TON is entering a stage of excessive expectations as two necessary catalysts emerge simultaneously: a $250 million buyback program and a digital asset treasury strategy tailor-made for the Telegram ecosystem.

Within the abet of this optimism, nonetheless, the market peaceful faces heavy “promote walls” and key resistance zones that will settle whether or no longer TON can surge 50% or dwell stuck in a narrow shopping and selling differ.

Institutional Push

Toncoin has drawn attention with a assortment of institutional-level strikes. The official announcement of TON Plan’s $250 million buyback program signals capital divulge expectations and proactive capital administration, whereas no longer all buyback programs back fabricate bigger token prices.

On the identical time, AlphaTON Capital no longer too long ago launched a digital asset treasury strategy focusing on the Telegram ecosystem. The firm is expected to in the beginning acquire around $100 million price of TON, creating a further institutional demand channel and expanding TON’s likely for storage and utility.

Beforehand, Verb Technology held over $780 million in TON property, marking a strategic shift toward Toncoin as its necessary reserve asset.

TON at a Severe Juncture

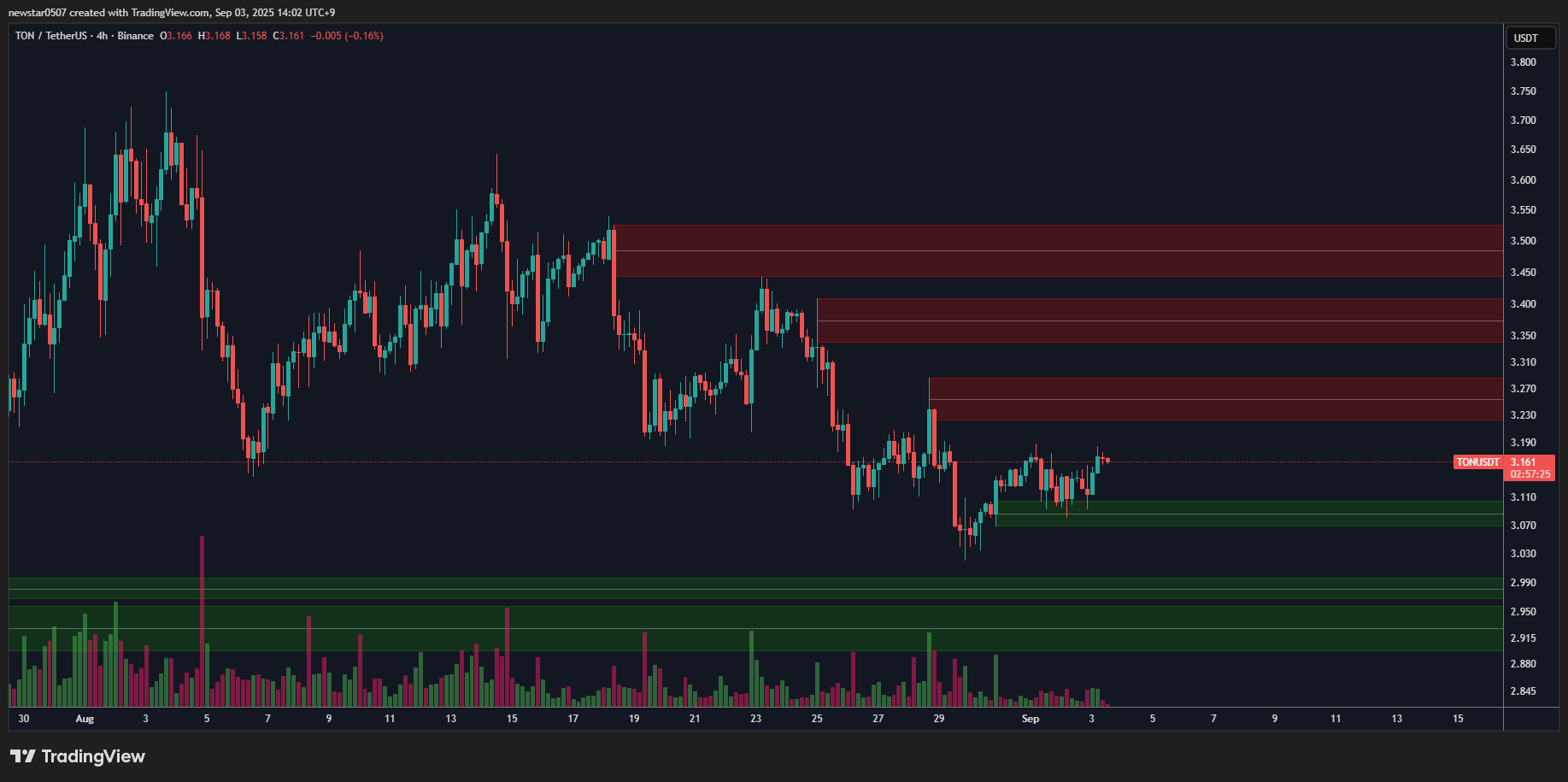

Within the marketplace aspect, Toncoin is shopping and selling at some stage within the $3.1–$3.4 differ, neatly underneath its most modern quick-timeframe high. On the entire, the emergence of treasury funds and buyback programs helps minimize circulating supply and give a rob to maintaining sentiment, which also can red meat up a likely rally if good shopping and selling volumes verify it.

