On July 18, President Donald Trump signed the GENIUS Act into legislation, establishing the foremost comprehensive federal framework to administer stablecoins within the united states, and bringing lengthy-awaited readability to the rising marketplace for U.S. buck-pegged tokens.

Since then, the marketplace for stablecoins globally has confirmed a level of resilience and growth that even basically the most skeptical observers can’t simply push aside, no longer no longer up to for now.

Proper weeks after being signed into legislation, the regulatory readability around how stablecoins might presumably well presumably comprise to be backed, audited, and supervised seemed as if it would aloof mountainous institutions and day after day traders, pushing the stablecoin market cap up an additional $18 billion, from about $260 billion on July 18 to over $278 billion by Aug. 21, a almost 7% soar in factual over a month, per records from DefiLlama.

Prolonged-Awaited Clarity

The GENIUS Act, shepherded via Congress by Senator Bill Hagerty (R-Tenn.) and handed with rare bipartisan consensus, mandates that every person so-called payment stablecoins be backed one-to-one by low-probability resources — particularly money or U.S. Treasury bills — field to monthly attestations by a Broad Four auditor and ongoing Bank Secrecy Act obligations.

It additionally creates a tiered oversight regime: issuers below $10 billion in market capitalization might presumably well presumably additionally unprejudiced characteristic below divulge supervision, but crossing that threshold triggers a crucial shift to federal regulators, or a transient end in contemporary coin issuance unless the cap recedes below the restrict.

Provide Surge Led by Yield-Bearing Tokens

When put next with the broader crypto market capitalization, which sits factual below $4 trillion as of this day, stablecoins comprise carved out a ceaselessly rising niche, now accounting for roughly 6.8% of the whole crypto market.

Since the stablecoin legislation was signed into legislation on July 18, whole stablecoin provide globally climbed by nearly 7% — a marked acceleration in contrast with the 1% monthly drift noticed within the foremost half of of 2025.

Tether’s USDT — by a long way the very finest stablecoin by market cap — alone has added over $7 billion to its circulating provide, keeping its extra than 60% market dominance, and boasting a market cap of over $167 billion as of Aug. 21 — a 4.3% lengthen since GENIUS was legislation.

