Economist Henrik Zeberg believes Bitcoin (BTC) is primed for a broad rally sooner than the cycle involves a discontinuance.

In a brand new scheme session on the analytics platform Swissblock’s YouTube channel, Zeberg says Bitcoin will hit a “new impolite all-time high” as a mode of possibility resources, in conjunction with stocks, upward push loyal into a “doable blow-off top.”

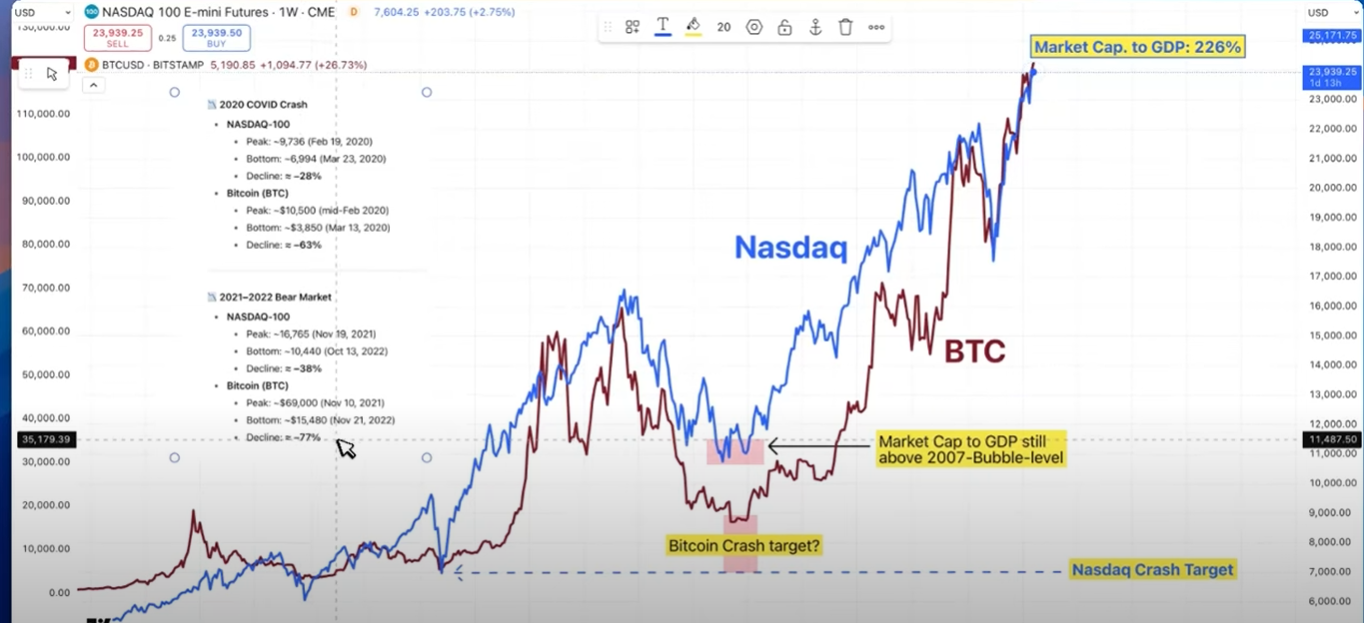

In keeping with Zeberg, Bitcoin will then decline critically after the blow-off top. The economist shares an inverse chart of Bitcoin to mission his downside aim for the crypto king.

“We’re in the finest bubble ever. No query about that… What would I request Bitcoin to manufacture if we glimpse 75% to 80% decline in the NASDAQ? Neatly, I will no longer to start with judge that Bitcoin would outperform or fabricate neatly in that fracture. I judge it would possibly possibly well possibly presumably presumably well outperform to the downside, which plot that it also can drop by better than 75 to 80%…

If the NASDAQ drops by 75 to 85%, we are able to also easily glimpse a [Bitcoin] decline of 90% or 95% into the fracture. That is what I judge can occur with Bitcoin. A seemingly decline of spherical 95%, presumably worse into the bubble top or after the bubble top.”

The economist says this kind of drastic decline in the cost of Bitcoin would possibly possibly presumably presumably well be in step with historical precedent and the crypto king’s correlation to the stock market.

“And if we then turn to the NASDAQ and Bitcoin, thanks to the discontinuance correlation, we glimpse that Bitcoin outperforms NASDAQ, no longer honest to the upside however also to the downside.

In 2020, we saw NASDAQ declining by 28% at some stage in COVID fracture, and we saw Bitcoin dropping by 63%.

NASDAQ in 2021 to 2022 dropped by 38%, Bitcoin by 77%.”

At time of writing, Bitcoin is price $112,799.