Key Insights:

- Solana label exchanged hands at $201 at press time, up 9% in 24 hours

- Network throughput reached bigger than 2,300 transactions per 2d

- Analysts tracked resistance conclude to $220 and longer-time interval ranges around $294.

Solana (SOL) label became once around $200 at press time. The token added 9% over the final 24 hours and about 7% prior to now week.

Monthly features stood at 8%. Amid the original rally, the network reached a file transaction tempo while traders assessed whether the token might perhaps take a look at the $200 level.

Solana Designate Rallies Sparking Optimism

The Solana label held above $200 at press time after loads of classes of downward pressure. Analysts said declaring this vary signaled continued demand despite broader market uncertainty.

The trend of the chart showed an inverse head-and-shoulders sample on the 12-hour timeframe. This formation is on the general seen as a doable reversal signal when increase is maintained. The new unpleasant of around $180 created a zone for patrons to defend.

Analysts great that if the Solana label changed into $200 into increase, the token might perhaps take a look at bigger resistance ranges conclude to $210 and presumably $220. A switch by these zones would leave $294, the prior all-time high, because the following indispensable technical target.

Momentum indicators pointed to larger lows, which urged patrons comprise been up to tempo. The sample of bigger lows and a defended vary underlined the optimistic setup for the token.

Solana Designate Supported by Network Teach

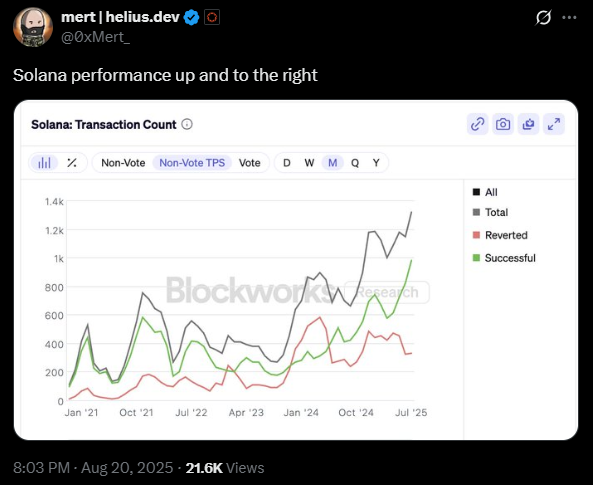

Amid Solana label rally, on-chain recordsdata showed fixed development in SOL network project. Transaction counts rose progressively over the final loads of years.

Market participants said the fabricate larger demonstrated that the network became once seeing extra unswerving-world usage.

Mert from Helius, a Solana trend firm, reported that successful transactions continued to upward thrust “up and to the gorgeous.”

While reverted transactions happened, successful ones a long way outnumbered them. Analysts said this pointed to enhancements in network efficiency because the ecosystem matured.

These developments added weight to the technical convey. Rising on-chain usage basically offered a stronger classic unpleasant for a token’s label.

Market observers said the development signaled that Solana’s network became once being adopted for applications requiring high tempo and scalability.

On the same time, analysts highlighted the importance of throughput in supporting Solana label. Network demand basically influenced market self belief by demonstrating the blockchain’s skill to job gargantuan volumes of project without breakdowns.

Transaction Milestone Added to 2025 Outlook

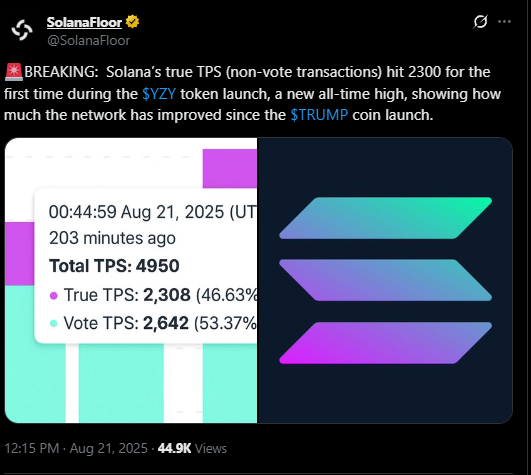

Solana region a original throughput file as its unswerving transactions per 2d crossed 2,300. Knowledge from SolanaFloor showed the extent had not been reached forward of. The fabricate larger came after earlier classes when transaction speeds comprise been extra minute.

Analysts said the milestone urged the network might perhaps sort out heavier workloads for the interval of classes of sturdy demand. They great that reliable throughput became once very significant for declaring investor self belief.

Chart watchers also pointed to Solana label vary highs conclude to $294 because the upper boundary of SOL’s new construction. The vary prolonged from increase conclude to $200 to the $294 ceiling.

Crypto King, a technical analyst, said the chart showed bigger lows and a bounce from uptrend increase. These indicators aligned with a veteran bullish continuation sample.

Heading into the final quarter of 2025, Solana label mixed resilient technical ranges with stronger network recordsdata.

Present ranges are around $200, left $220 because the following conclude to-time interval take a look at. Longer-time interval resistance remained defined at $294.

Analysts said the combo of defended increase, bigger lows, and stronger throughput left Solana label in put aside for extra features if momentum continued.

The broader route would quiet depend upon market liquidity stipulations, nonetheless the technical setup favored the risk of one other switch bigger in 2025.