Asia’s wealthiest households and family offices personal vastly increased crypto publicity, taking attend of bettering guidelines and strong returns.

These high-get-price traders now witness digital property as integral to a most modern diversified portfolio.

Wealth Managers File Rising Crypto Allocation

Wealth managers at some stage in indispensable Asian markets relate surging ardour. UBS signifies some in a foreign country Chinese language family offices realizing to develop crypto holdings to roughly 5 percent of their portfolios. Reuters reported that institutions that on the beginning examined bitcoin ETFs are now embracing insist token publicity.

One catalyst is the performance of a crypto equity fund. Jason Huang, founder of NextGen Digital Enterprise, acknowledged:

“We raised over $100 million in precisely about a months, and the response from LPs has been encouraging.”

That fund performed a 375 percent return in below two years. Market-objective suggestions reminiscent of arbitrage also entice sophisticated traders in quest of low-correlation returns.

Regulatory Readability Drives Self assurance

Regulation plays a severe position. Hong Kong passed guidelines masking stablecoins, whereas US policymakers superior the GENIUS Act, extra legitimizing digital property. These inclinations are encouraging prosperous households to prolong their crypto holdings, based on Reuters.

BeInCrypto reported that Asia’s Web3 guidelines complement world frameworks, guaranteeing compliance whereas supporting innovation. This alignment reduces boundaries for traders in quest of publicity to tokenized merchandise and custody providers and products.

Hong Kong and Singapore reside regional hubs. Authorities now toughen bond tokenization, digital gold platforms, and custody frameworks.

Modern reforms consist of streamlined licensing and tax concerns designed to entice family offices and fund managers, based on the Financial Instances reported.

Bitcoin’s surge above $124,000 coincided with relate on each day basis volumes at HashKey Exchange and indispensable South Korean exchanges, signaling sturdy interrogate at some stage in Asia.

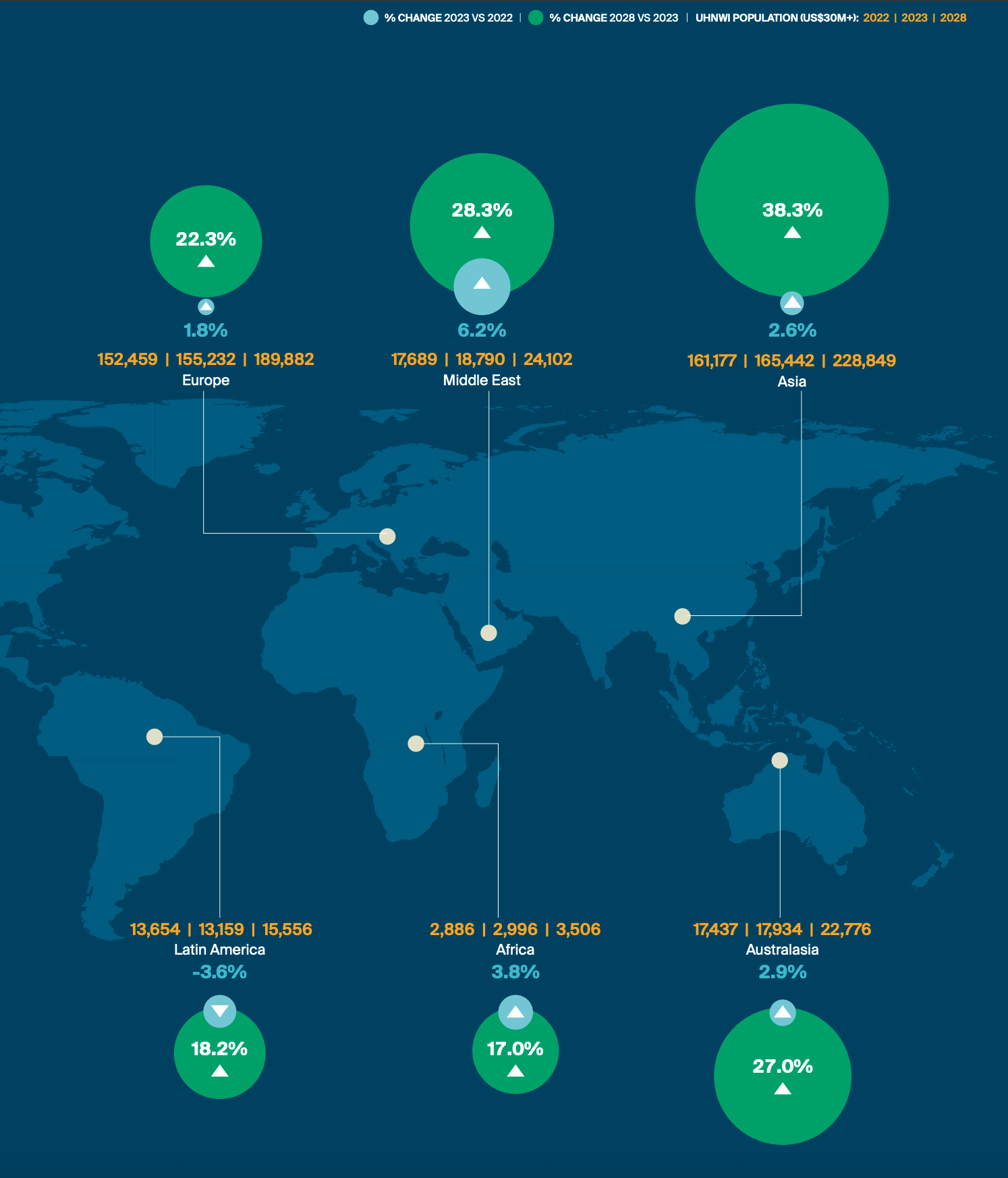

Wealth Sizing Mannequin | Knight Frank

Global wealth trends make stronger this shift. Knight Frank’s Wealth File highlighted that Asia-Pacific now leads in extremely-high-get-price relate, organising stronger interrogate for diversified digital funding autos.

Strategic Implications for Family Locations of work

Shifts in funding approach highlight plenty of trends:

- Capital waft security: Regulatory clarity lowers entry dangers, making long-term publicity more comely.

- Product innovation: Varied crypto instruments allure to each and each veteran households and new traders.

- Regional attend: Singapore and Hong Kong’s frameworks make stronger Asia’s leadership in digital wealth.

These strikes coincide with rising allocations into tokenized merchandise and custody providers and products, building a sustainable ecosystem for institutional-grade crypto funding.

Many family offices personal shifted from ETFs to insist token ownership. This exchange reflects a necessity for flexibility, liquidity, and withhold watch over over holdings as crypto markets former.

Readability on taxation, licensing, and custody requirements is fostering increased have confidence in digital property. Regional frameworks provide the infrastructure for long-term adoption, whereas family offices leverage their location to capture relate in tokenized wealth.

The put up Asia’s Effectively off Families Enhance Crypto Exposure Amid Favorable Regulation looked first on BeInCrypto.