Crypto merchants possess swung into more unfavorable sentiment and deeper dismay, uncertainty, and doubt (FUD), constant with the onchain analytics platform Santiment, however analysts state it’s seemingly excellent non everlasting.

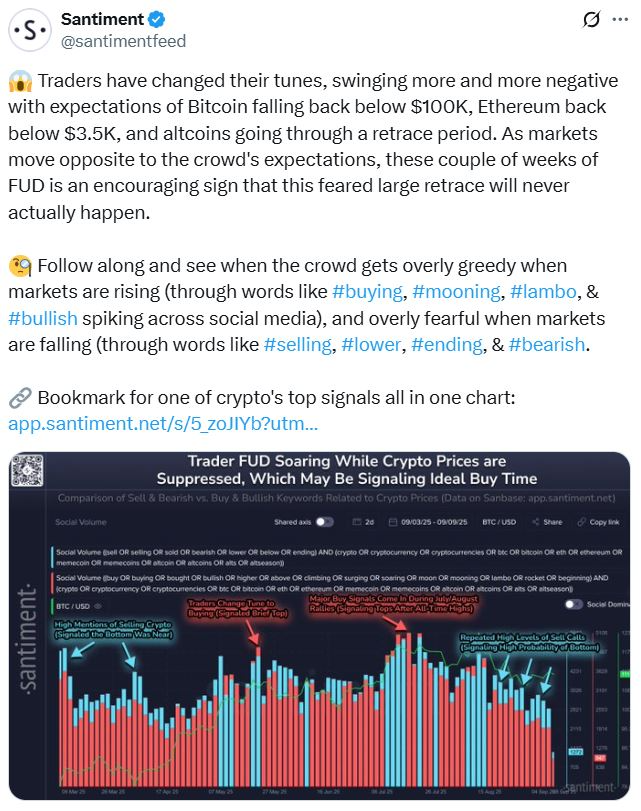

Santiment mentioned in an X put up on Tuesday that with the price of Bitcoin (BTC) falling, and altcoins going through a retrace period, merchants had been an increasing number of talking about selling, the market sinking decrease or a have market.

It added that markets generally “switch opposite to the crew’s expectations,” so the final “couple of weeks of FUD is an encouraging signal that this feared extensive retrace couldn’t ever if truth be told happen.”

Crypto market sentiment slipped into Disaster on Sunday and showed signs that merchants had been temporarily stepping back, constant with Santiment.

Analysts told Cointelegraph that the unfavorable sentiment will seemingly pass soon, because the price of Bitcoin recovers and a that you just will give you the choice to assume of US payment decrease is on the horizon.

US payment decrease a key catalyst for positivity

Some monetary institutions and market analysts are projecting the US Federal Reserve will reduce passion rates as a minimal twice in 2025.

Pav Hundal, lead market analyst at Australian crypto broker Swyftx, told Cointelegraph all eyes are if truth be told on the Fed’s assembly next week, with a decrease of any kind perchance being “the following key catalyst for positivity.”

He added worries around bond markets and job openings possess bought the market’s consideration, and it’s correct recalibrating with a “healthy correction” after coming off very high sentiment.

“We possess a euphoria index mannequin that very clearly reveals BTC’s most modern all-time high became as soon as the product of a frothy market,” Hundal mentioned.

“The rolling 30-day efficiency of Bitcoin is unfavorable and that means we’ve already gone through a correction, which is ready to possess shaken out reasonably heaps of gentle hands since we hit the $124,000 top.”

Bitcoin reclaiming $117,000 might perchance well perchance shift sentiment certain

The Crypto Disaster & Greed Index, which tracks the broader crypto market sentiment, has been at “Neutral” since Monday after several days in “Disaster” and registering an common rating of “Greed” final month.

Charlie Sherry, head of finance at crypto alternate BTC Markets, told Cointelegraph that trader sentiment tends to switch to extremes in each directions, when merchants lean heavily bearish, it ought to generally impress the pause of that switch in decision to the commence.

“If Bitcoin reclaims $117,000, I wager sentiment would with out note swing back; now we possess already seen early signs of that on Bitcoin’s fresh bounce to most modern ranges,” Sherry mentioned.

“Bitcoin has broken the $100,000 barrier and now there might be a chunk of of a matter of ‘what next?’ $200,000 is the following high timeframe major purpose, however that indubitably appears to be like a long system away, every time and rate-lustrous, so there might be more uncertainty quick term.”

One more relate that will perchance well perchance swing sentiment back into certain is crypto treasuries, which possess sparked firms into a walk to amass more crypto.

In a single of the most modern cases, gain and manufacturing firm Forward Industries mentioned on Monday it had secured $1.65 billion in cash and stablecoins to commence a Solana (SOL)centered crypto treasury blueprint.

Associated: Tricks on how to be taught market sentiment with ChatGPT and Grok forward of checking a chart

“There is potential for upside in the Solana treasury trade, however perchance the returns shall be more compressed than what we saw with Ether; however that will perchance well perchance also very neatly be a pattern to examine that will perchance well perchance flip sentiment certain,” Sherry added.

Traders more cautious in September

Meanwhile, ZX Squared Capital co-founder and chief investment officer CK Zheng told Cointelegraph that September, on common, has historically been the “worst with regards to equity return. So folks naturally are usually more cautious.”

Nonetheless, he also thinks the unfavorable trader sentiment is great non everlasting and a shift will count upon elements such because the User Fee Index, the Producer Fee Index, and how noteworthy of an affect US President Donald Trump’s tariffs possess.

In the past, Trump’s announced tariffs on a raft of worldwide locations possess dented crypto prices and resulted in extra losses when implemented.

Journal: Astrology might perchance well perchance extinguish you an even bigger crypto trader: It has been foretold