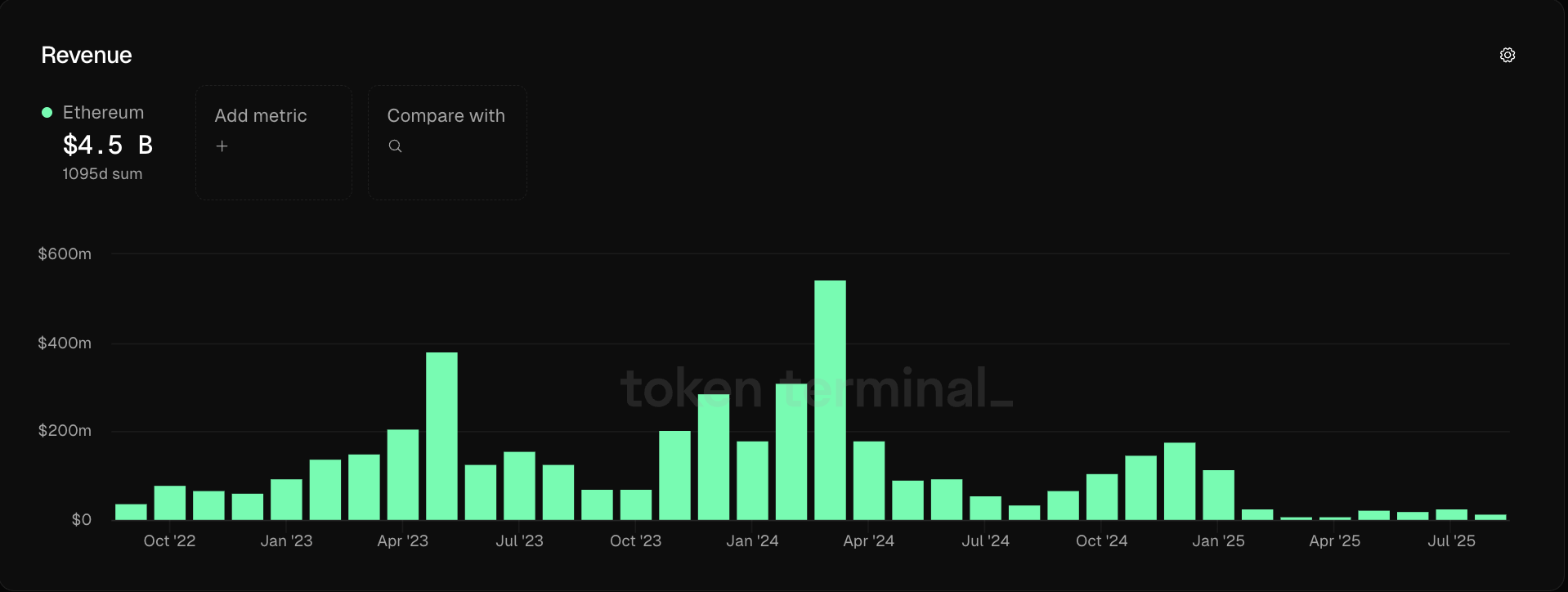

Ethereum earnings, the portion of community payments that accrue to Ether (ETH) holders as a outcomes of token burns, dropped by about 44% in August, even amid all-time high ETH prices.

Income for August totaled over $14.1 million, down from July’s $25.6 million, in step with Token Terminal. The drop befell amid ETH rallying by 240% since April and ETH hitting an all-time high of $4,957 on August 24.

Community payments also dropped by about 20% month-over-month, falling from about $49.6 million in July to about $39.7 million in August.

Monthly Ethereum community payments fell by an recount of magnitude following the Dencun upgrade in March 2024, which greatly diminished transaction payments for layer-2 scaling networks the usage of Ethereum as a unhealthy layer to post transactions.

The community’s dwindling payments and revenues have sparked debate about the viability of Ethereum, with critics asserting that the layer-1 neat contract platform has unsustainable fundamentals and proponents arguing that it is the backbone of the future financial machine.

Connected: Ether ETFs post straight week of outflows amid little mark dip

Ethereum courts institutional hobby in 2025

The Ethereum community has had an eventful 2025, as the community pitches the blockchain platform to Wall Avenue corporations and ETH public treasury firms emerge, driving up ETH prices to all-time highs.

Etherealize, an advocacy and public kinfolk company that markets the Ethereum community to publicly traded firms, launched that it executed a $40 million capital elevate in September.

Matt Hougan, the manager investment officer (CIO) at investment company Bitwise, instructed Cointelegraph that institutional and primitive financial investors are drawn to Ether’s yield-bearing aspects.

“When you rob $1 billion of ETH and you put it into a firm and you stake it, suddenly, you are producing earnings. And investors are in actuality extinct to firms that generate earnings,” Hougan acknowledged.

These corporations are exploring staking Ethereum — locking up their ETH tokens to stable the community — earning a yield for offering validation companies to the layer-1 blockchain neat contract platform.

Magazine: How Ethereum treasury firms might spark ‘DeFi Summer 2.0’