The Winklevoss twins-hotfoot alternate is subsequent in line for a public debut on a stock index.

Coinbase and Bullish have already taken the leap, and have raised about a eyebrows. What’s subsequent for Gemini?

Court docket cases Underway

Shared by the use of an announcement, Gemini Put Station, Inc., the guardian company of the alternate, presented earlier this week that it has begun the initial public offering (IPO) project, with the provide of over 16.6 million shares of sophistication A typical stock.

This follows the registration assertion on the S-1 bear filed with the Securities and Alternate Fee within the United States. Alongside with the provide, Gemini and the shareholders who could be promoting their stock map to produce underwriters (a financial institution/professional that assesses and assumes the likelihood of a possible mortgage) with an option of purchasing extra shares for a duration of one month.

These amounts are 2,396,348 and 103,652 shares of sophistication A typical stock, respectively, which could be liable to veil over-allotments (an option allowing underwriters to promote as a lot as fifteen% more shares than before all the pieces planned). The IPO label for the stock is for the time being map at a unfold between $17 and $19, reckoning on the industrial local climate and diverse prerequisites.

Additionally, the announcement reads that there could be now now not a guarantee as to when and if the offering could be completed, or the actual size of it. Gemini has applied for a checklist on the NASDAQ index with the ticker “GEMI.” Leading bookrunners (underwriters) are financial giants Goldman Sachs, Citigroup, and Morgan Stanley.

Will We Search One other Stellar Performance?

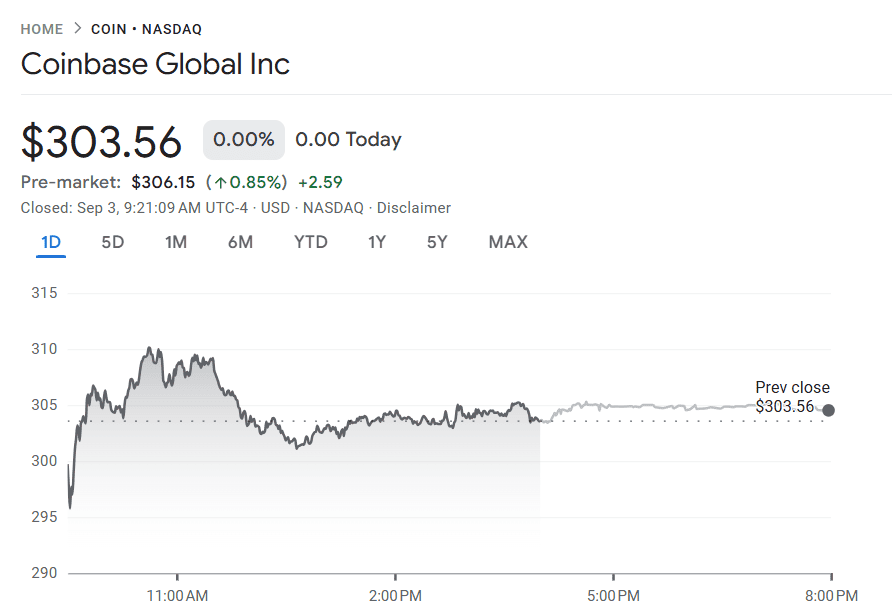

Recall Coinbase in 2021, which went straight for an rapid checklist on the NASDAQ, pretty than the identical old IPO. Old to the checklist, the reference label per fragment used to be $250, and at the tip of the principle shopping and selling day, it closed at $328.28, a 31% jump. Earlier this week, COIN traded at arond $303, which represents a minor decline in some unspecified time in the future of the final few years.

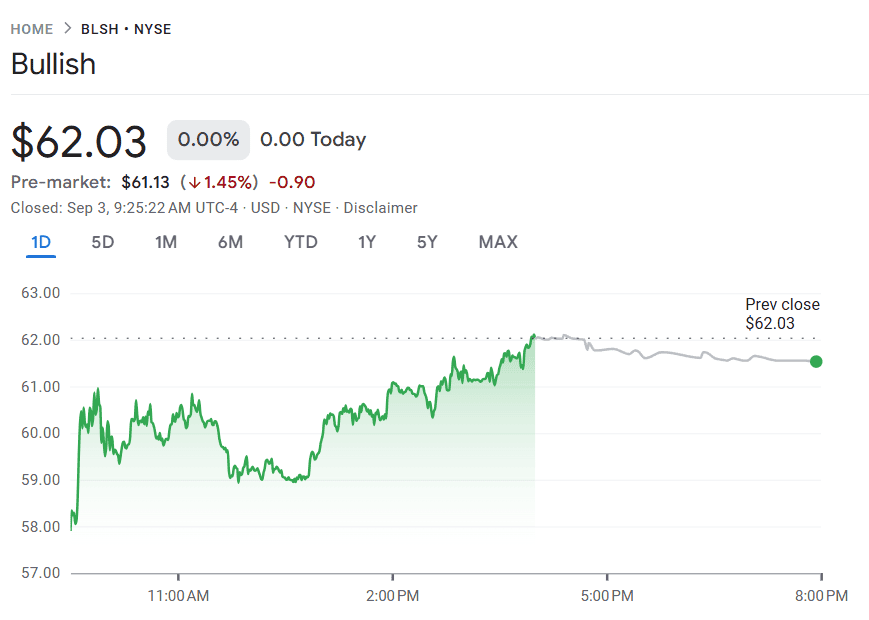

More recently, the Bullish alternate, which went live on the New York Stock Alternate (NYSE) final month, also noticed an spectacular debut after its IPO, which raised $1.1 billion, making its initial valuation $5.4B, with the fragment worth being $37.

Its first shopping and selling day went neatly, with the shares opening at $90 and reaching peaks of $118, representing will enhance of 143% and 218%, respectively, sooner than finishing the day at $68. At print time, the stock label is keeping steady at round $62.

Significantly, this IPO used to be entertaining in itself, as it used to be the principle ever to be fully settled in stablecoins.

“Getting your IPO proceeds in stablecoins is a baller jog. Plentiful moment for all of crypto. Soon this could occasionally be the sleek fashioned.” – Brian Armstrong, Coinbase CEO