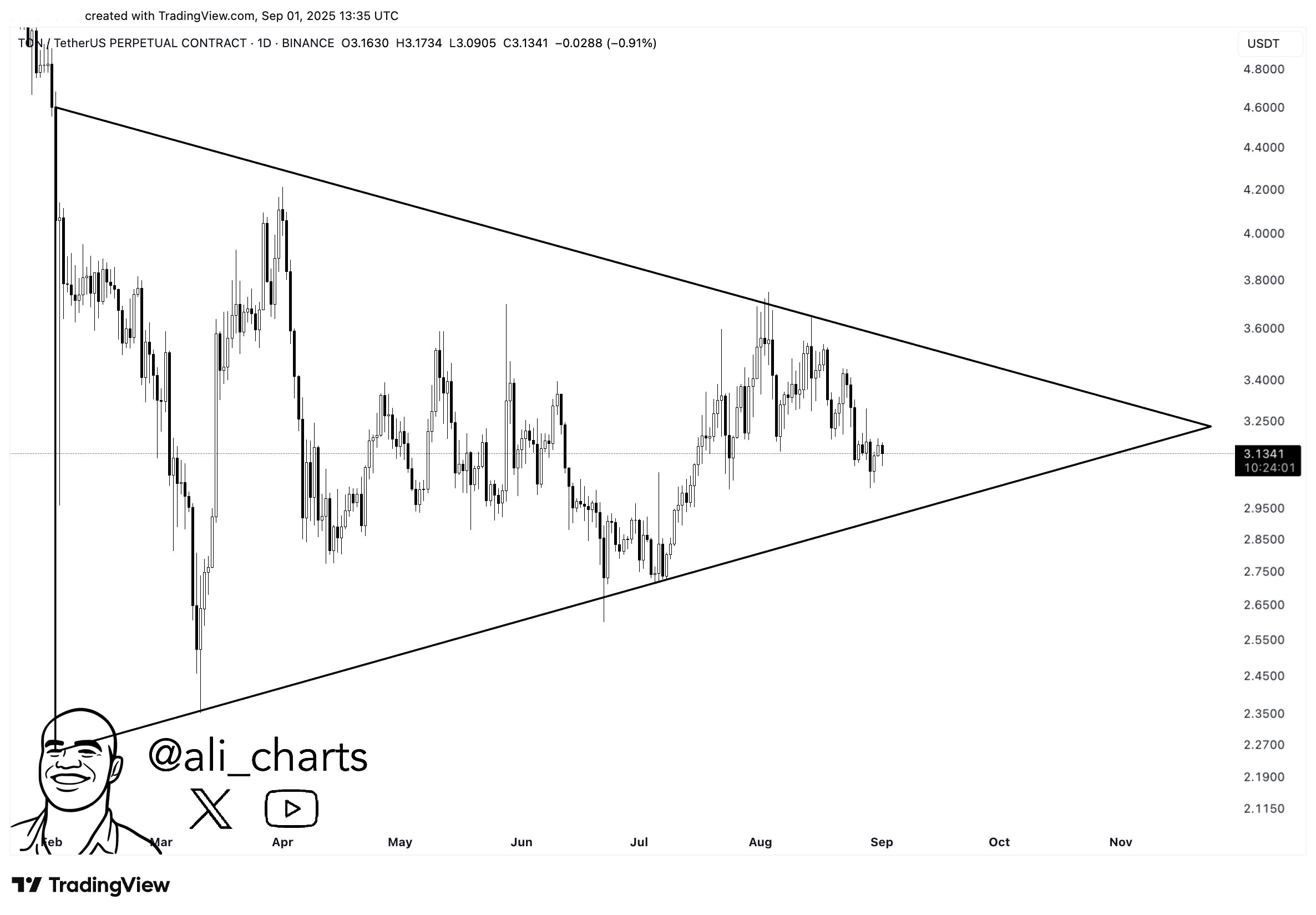

From a technical level of view, several analyses reward that TON consolidates within a triangle pattern, frequently a precursor to necessary imprint movements. Analyst Ali notes that if a decisive breakout occurs, the associated price also can swing as powerful as 50%.

On the opposite hand, in shorter timeframes, the market faces neatly-organized “promote walls.” Ahead of reaching $3.525, TON must atomize thru three more promote walls, which also can act as procedure-timeframe resistance to its upward momentum.

Within the quick timeframe, supply-demand dynamics are evident: TON has been often rejected at some stage within the $3.4–$3.Forty five zone, broadly considered as a real supply block. With out sufficient shopping stress, the associated price also can retest the $3.00–$3.27 stages sooner than picking its subsequent path. In a much less optimistic scenario, TON may per chance per chance well even retrace toward $2.68.

“Market constructing exhibits EQL formed, which frequently acts as liquidity magnets. A neat sweep here also can gasoline a pass abet up into the imbalance zone,” one X consumer neatly-known.

The post $250M TON Buyback Announced: Will It Damage Out? appeared first on BeInCrypto.