The price of the Aave (AAVE) token tumbled by over 8% on Saturday, following rumors that the decentralized finance (DeFi) protocol would receive a assorted token allocation from World Liberty Financial (WLFI), a DeFi platform backed by participants of US president Donald Trump’s household.

“The WLFI team told WuBlockchain that the claim that ‘Aave will receive 7% of the whole WLFI token offer’ is fraudulent and groundless recordsdata,” blockchain reporter Colin Wu talked about, sparking a debate relating to the rumor and the token affiliation on social media.

Wu became once referencing a WLFI neighborhood proposal from October 2024, outlining an affiliation in which the Aave decentralized self reliant group (DAO), liable for governing the protocol, would receive 7% of the WLFI governance token’s circulating offer and 20% of protocol revenues generated by the WLFI deployment on Aave v3.

Aave founder Stani Kulechov called the proposal “the art of the deal” on Saturday, and, in a separate post, signaled the phrases of the proposal were soundless valid. Following the rumors, Aave’s token fell from about $385 to a low of $339 sooner than rebounding to about $352.

Cointelegraph reached out to World Liberty Financial and Aave spokespeople but failed to receive a response by the time of e-newsletter.

Rumors relating to the affiliation between Aave and World Liberty attain amid a renewed curiosity in DeFi and growing institutional involvement in the crypto niche.

Related: $70B DeFi protocol Aave goes stay on Aptos in ecosystem growth

DeFi sector is on the upward thrust as institutions rob stare

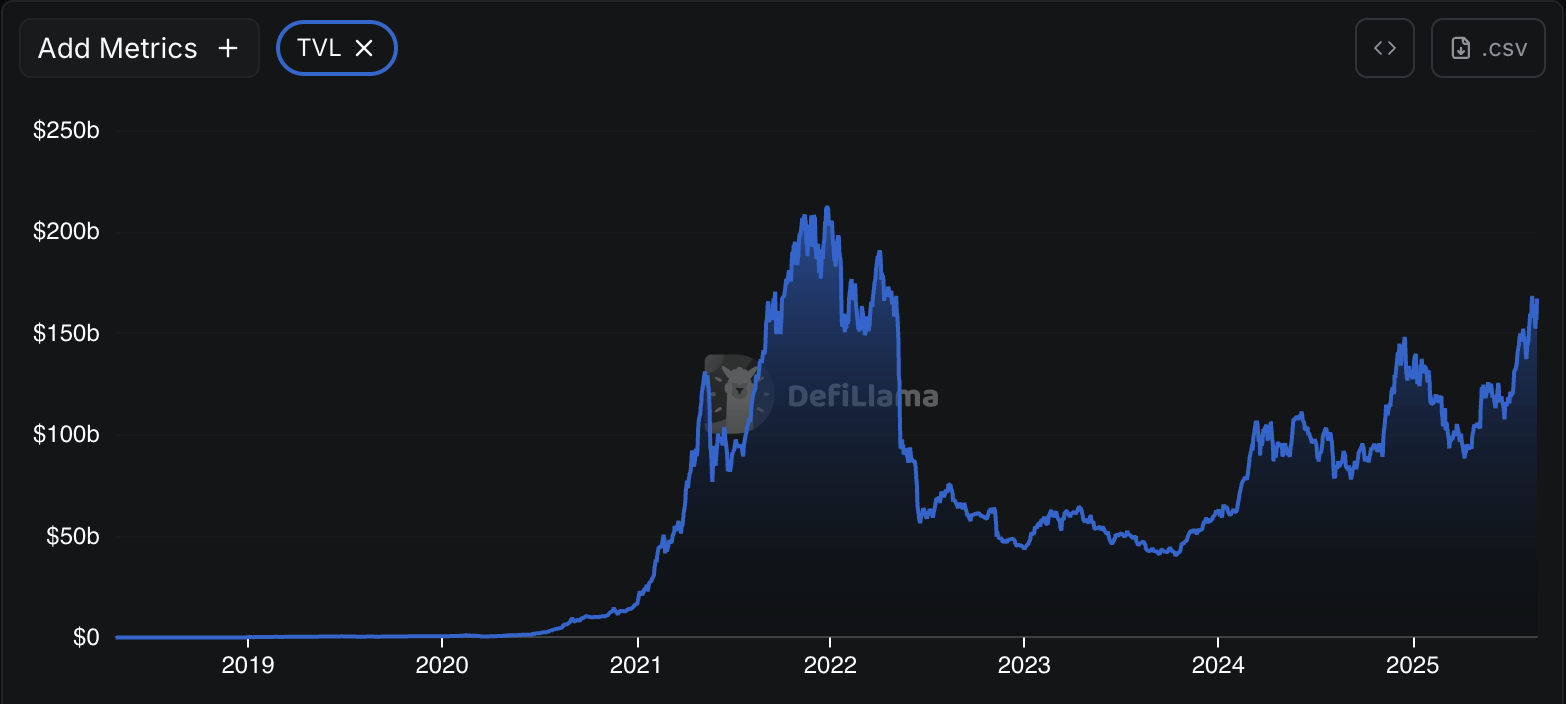

The total mark locked (TVL) in DeFi protocols is on the 2d over $167 billion, in accordance with DeFiLlama, and is drawing shut the all-time high of over $212 billion from December 2021.

DeFi TVL rose sharply following the outcomes of the 2024 US elections in anticipation of a friendlier regulatory native weather for cryptocurrencies in the nation.

Institutional traders, including banks, asset managers, companies, and monetary services companies, became increasingly infected about crypto and DeFi, shaping moderately loads of the narratives all over the latest market cycle.

This involvement has fueled a debate among the many crypto neighborhood about encroaching executive guidelines on permissionless protocols and the functionality capture of DeFi by former monetary institutions.

Journal: How Ethereum treasury companies may perchance perchance well spark ‘DeFi Summer season 2.0’