Bitcoin prolonged-time interval holders archaic between 5 to 7 years archaic ranking lost $6.4 billion in Realized Cap over the last 365 days, but selling isn’t in the help of the descend.

5 To 7 Years Ancient Bitcoin Holders Have Been Maturing To Even Older Bands

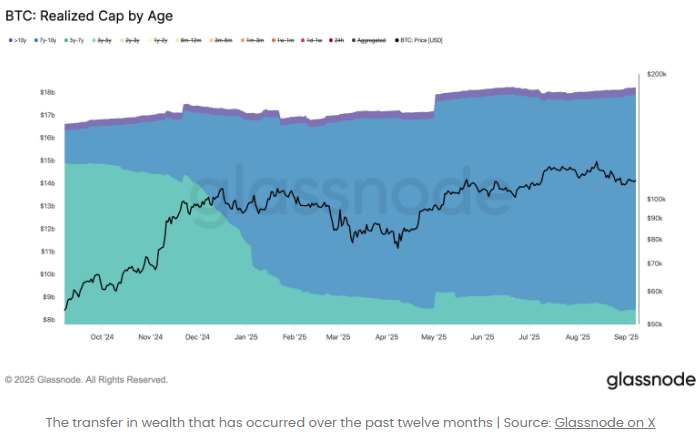

In a fresh put up on X, on-chain analytics company Glassnode has talked about how the Realized Cap linked to the 5 to 7 years archaic Bitcoin investors has modified over the last 365 days.

The “Realized Cap” here refers to an indicator that mainly measures the amount of capital that the investors of the cryptocurrency ranking keep into it. As such, changes in the metric correspond to the exit or entry of capital into the community.

Within the context of basically the most up-to-date subject, the Realized Cap of your entire market isn’t of interest, but quite that of about a particular investor segments. These are the holders with 5 to 7 years archaic, 7 to 10 years archaic and 10+ years archaic tokens.

Statistically, the longer an investor holds onto their cash, the less most likely they change into to promote them in due course, so these teams with their extraordinarily prolonged maintaining times would correspond to a number of basically the most resolute fingers in the sphere. What the habits of these investors is like, therefore, can even be one thing to understand for.

Under is a chart exhibiting the pattern in the Realized Cap for these Bitcoin teams.

As displayed in the above graph, the Realized Cap linked to the youngest of these teams, the addresses maintaining cash archaic between 5 and 7 years archaic, has considered a steep descend over the last 365 days. The metric began out the window at a stage of $14.9 billion, but this day, it stands at dazzling $8.5 billion, reflecting a decline of fair about 43%.

Investor teams labeled essentially based fully mostly on age lose Realized Cap after they damage their dormancy and take part in transactions. As an illustration, as rapidly as a holder portion of the 5 to 7 years archaic segment shifts their cash, the age of said tokens resets help to zero, and in addition they alongside with their Realized Cap share bag kicked out of the team.

There’s one extra scheme for the metric to decline for a cohort, however: upward promotion. This happens when an investor HODLs previous the upper sure of the team’s age fluctuate.

From the chart, it’s visible that the mixed Realized Cap linked to the 5 to 7 years, 7 to 10 years, and 10+ years segments has in actuality long gone up over the last 365 days, no subject the foremost of them noting a steep descend in its metric. Since capital can’t at once transfer to the latter two teams, it must ranking long gone during the archaic.

In other words, almost the total “selling” that the 5 to 7 years team has participated in has in actuality corresponded to diamond fingers maintaining trusty ample to coast on to a greater cohort.

As Glassnode has pointed out, though, this doesn’t mean that the cohort hasn’t participated in any real selling in any appreciate. “The 5–7y team restful spent ~385k $BTC in earnings over the 365 days, exhibiting that while most cash matured passively, some holders selectively disbursed,” notes the analytics company.

BTC Label

At the time of writing, Bitcoin is buying and selling round $112,400, up 3% over the last week.