The privately held company has made changes to the ETFs it manages, every reducing and adding to explicit positions.

Falling Prices

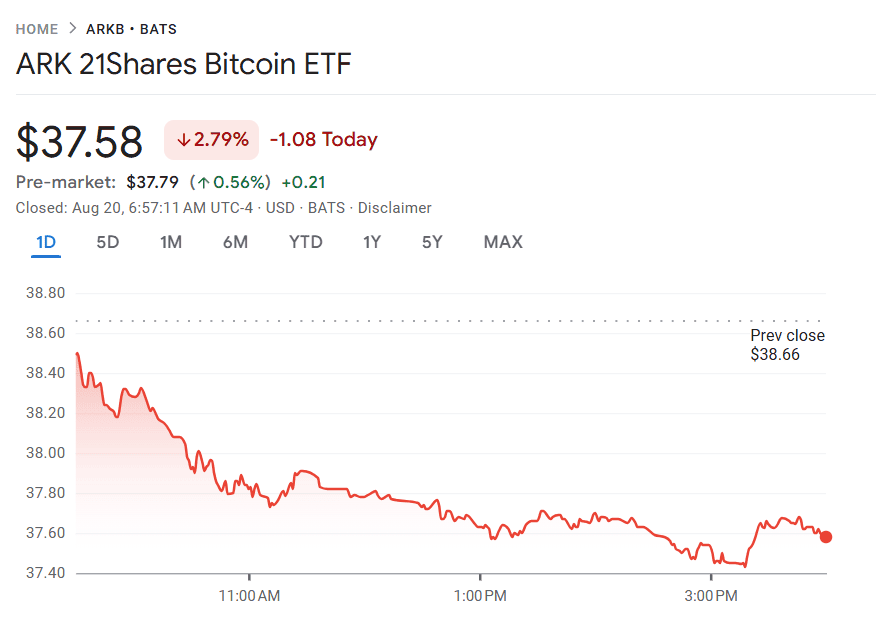

Ark Invest, the funding management firm with extra than $6 billion in assets below management (AUM), reduced the size of its ARKB (ARK 21Shares Bitcoin ETF) by 559.85 BTC, or roughly $64.4 million, as reported by the market watcher internet page Whale Insider the day prior to this.

The crypto neighborhood spoke back with mixed emotions in regards to the sale, with some indicating that it used to be a long-established rebalancing of the fund. In inequity, others outright questioned it and even mocked it.

