Germany’s essential-publicized Bitcoin seizure campaign has come below unique scrutiny after blockchain analysts published that with regards to $5 billion value of BTC has remained untouched. The discovering raises intrigue internal the crypto community, as questions swirl over whether the funds are lost, frozen, or simply being held in reserve.

Why The Money Live Untouched

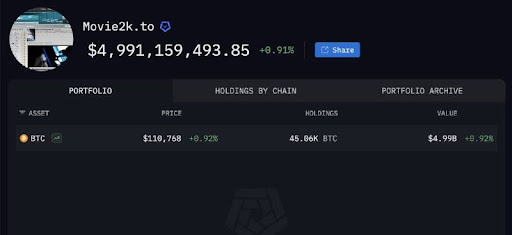

In an X submit, Elite KOL Crypto Patel, who is additionally related to CoinMarketCap and Binance, has highlighted that Germany’s Bitcoin crackdown has encountered a serious roadblock. Blockchain analytics firm Arkham has published a large trove of untouched BTC connected to the now-defunct Movie2K piracy effect, suggesting that German authorities’ seizure efforts could well well have hit a wall.

In accordance to the document, roughly forty five,000 BTC, valued at around $5 billion, has been sitting dormant across over 100 wallets since 2019. These coins are believed to quiet be below the tackle watch over of the positioning’s long-established operators.

Earlier in 2024, German authorities efficiently seized almost 50,000 BTC, which have been later liquidated for roughly $2.9 billion. Then again, despite that high-profile pass, this unique revelation highlights that a serious fragment of the Movie2K fortune is quiet out of attain.

Bitcoin continues to assemble critical mainstream adoption among prominent figures, institutions, and nations. Crypto professional Hashley Giles explained that Bitcoin is an preferrred steadiness sheet asset for a large different of profitable companies of all sizes and across all industries.

Within the UK, opening an e-money myth is a really easy diagram for companies to assemble BTC exposure without straining existing banking relationships. Accounting is additionally straightforward when companies focal point on amassing in preference to shopping and selling, taking away the complexity of fixed attach-to-market volatility.

Beyond ease of integration, Bitcoin provides unmatched liquidity. Companies can straight away convert BTC into pounds internal seconds at any time when industry efficiency requires it, and even on weekends when banks are closed.

In comparison with the ultra-low interest charges on industry bank deposit financial savings within the UK, those with a limited bit better yields on the general require 90-day or longer look classes before funds can be accessed. Bitcoin, on the just a few hand, has no look length, making it every versatile and efficient.

Striking forward Bitcoin’s Security Whereas Unlocking Liquidity

Bitcoin has lengthy been the most depended on digital asset. Then again, to fulfill its skill and in point of truth energy loyal economies, it requires a stable unit of myth. BSquaredNetwork emphasised that the lacking fragment is U2, a BTC-backed, USD-pegged stablecoin designed to attend Bitcoin’s safety whereas unlocking world liquidity.

BSquaredNetwork’s imaginative and prescient extends previous straightforward payments. With U2 as a stable unit of myth, BTC can change into into the settlement engine for fee, decentralized finance (DeFi), and even AI-to-AI microtransactions. This innovation bridges the outlet between BTC’s digital gold properties and its skill because the muse of the lustrous economy.