transfer into the $118,000–$130,000 differ, would be bolstered by an accurate breakout over the cease border.

A breakdown beneath $108,000, on the different hand, would transfer the market in the route of a bear market, where prices would drop to between $100,000 and $104,000. With traders wanting forward to a likely $20,000 whipsaw as soon as Bitcoin in the end breaks out of its consolidation zone, the BTC designate forecast stays delicately balanced. Each and every bullish and bearish projections are on the table, with sentiment shifting speedy as unique files emerges.

Contemporary Market Triggers to Look

Indubitably one of basically the fundamental forces in the help of the present rally effort is nonetheless ETF flows. Critical inflows get been made into be troubled Bitcoin ETFs, indicating tough institutional ask for the time being. Additionally, macro stipulations are enhancing, with a obvious atmosphere for possibility sources being created by greenback weakening and prospects of fee cuts from the Federal Reserve.

The market is nonetheless supported by stablecoin liquidity, which makes obvious there’s adequate cash to face up to selling tension and support features.

Analysts are additionally maintaining a careful seek on chart constructions love transferring realistic tests and head-and-shoulders formations to acquire accurate views on Bitcoin’s outlook for the coming weeks, since they would possibly per chance well help as the technical triggers for the subsequent necessary leap forward or breakdown.

Disclosure: This article does now no longer symbolize funding advice. The verbalize and materials featured on this web verbalize are for academic functions most intelligent.