StablecoinX and TLGY Acquisition enjoy secured a further $530 million in financing to aquire digital property, bringing entire commitments to $890 million sooner than a deliberate merger and Nasdaq checklist.

The mixed company, to be renamed StablecoinX Inc., is build to set bigger than 3 billion ENA, the native token of the Ethena protocol. Per the corporate, this is in a position to perchance be the first devoted treasury industry for the Ethena ecosystem, which disorders the USDe and USDtb stablecoins.

The capital became once raised by a non-public investment in public fairness (PIPE) transaction, which permits public corporations to seize capital by selling discounted shares to institutional merchants.

Unusual merchants within the corporate consist of YZi Labs, Brevan Howard, Susquehanna Crypto, and IMC Trading, as properly as returning backers Dragonfly, ParaFi Capital, Maven11, Kingsway, Mirana and Haun Ventures.

The PIPE deal became once priced at $10 per share, with section of the proceeds allocated to discounted locked ENA bought from a foundation subsidiary.

“The further funding strengthens ecosystem resilience, deepens ENA liquidity, and supports the sustainable increase of USDe, USDtb, and future Ethena products,” Marc Piano, director on the Ethena Foundation, acknowledged in an announcement.

The announcement follows a July 21 disclosure that outlined TLGY and StablecoinX’s proposed merger, an preliminary $360 million PIPE financing, and a $260 million ENA buyback program.

Ethena stablecoin is setting data

Launched in early 2024 by Ethena Labs, the Ethena protocol disorders synthetic greenback stablecoins corresponding to USDe and USDtb, that are backed by a delta-neutral hedging mannequin rather than used reserves.

The mission is overseen by the Switzerland-basically basically based Ethena Foundation, which is accountable for governance and ecosystem pattern.

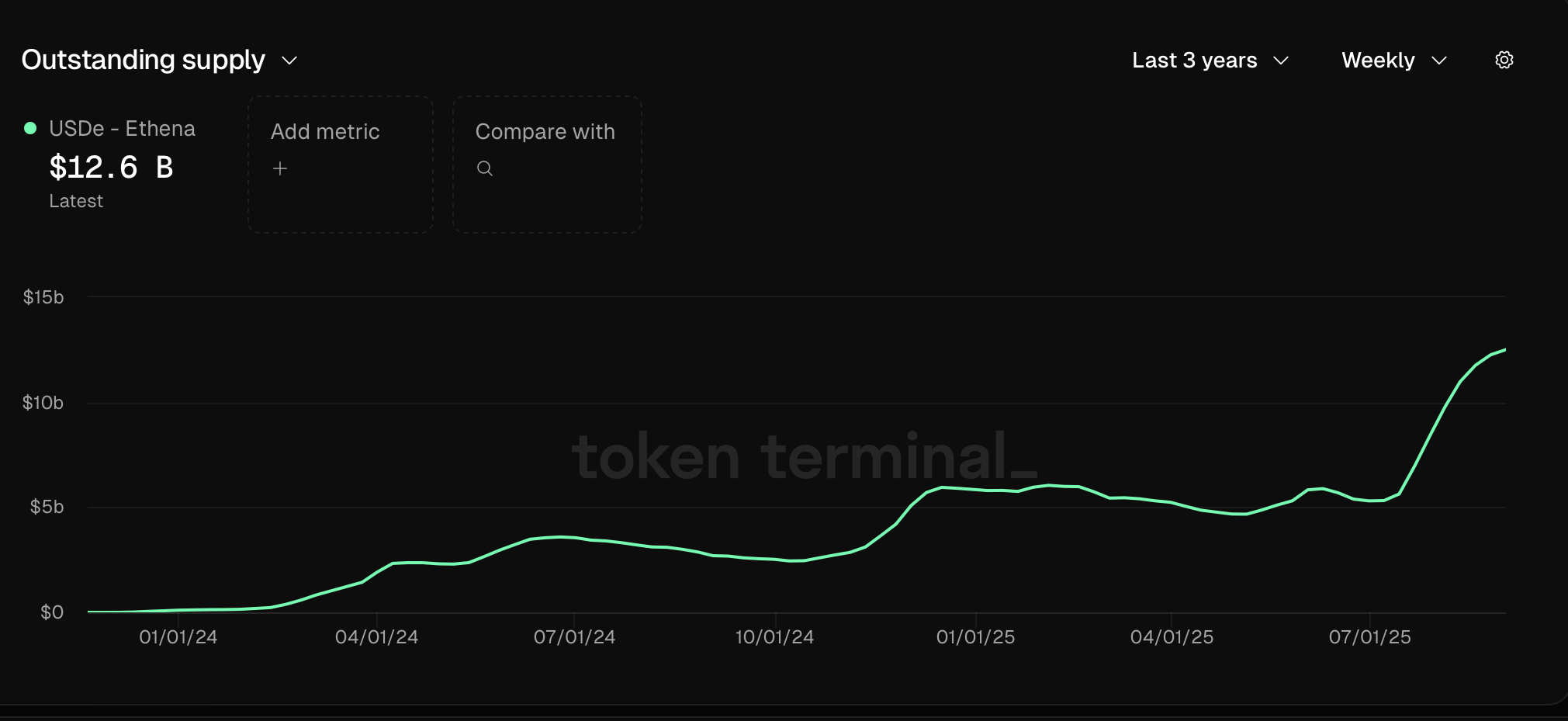

Per Binance Compare’s September document, USDe became the fastest stablecoin to surpass $10 billion in provide, reaching $12.6 billion as of September. The document well-known that the milestone came in below ten months, when in contrast with about 88 months for Tether’s USDT and 38 months for Circle’s USDC.

Token Terminal data presentations USDe provide has grown 31% within the past month, making Ethena the third-biggest stablecoin issuer within the support of Tether and Circle.

Ethena has moreover generated over $500 million in cumulative income as of August, not too long within the past exceeding $13 million in weekly protocol earnings.

Binance Compare attributed the originate bigger to elevated predict for USDe and returns from the mission’s hedging mannequin, which captures yield from crypto markets to set the stablecoin’s peg.

It moreover well-known that Ethena’s fiat-backed stablecoin, USDtb, is being developed with a pathway to compliance below the not too long within the past enacted US GENIUS Act, which US President Donald Trump signed into law on July 18.