The crypto market has slipped genuine into a corrective segment, down from its $4.08 trillion height on August 15 to about $3.89 trillion nowadays. That’s a 4.6% pullback in lower than per week, leaving most classes below rigidity. Natty contract platforms and DeFi tokens have led the retreat. No topic this uneven backdrop, a handful of projects nonetheless stand out as altcoins to are looking ahead to this weekend.

Now we have handpicked three coins/tokens which can possibly also very neatly be exhibiting solid bullish setups. One coin is even seeing decent demand from whales.

Zcash (ZEC)

Zcash, known for its privacy-centered protocol, is exhibiting signs of renewed energy after weeks of sideways trading. It is already up 9% day-on-day.

On the 12-hour chart, the ZEC tag is urgent in opposition to the resistance at $43.forty eight.

What makes this mosey principal is the rising alignment of momentum indicators: the 20-day EMA or Exponential Transferring Moderate (crimson line) is on the verge of crossing above the 50-day EMA (orange line). This bullish shift recurrently precedes sharp rallies.

A bullish EMA crossover occurs when a shorter-term EMA (adore the 20-day) moves above a longer-term EMA (adore the 50-day). It suggests that traders are gaining energy and the style could possibly also honest be turning upward.

On the identical time, the Bull Endure Vitality indicator has grew to turn into aggressively in desire of bulls, backing the weekend-centric bullish momentum.

The Bull Endure Vitality reveals the tug-of-battle between traders (bulls) and sellers (bears). When it is miles positive, bulls are stronger; when it is miles adversarial, sellers are urgent harder.

If the setup holds, ZEC could possibly extend its rally against $forty five.99 and $47.12. On the other hand, a entire candle shut above $43.forty eight is required for that. The threat, on the opposite hand, lies in shedding the $39.60 atrocious, which would neutralize the bullish crossover account and residing the token help into consolidation.

For token TA and market updates: Desire extra token insights adore this? Signal up for Editor Harsh Notariya’s Day-to-day Crypto Newsletter here.

Chainlink (LINK)

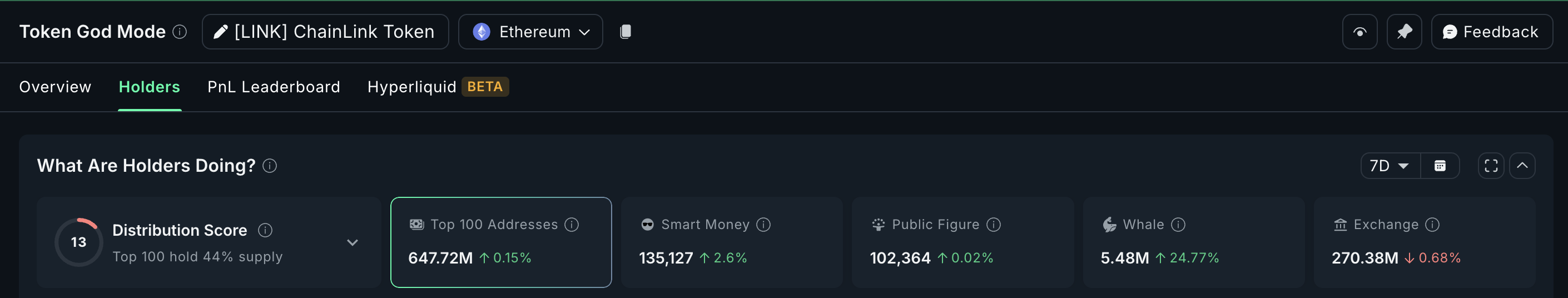

Chainlink continues to present a boost to its repute because the main oracle project, and up to the moment on-chain task has added gas to the account.

In precisely the past week, whales have accumulated 1.09 million LINK, a 24.77% magnify in holdings, now price practically $27 million at fresh costs. Such concentrated shopping for from sizable holders customarily ever goes no longer neatly-known, and it recurrently creates a floor below the market whereas hinting at self belief in the project’s outlook.