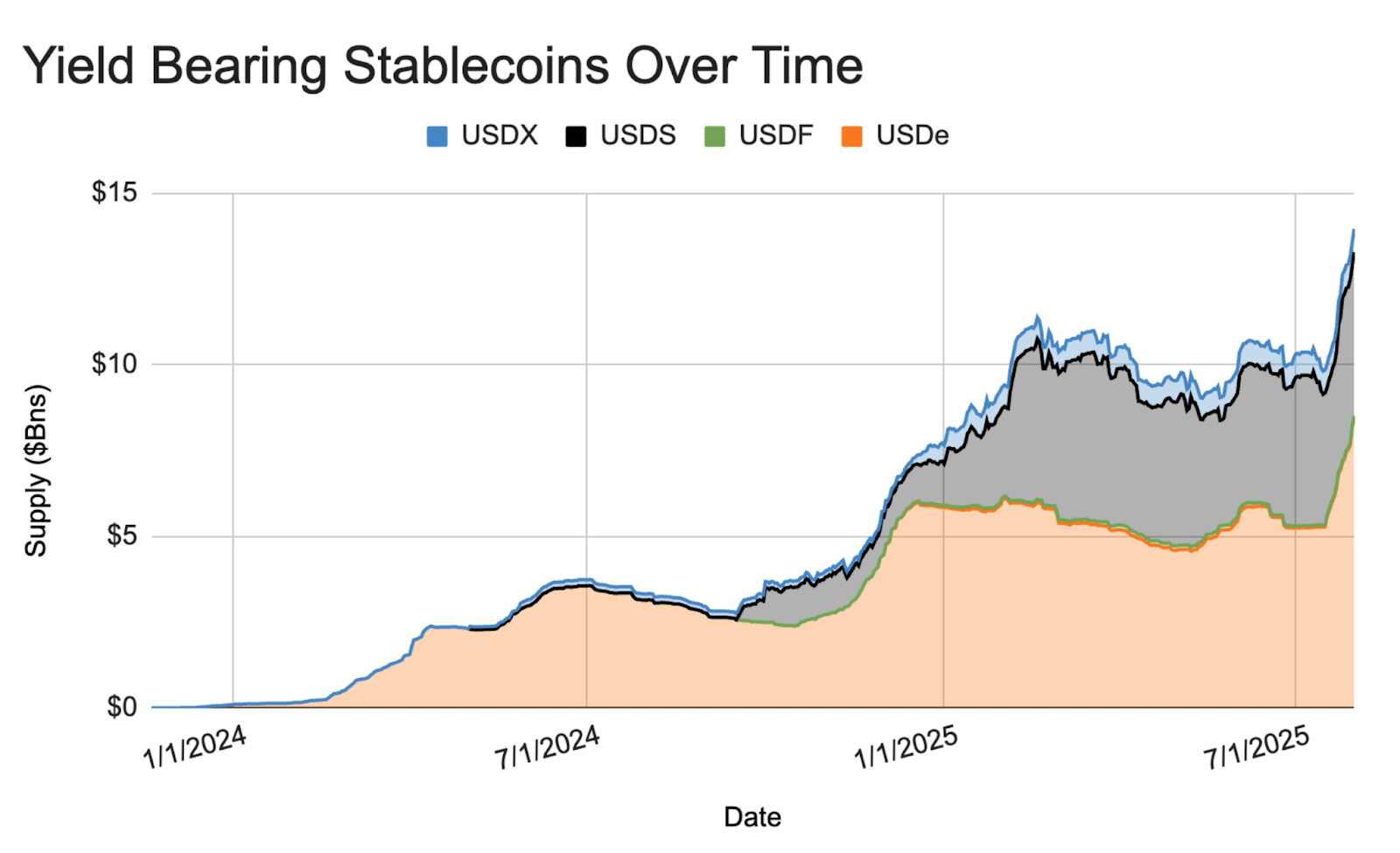

The provide of the very finest yield-bearing stablecoin, Ethena (USDE), increased even extra notably, rising by around $6 billion over the a comparable interval, or 107% — from $5.6 billion to $11.6 billion. The interesting lengthen since GENIUS’s signing signals burgeoning question for stable tokens with built-in yield, despite the U.S. legislation’s ban on such merchandise. USDE’s issuer, Ethena Labs, is headquartered outside of the U.S., on the opposite hand.

In actuality, Anthony Yim, co-founder of analytics firm Artemis, infamous in an X post earlier this month that yield-bearing stablecoins are rising because the “exquisite winners” since the GENIUS Act was authorized, with presents surging, despite being restricted within the U.S. below the proposed bill. Per the legislation — which is explicitly centered on USD-pegged stablecoins designed for payments — stablecoin issuers can no longer valid now offer yield to holders.

Amongst stablecoins from U.S. issuers, PayPal’s PYUSD is the very finest yield-bearing token. Its provide has additionally risen sharply over the closing month, rising 35% from $885 million to $1.2 billion as of this day. PYUSD skirts the GENIUS Act’s yield restrictions by setting apart out the issuer and the yield offerer — PYUSD is de facto issued by Unique York-based mostly totally mostly Paxos Trust Company, while payments huge PayPal pays out yield to holders.

Meanwhile, Circle, the very finest U.S.-based mostly totally mostly stablecoin issuer and 2d-greatest globally, noticed the provide of its non-yield-bearing USDC develop about 4% since signing. USDC provide originally grew extra modestly, from $64.8 billion on the eve of the GENIUS Act to $65.5 billion by mid-August, even though that pick within the extinguish jumped to $67.5 billion over the final ten days.

Proper closing week, the company announced its most modern building on the infrastructure side. Circle is building its comprise blockchain protocol, Arc — what the firm describes as a Layer 1, designed for stablecoin transactions and the usage of USDC as native gasoline.

