Hedera (HBAR) mark is exhibiting resilience even because the U.S. Securities and Alternate Price (SEC) delayed its resolution on Canary Capital’s proposed HBAR ETF to November 8.

No subject most fresh bearish strain, the altcoin managed to climb 4% as investor anticipation fueled shopping passion.

Hedera Has The Investors’ Beef up

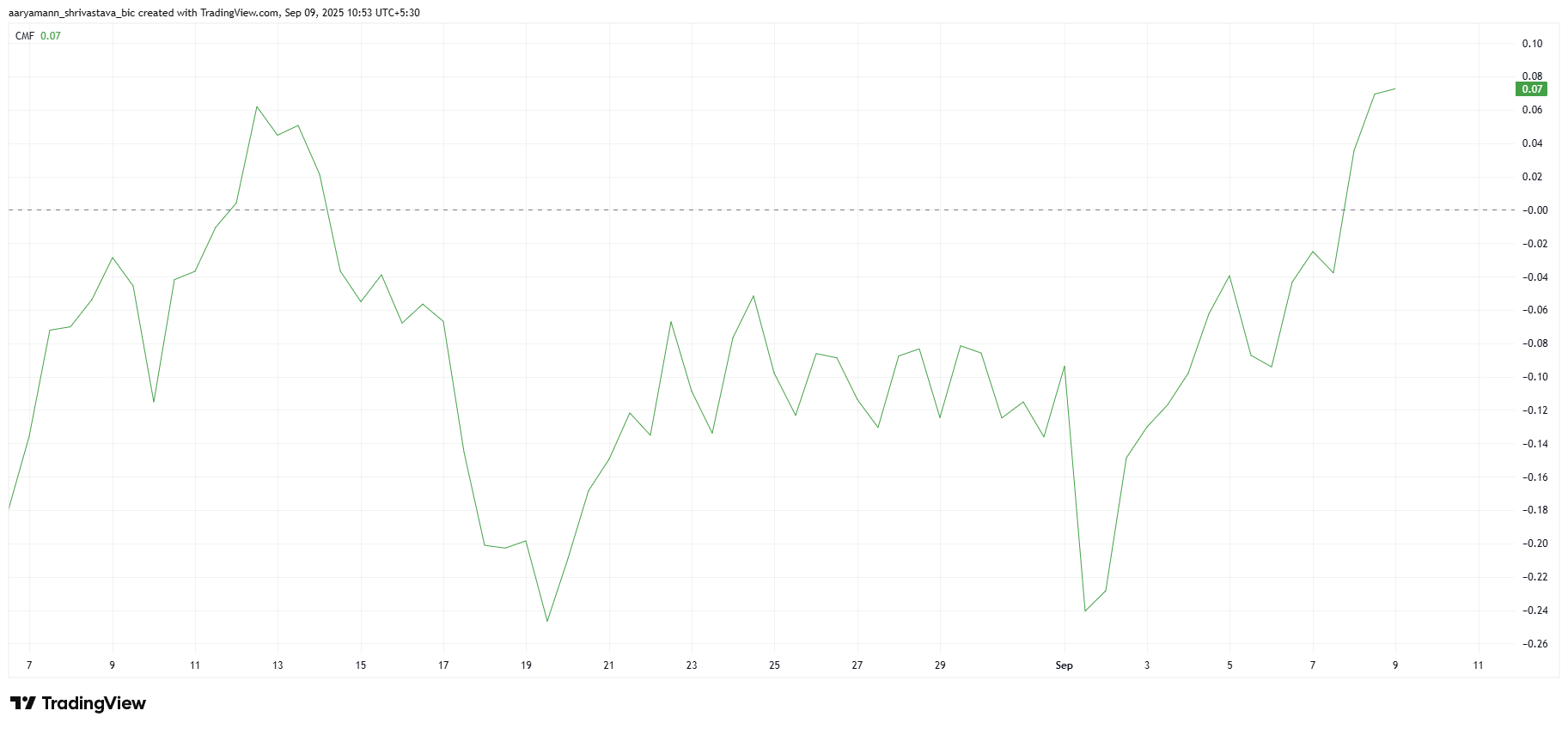

On the 12-hour chart, the Chaikin Cash Drift (CMF) highlights a nice looking uptick, signaling solid capital inflows into Hedera. This pattern implies that investors remain confident in HBAR’s skill, largely ignoring regulatory uncertainty surrounding the delayed ETF approval.

Investor conviction seems to be bolstering HBAR’s stability. Sustained inflows at some stage in uncertain cases suggest that holders accept as true with within the asset’s lengthy-interval of time development skill. This particular sentiment might possibly almost definitely well abet withhold mark energy, guaranteeing the token does no longer collapse below exterior market or regulatory pressures.

Desire extra token insights bask in this? Be a half of Editor Harsh Notariya’s Day-to-day Crypto Newsletter right here.