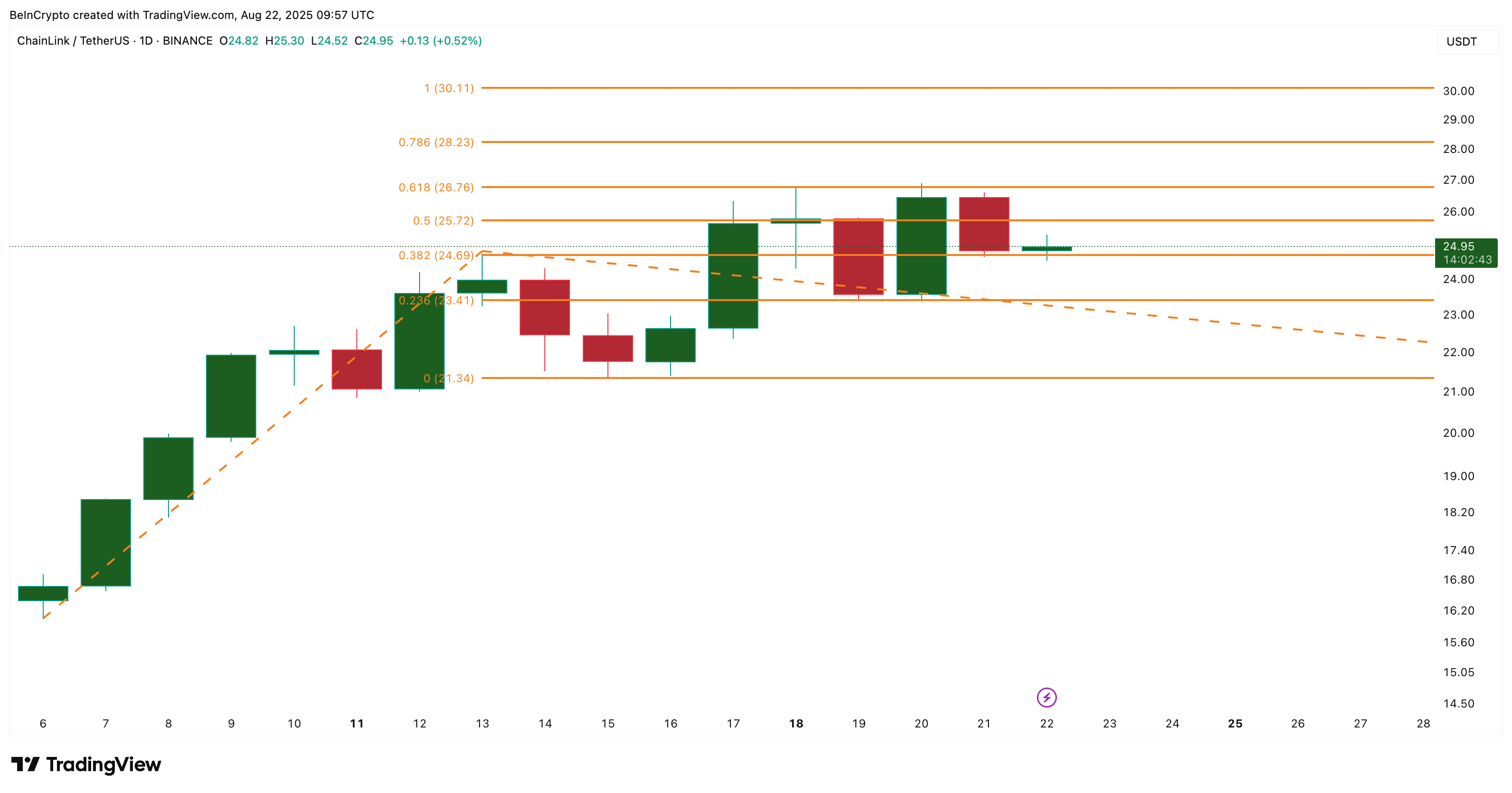

Technically, LINK has been consolidating around $24.95, sitting correct between the Fibonacci retracement zones of $24.69 (0.382) and $25.72 (0.5).

A successful breakout above $26.76 (0.618) could possibly propel the token against $28.23 and at closing the psychological $30.00 stage.

Importantly, the sizzling dip has equipped unusual entry zones correct as whale demand has elevated, underscoring why Chainlink remains a top opt in any checklist of altcoins to are looking ahead to. A sustained breakdown below $21.34, on the opposite hand, would invalidate the bullish setup.

Toncoin (TON)

Toncoin has been regularly gaining market consideration, both technically and basically. On the charts, TON trades shut to $3.28, resting inner per week-long ascending channel. The cost is consolidating correct below the resistance at $3.35, and a breakout here could possibly traipse moves against $3.51 and $3.70.

Including weight to the bullish case is a hidden divergence: whereas the RSI (Relative Energy Index) has made a lower low, the tag itself has printed a more in-depth low; a conventional signal of underlying buyer energy and a likely reversal forward.

The RSI tracks shopping for and promoting momentum on a scale of 0 to 100. A divergence occurs when tag and RSI mosey in reverse instructions. As an illustration, in a hidden bullish divergence, the tag makes a more in-depth low whereas the RSI makes a lower low. This recurrently signals that shopping for rigidity is quietly constructing even supposing the chart looks frail.

Fundamentals provide noteworthy extra pork up. Verb Skills’s $780 million treasury approach backing TON has boosted investor self belief, whereas Ledger Reside’s integration of native TON staking has opened secure, non-custodial staking secure genuine of entry to to hundreds and hundreds of users.

Together, these elements residing TON as one of many strongest altcoins to are looking ahead to this weekend. Nonetheless, invalidation rests below $3.18, and a deeper slip below $3.09 would shift the bias to neutral.

The put up 3 Altcoins To Look This Weekend | August 23 – 24 looked first on BeInCrypto.