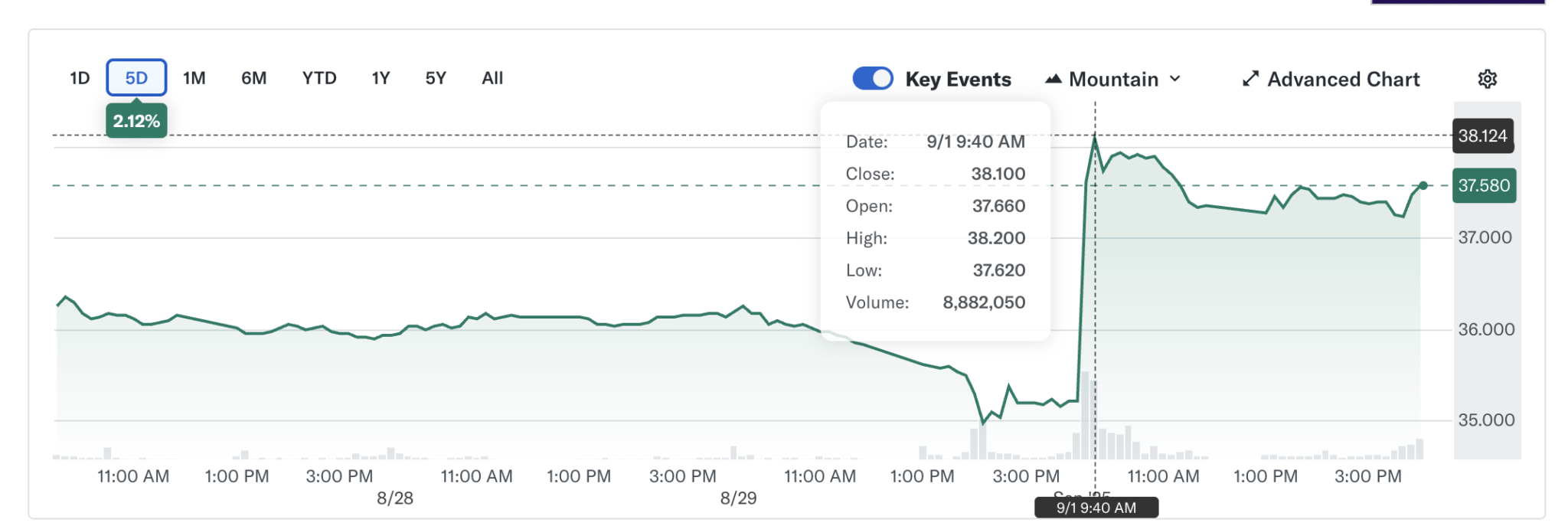

Bank of China’s Hong Kong-listed shares jumped 6.7% on Monday to shut at HKD 37.580, after native stories suggested the lender’s city unit is making ready to spend for a stablecoin issuer license. The transfer comes simply weeks after Hong Kong rolled out one of the notable realm’s first dedicated licensing frameworks for fiat-referenced stablecoins on August 1.

The grunt has fueled speculation that one of China’s most interesting issue-owned banks can also birth its stablecoin, doubtlessly increasing a industrial rival to Beijing’s centrally managed digital yuan.

Bank of China Strikes Against Stablecoin Utility

In line with the Hong Kong Financial Journal, the Bank of China (Hong Kong) has space up a dedicated job drive to explore stablecoin issuance and prepare utility materials. The bank did no longer respond to requests for commentary, but no longer too long ago instructed merchants it is miles researching digital asset functions and linked risk administration.

Market analysts insist Bank of China would be amongst basically the indispensable candidates, given the scale of its operations and the govt.s parallel rollout of the digital yuan. Some observers dangle an authorized Bank of China token can also present a regulated, internationally accessible counterpart to the central bank’s CBDC.

This news pushed BOC Hong Kong shares up 6.7% to shut at HKD 37.580. The stock has risen 50.62% yr-to-date, underscoring a stable upward pattern in investor self belief. The stock’s historical excessive remains HKD 40.850, recorded in April 2018, leaving simply HKD 3 unless a brand new high.

Hong Kong’s New Stablecoin Framework and World Growth

Hong Kong’s new ordinance requires any entity issuing stablecoins in town—or these linked to the Hong Kong buck abroad—to acquire approval from the Hong Kong Monetary Authority (HKMA). Licensed issuers must discover strict reserve administration strategies, segregate client funds, insist redemption at par, and discover disclosure, audit, and anti-money laundering requirements.

BREAKING

Bank of China (Hong Kong) surged over 7% on the modern time after asserting plans to spend for a stablecoin issuer license.

POWER OF #RWA

pic.twitter.com/FSN4gNDegB

— Accurate World Asset Watchlist (@RWAwatchlist_) September 1, 2025

The HKMA started accepting expressions of passion on August 1 and space September 30 because the utility deadline. Officers acknowledged greater than 40 companies, along with Typical Chartered, Circle, and Animoca Brands, bear already inquired. On August 8, Animoca confirmed a joint project with Typical Chartered Hong Kong and HKT to pursue town’s first license.

Chinese tech giants JD.com and Ant Neighborhood moreover launched plans to discover stablecoin licenses abroad. JD.com founder Richard Liu acknowledged in June that the corporate targets to gash execrable-border rate costs thru stablecoins, starting with industry-to-industry transfers sooner than rising to customers. Vincent Chok, CEO of Hong Kong-based First Digital, highlighted efficiency as a driver.

“Blockchain technology reduces settlement instances and bypasses the used middleman costs of banks. The chance is particularly pronounced in emerging markets the build stablecoins hedge against currency volatility.” He added that laws is accelerating adoption: “The brand new trajectory suggests exponential grunt in the next two to 5 years.”

Stablecoin Rally Drives Investor Hobby in Asia

Investor job in Hong Kong’s digital asset sector has surged alongside the new licensing regime. In July, listed companies raised about $1.5 billion for stablecoin and blockchain ventures. OSL—one of the notable city’s most interesting licensed digital asset platforms—secured $300 million thru a portion placement supported by sovereign wealth and hedge funds.

A sector index monitoring stablecoin-linked equities has obtained greater than 60% this yr, a ways before the Dangle Seng. Bank of China’s rally underscores stable appetite but highlights the volatility regulators many instances caution against.

Then again, in mid-August, Hong Kong’s SFC and HKMA warned that fascinating market swings tied to licensing rumors can also mislead merchants, urging vigilance.

Analysts cover that Hong Kong’s strict regime can also velocity up the upward thrust of non‑USD stablecoins in Asia, offering choices to the buck in regional alternate and settlement.

Japan is making ready to approve its first yen-pegged token later this yr, whereas China reportedly explores yuan-backed stablecoins to complement the digital yuan. In South Korea, financial authorities are moreover learning obtained-backed stablecoin initiatives.

At this stage, the HKMA has no longer issued any licenses. Merchants are instructed to test issuer credentials thru legit channels, as regulators place that rumors by myself will now not translate into approvals.

BREAKING

BREAKING  Bank of China (Hong Kong) surged over 7% on the modern time after asserting plans to spend for a stablecoin issuer license.

Bank of China (Hong Kong) surged over 7% on the modern time after asserting plans to spend for a stablecoin issuer license.  pic.twitter.com/FSN4gNDegB

pic.twitter.com/FSN4gNDegB