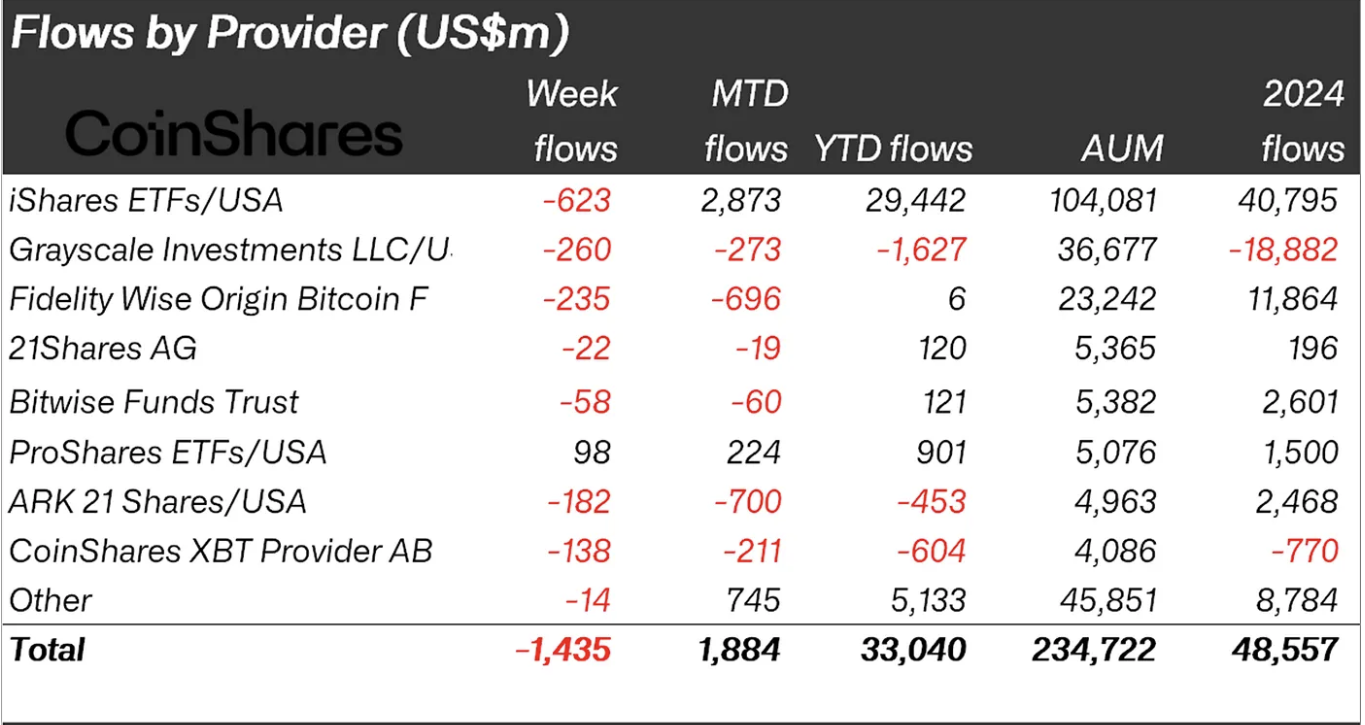

CoinShares released a story on weekly digital asset investment, analyzing the intense outflows all the very best scheme thru the crypto ETF market. In total, crypto investment merchandise saw $1.43 billion in outflows within the final week.

Diminished hopes of lowered ardour charges powered various this pessimism, however there’s been one thing of a comeback. Soundless, the scenario is volatile, and it’s unclear what’s going to happen subsequent.

Crypto ETF Outflows Final Week

Crypto ETF investment took the area by storm since early 2024, however a recent pattern of outflows has been making investors worried. Quickly after ETH ETF inflows surpassed Bitcoin, your entire asset category began posting heavy losses.

CoinShares released a story on this pronounce to better analyze it:

In truth, the story posits that bearish hopes for a US ardour rate decrease spurred these ETF outflows, and Jerome Powell’s surprising reconciliation efforts at some stage in his Jackson Hole speech blunted one of the necessary adversarial momentum. Nearer evaluation of every of the main funds and tokens offers truly helpful clues.

The Significance of Institutional Investors

As an illustration, Ethereum became once extra horny than Bitcoin to these swings, reflecting its space as a hot commodity amongst institutional investors.

All the very best scheme thru August 2025, ETH inflows exceeded BTC’s by $1.5 billion, a indubitably surprising turnaround. In other words, the unique investment narratives for Ethereum are having an accurate influence.

At conceal, it sounds as if institutional investors are the primary market mover here. Independent data from other ETF analysts helps this hypothesis:

WHO Owns the put Bitcoin ETFs??? I wrote about this final week however ‘Advisors’ are by far the very best holders now. Somewhat powerful every category we track on Bloomberg increased their Bitcoin ETF publicity over 2Q pic.twitter.com/piUlS73jAv

— James Seyffart (@JSeyff) August 25, 2025

CoinShares checked out all digital asset fund investments, no longer factual ETFs, so its outflow data has about a attention-grabbing tidbits.

As an illustration, XRP and Solana performed better than Bitcoin and Ethereum in this sector, however their associated ETFs haven’t gained approval.

In other words, digital asset treasury (DAT) investment could well well create up some of this total.

To make certain, though, this sector is also particularly at threat of macroeconomic components.

Despite broad DAT inflows this month, investor misgivings and stock dilution issues bear precipitated predominant complications for several fundamental firms. Even Strategy, a certain market leader, has confronted about a key warning indicators.

All that is to reveal, the present scenario is extremely volatile.

It’s complex to extrapolate this data to create a future prediction, however one component appears certain. Ethereum’s unique prominence is extremely seen, and it would bear broad implications for altcoins.

The post Institutional Investors Energy Crypto ETF Outflows as ETH Takes the Spotlight seemed first on BeInCrypto.