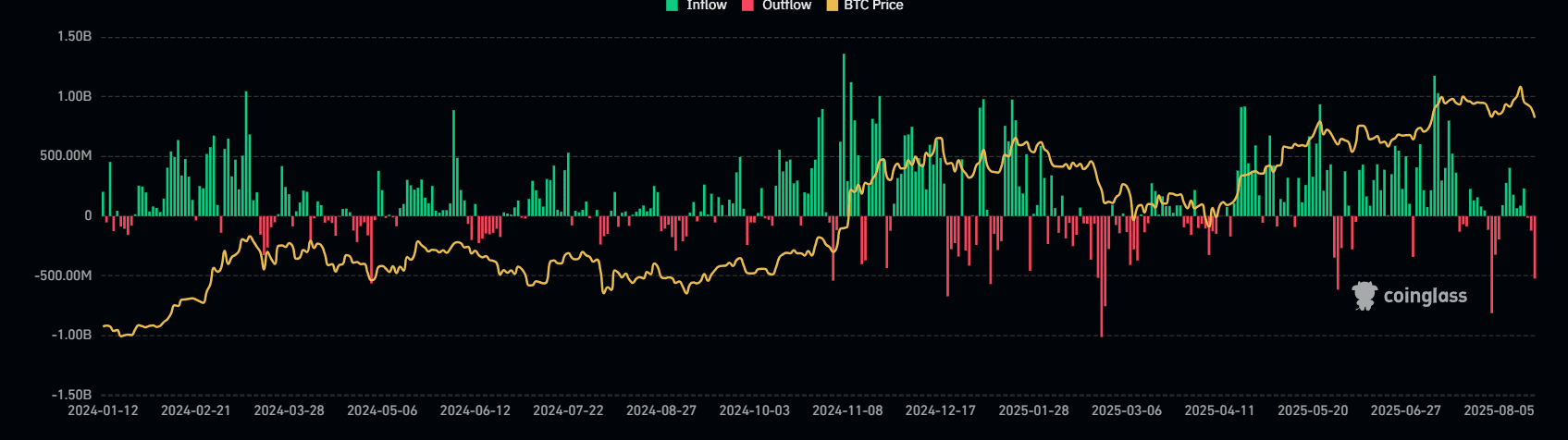

Info level-headed at print time from CoinGlass additionally signifies a wave of promote-offs across exchange-traded funds, coinciding with the most novel brand fling for the leading cryptocurrency, which used to be preceded by a new all-time excessive of over $124,000.

The ARKB stock appears to be like to earn reacted negatively to the sale, with the most most novel recordsdata indicating a 2.seventy 9% day-to-day decline, as reported by Google Finance.

Shopping Different

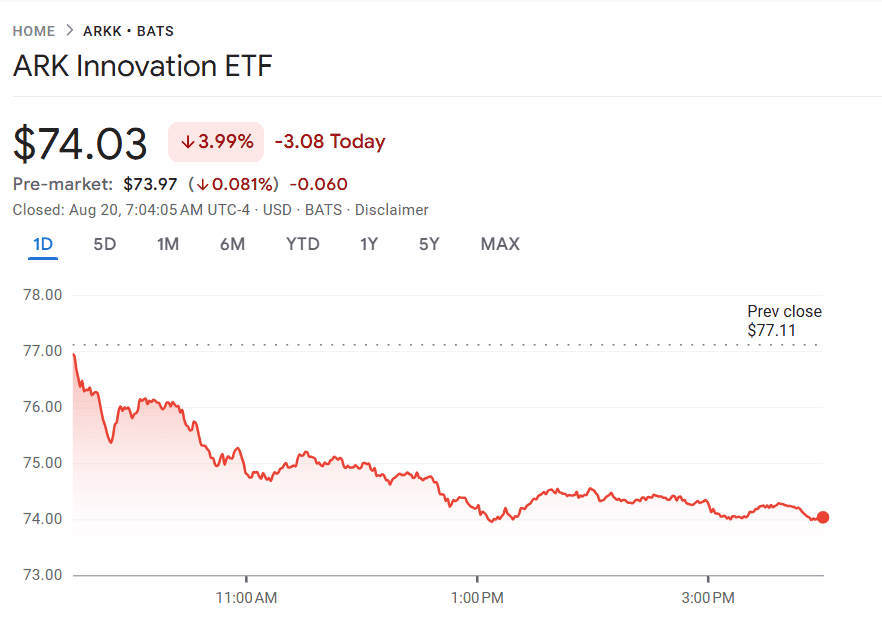

The corporate has no longer simplest been selling, though, because right this moment, the ARKK (ARK Innovation ETF) scooped up 356,346 shares of Bullish, with an estimated brand of $21.2 million, and 150,908 shares of Robinhood Markets shares, rate about $16.2M.

This is a continuation of closing week’s enjoy of two.Fifty three million Bullish shares, rate roughly $172 million, following the exchange’s debut on the NYSE, and loads of other making an are attempting to search out lessons of Robinhood stock, with the closing two being $14 million and $9 million, respectively.

This fund’s stock is additionally plummeting, no longer reacting to the stocking up, posting a a runt bit extra main 3.99% day-to-day plunge, which is in step with the currently shaky markets, with shoppers and institutions making ready for the upcoming Fed speech on the Jackson Hole symposium, which is titillating to seemingly set the tone for the markets for the coming weeks and months.