Leaders React

Commerce leaders comprise been mercurial to praise the legislation. Jeremy Allaire, co-founder and CEO of Circle, lauded the GENIUS Act as “one in every of basically the most transformative objects of legislation in decades.”

Meanwhile, Tether CEO Paolo Ardoino mentioned in an interview with Bloomberg on July 23 that the company is “effectively in growth” on building its U.S. domestic strategy below the GENIUS Act, with plans to intention institutional markets and offer a stablecoin designed for payments, interbank settlements, and trading.

Proper this week, the leading stablecoin issuer — which is registered within the British Virgin Islands — announced a key strategic hire that marks the firm’s legitimate post-GENIUS push into U.S. markets. USDT’s issuer has employed Bo Hines, the feeble govt director of the White Home Crypto Council below the Trump administration, as strategic advisor for its United States strategy.

Tether’s treasury minted over $6 billion USDT in July alone, basically channeling the contemporary tokens into centralized exchanges and DeFi platforms to meet surging liquidity demands.

Meanwhile, Sergey Nazarov, co-founder of blockchain oracle Chainlink, mentioned that the GENIUS Act might presumably well presumably suggested extra tech and financial institutions to commence their very comprise stablecoins, doubtlessly rising the market tenfold, from $200 billion to about $2 trillion.

On Wall Boulevard, JPMorgan has additionally forecasted that the stablecoin market might presumably well presumably swell to $2 trillion, propelled by tokenized payments, defective-border settlements, and programmable finance exercise cases.

As presents climb, smaller issuers face a annoying resolution. The GENIUS Act requires these with extra than $10 billion in resources to both make a federal constitution — an dear and lengthy direction of — or end growth.

Charting the Direction Forward

With the regulatory scaffold now in situation, attention turns to the GENIUS Act’s broader financial ripple effects. Proponents argue that by undergirding stablecoins with Treasury bills, the legislation will reinforce question for non everlasting govt debt, no longer valid now subsidizing U.S. borrowing costs.

Detractors, on the opposite hand, fear it can presumably well presumably amplify systemic probability if issuers undertake maturity transformation — a direction of of borrowing from the non everlasting debt market and issuing lengthy-length of time loans on the funds — or excessive rehypothecation, actions scrutinized carefully after the 2022 Terra give blueprint.

Meanwhile, global traits are accelerating in lockstep. The European Union’s MiCA regime and Hong Kong’s contemporary stablecoin pointers comprise developed in parallel to the U.S. model, prompting world issuers to reassess compliance frameworks on a multi-jurisdictional foundation.

Amram Adar, co-founder and CEO of Oobit, a Tether-backed stablecoin payments platform, told The Defiant that the Act is a milestone that sends a clear message: “digital dollars aren’t going away, and now there’s a framework to administer them responsibly.” Gentle, he emphasised that regulation alone isn’t enough.

“However it surely says nothing about spending. That’s the outlet. Whereas Washington makes a speciality of the provide side: who can field how reserves are managed, the question side is huge open. Who’s building for the real users? Who’s making it potential to tap your cellular phone and pay with a stablecoin care for it’s any totally different forex?” Adar infamous.

The Oobit CEO infamous that regulation can “pave the toll road, but it’s up to innovators to comprise the automobiles.”

Equally, Gitay Shafran, founder of The Fedz, an issuer of fractional reserve stablecoin FUSD, sees the GENIUS Act as “a favorable milestone” and a impress that the U.S. is taking digital dollars seriously. However Shafran warned against complacency, asserting the Act is factual the starting of what’s wished to comprise resilient and decentralized financial programs.

“We read about contemporary stablecoin by prone financial institutions each day but we additionally want decentralized stablecoins and synthetic dollars that aren’t tied to a single company,” Shafran told The Defiant.

Meanwhile, factual this week, Wyoming was the foremost U.S. divulge to field its comprise stablecoin. The USD and Treasury bill-backed Frontier Right Token (FRNT) is being hailed by some as a milestone for the alternate, but others comprise expressed exertion about privateness and centralization.