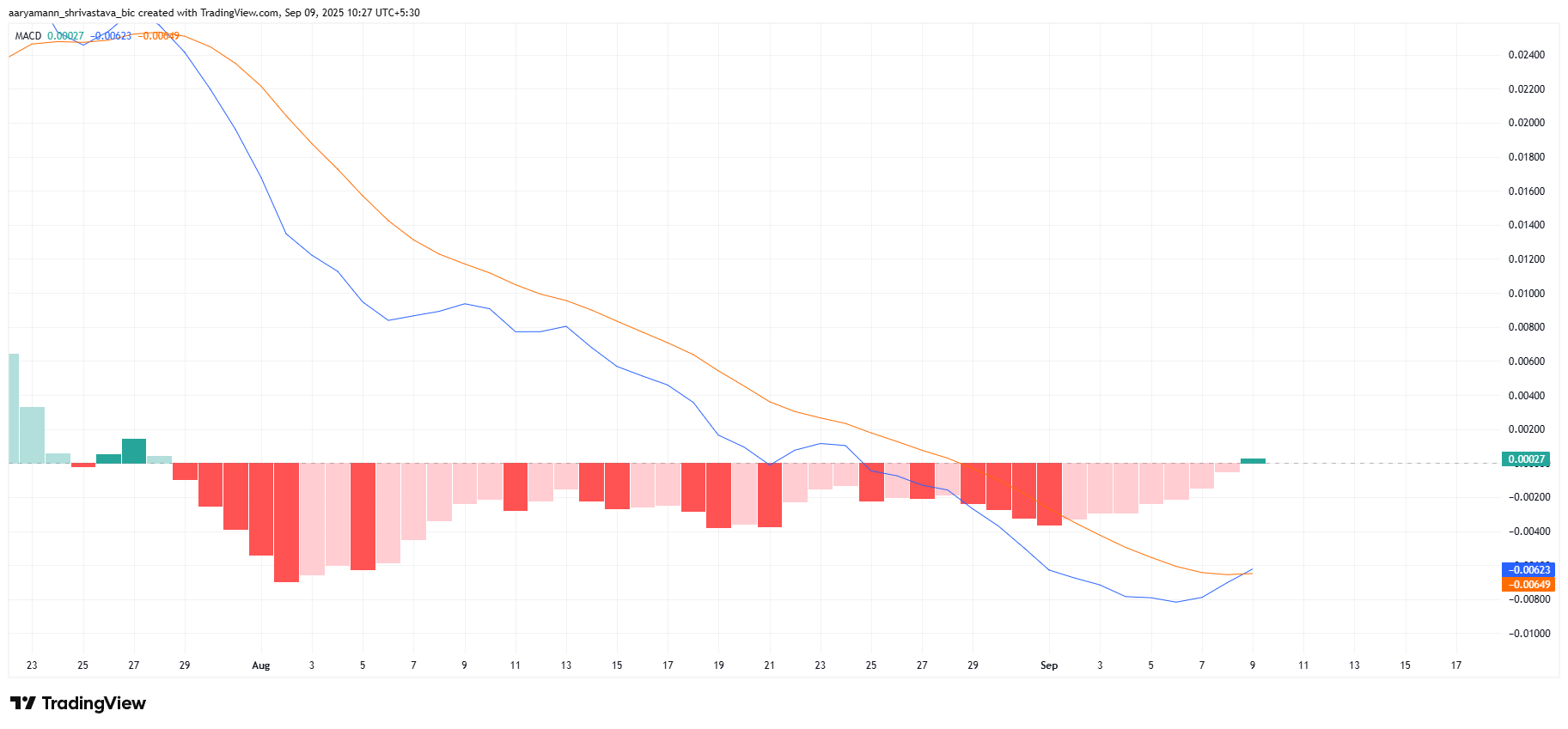

The Challenging Realistic Convergence Divergence (MACD) is flashing encouraging indicators, exhibiting its first bullish crossover in bigger than six weeks. This technical mark underlines renewed optimism for Hedera and suggests an emerging upward pattern backed by investor query.

Whereas the broader crypto market has remained cautiously bullish in most fresh sessions, HBAR stands out as it builds momentum independently of general sentiment. Beef up from dedicated holders continues to play a in reality crucial position, serving to the token withhold beneficial properties even within the face of delayed regulatory selections.

HBAR Mark Aims At Rallying

At the time of writing, HBAR trades at $0.227, up 3.5% over the excellent 24 hours. The altcoin is for the time being checking out resistance at $0.230, having rebounded from a solid increase unfriendly at $0.219.

If bullish momentum continues, HBAR might possibly almost definitely well fracture past $0.230, opening the door for a upward push toward $0.245 within the advance interval of time. Sustained shopping strain might possibly be critical in validating this transfer and strengthening investor sentiment extra.

On the shrink back, if momentum fades and sentiment shifts, a failure to breach $0.230 might possibly almost definitely well lead to a retracement. In this sort of tell, HBAR mark might possibly almost definitely well per chance slip support toward $0.219 or even take a look at lower increase ranges at $0.213, invalidating the bullish outlook.

The post HBAR Mark Rises No subject SEC Delaying Canary HBAR ETF Approval Yet As soon as more seemed first on BeInCrypto.